Happy New Year! For most investors, last year was happy. My annual Outlook last year was titled, “The Bear Should Flee in 2023“. It sure did! 2023 was one of the best bull markets ever for growth stocks. The final weeks of 2023 couldn’t have gone much better for the stock market. The S&P 500 closed the year near a record high and up nine consecutive weeks. That’s the longest winning streak since January 2004. Thankfully, the bear did flee. As a reminder, 2022 was the worst year for the S&P 500 since 2008 and the fourth-worst year since 1957.

Closing a calendar year at a historic high is a rare event for the stock market. It has only happened eight times since 1926, and only four times since 1963. The S&P 500 index came close in 2023. Its all-time high was 4,796.56, set on January 3, 2022. With a 2023 year-end close of 4,770, the major index missed a new historical high by just about 26 points, or 0.5%.

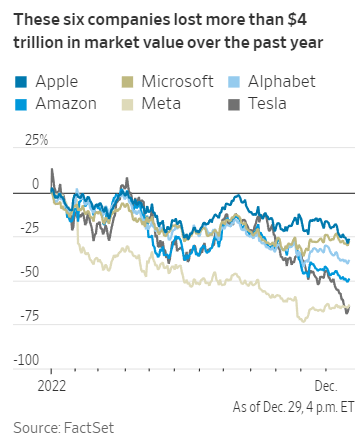

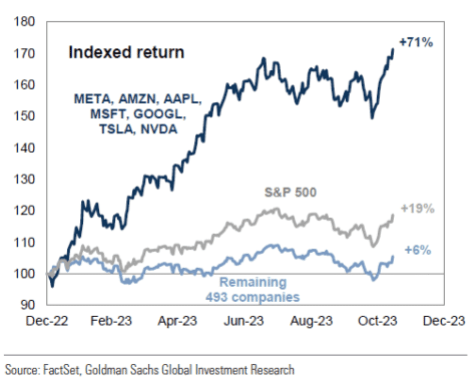

Before getting to my 2024 Outlook, I think it is noteworthy to look back to 2023 and underscore what lifted the stock market so strongly. It was the same force that caused the weakness in the stock market in 2022: mega-cap technology stocks. The short list of these stocks with amazing gains in 2023 was named the “Magnificent Seven”. Below is the chart I shared in my 2023 Outlook. To the right is a current chart. Note the tremendous rebound they experienced in the last year:

You may see an important difference in the two charts above. The chart of 2022’s decliners represented six companies. The current chart for 2023 includes seven. The difference is Nvidia is one of 2023’s Magnificent Seven, and not on the 2022 list (however, Nvidia dropped 50.3% in 2022)

