Trade Tensions Sink Stocks

China declared a currency manipulator by U.S. Treasury