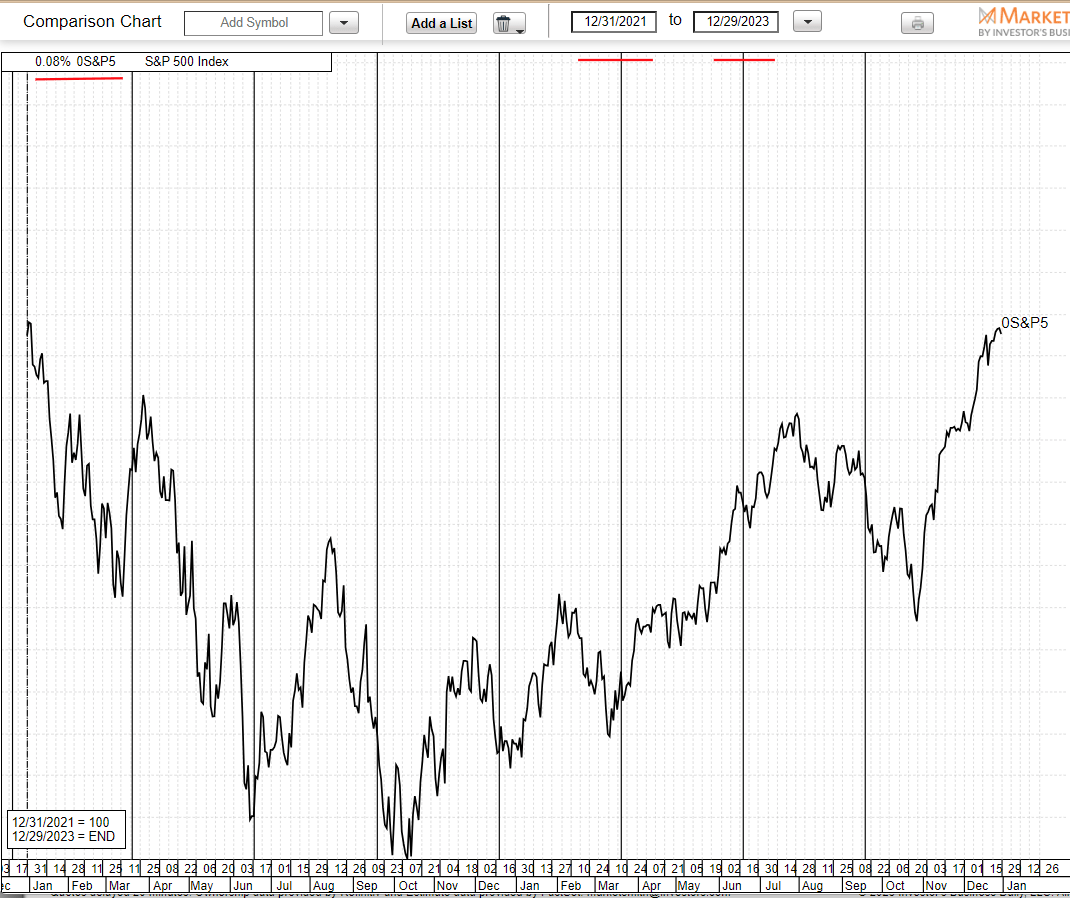

Funny how the math works. After losing just over 18% in 2022, it took the S&P 500’s 2023 gain of about 24% to get the index to where is was at the end of 2021.

The chart below shows that. After the last two years the S&P 500 is flat, gaining only 0.8%.

Okay, we know ’23 was a great year for stocks. Now, I will share what I expect to be in store in ’24. Late in 1984, my rookie year, I wrote my first investment letter to clients. It was to titled, “The only thing constant is change.” There were significant market changes occurring then, and there are meaningful changes developing now as we enter 2024. For starters, 2024 could see a change in the Oval Office. We could have a new/old President. Interest rates are expected to change. After 11 rate hikes, the Federal Reserve has left its Federal Funds interest rate unchanged since July. The Fed has indicated it will cut interest rates 3 times in 2024. Some investors expect more. There was also a dramatic change the last year in market leadership. As noted above, mega-cap growth tech companies led the charge higher. Many value stocks lost value in the last year. This change in 2023 was the opposite of 2022 and has investors speculating that a change back to value could happen in 2024. The three E’s: earnings, economy and energy are expected to change in the year ahead. Earnings are expected to increase, oil/energy prices are expected to climb higher as world demand grows, and the U.S. economic change in 2024 may avoid a recession. One constant I have seen in the financial markets over the last 40 years has been change.

As we bid farewell to 2023 and look ahead to 2024, I am placing considerable risk to any outlook for 2024 on what happens with Federal Reserve policy, interest rates, inflation, and, importantly, the avoidance or impact of a recession. The U.S. stock market has simply shot straight up since the Fed telegraphed an end to rate hikes and signaled rate cuts in 2024. This was November 1. The S&P 500 is up nearly 14% since then. Too much too fast? Don’t know, but rate cuts are now priced in the market and the market may have borrowed from next year’s gains. The Wall Street adage “buy the rumor and sell the news” should not be ignored. Inflation is consideration #1. As inflation goes, so goes the Fed – and interest rates. The economy’s health will follow.

The dominant market theme in 2023—and likely heading into 2024—has been the supremacy of the “Magnificent Seven” group of mega-cap stocks: Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla. I noted above these giants lifted market-cap-weighted indexes higher in 2023, but as I also noted, they contributed to the bear market plunge in 2022. This underscores an important aspect of the mega-cap highfliers worth noting for the future: They are not immune to the business cycle and can also be a drag on cap-weighted indexes. That in turn underscores my emphasis on diversification when it comes to the mega caps and the rest of the market.

Here are the highlights of my expectations for 2024:

2024 U.S. Stock Market Outlook

Stocks tend to do well in election years. There have been 24 presidential elections since the S&P 500 index was created, going back to 1928. The stock index has been positive in 20 out those 24 for a winning record of 83%. The average return over all election years has been greater than 11%. So, the stock market in 2024 has that going for it. Election years aside, I expect the U.S. stock market to continue its climb in 2024. As we head into 2024, I offer caution that the market may be over-estimating the number of rate cuts for the coming year. While I expect the Fed will start to ease rates in Q2 and perhaps trim by a total of 75 basis points by year-end, I do not anticipate the four or more cuts currently built into the market’s expectations.

Since the start of my profession, I have learned the single most important determining factor of a company’s stock price is earnings. Growing earnings are the lifeblood of almost all major stock moves. Without increased earnings, there is little reason for a stock to advance in price. Accordingly, the market of stocks will not experience sustainable price appreciation without earnings growth. I expect earnings for the S&P 500 to increase in 2024. With an earnings forecast of $251 and a probable market multiple of 20, I arrive at my target price for the S&P 500 next year: 5024 in 2024. If offering an educated guess, why not have fun with it?

U.S. Economy in 2024

In addition to change being a constant when looking into the future, so is uncertainty. When asked what we think is in store for the economy in the year ahead, the honest answer is that we don’t know with any certainty. So, my educated guesses are based on the thesis that the economy will grow, benefiting from less restrictive monetary policy and improved monetary liquidity. A steady economic environment should be the story in 2024. The economy in the year ahead should avoid a recession. Continued cooling inflation will result in a lower yields. With that expected 2024 macro economic backdrop, earnings growth will likely become less challenging for many market areas. GDP growth in the U.S. is projected to be 2.4% in 2023. I expect that growth to slow. My 2024 GDP growth forecast is 1.5%. This prediction for the U.S. economy is consistent with a forecast by the Organization for Economic Co-operation and Development (OECD). I stated above and will reiterate here, there are a range of risks which could negatively impact the economy and financial markets in 2024. Geopolitical tensions remain a key source of uncertainty and have risen further as a result of the evolving conflict in the Middle East. Amid heightened geopolitical tensions and a longer-term decline in the trade growth, economic contraction could occur.

Overall, these are my asset class expectations for 2024:

- Equities outperform bonds. The “higher-for-longer” Fed interest rate policy since early 2022 has changed. Lower bond yields in 2024 will favor stocks.

- Long-term bond yields should fall. A less steep yield curve will be a function of easing inflation pressure and Fed interest rate cuts.

- U.S. equities outperform international.

- The rotation to growth stocks from value continues, allowing further outperformance by the growth class. However, expect a bounce back by value equity dividend payers as they benefit from lower bond yields.

- As in 2023, maintain exposure to managed futures to benefit from continued price volatility in energy, currencies, industrial metals, agricultural goods and other commodities in 2024.

We all must adhere to our portfolio management discipline and investment rules. As the market dynamics change, for better or worse, we must be willing to adapt and change accordingly. Many investors chase performance because they suffer from the 7th deadly sin – Greed. Some want all of the rewards without regard for the consequences. In a year like 2023, where primarily seven companies drove the S&P 500 index, many individuals, thinking they “missed out,” will want to change their strategy for next year. As is often the case, this could be a mistake.

At the start of 2024, investors should re-assess their portfolio positioning and assess their risk exposure. Too often investors are consumed by what the market will do and take their attention off how their investment plan is doing. A prudent and diligent investment plan will allow an investor to withstand what will likely be another volatile year in the investment markets.

I hope you can look back at 2023 and recall many happy experiences and 2024 brings you many more.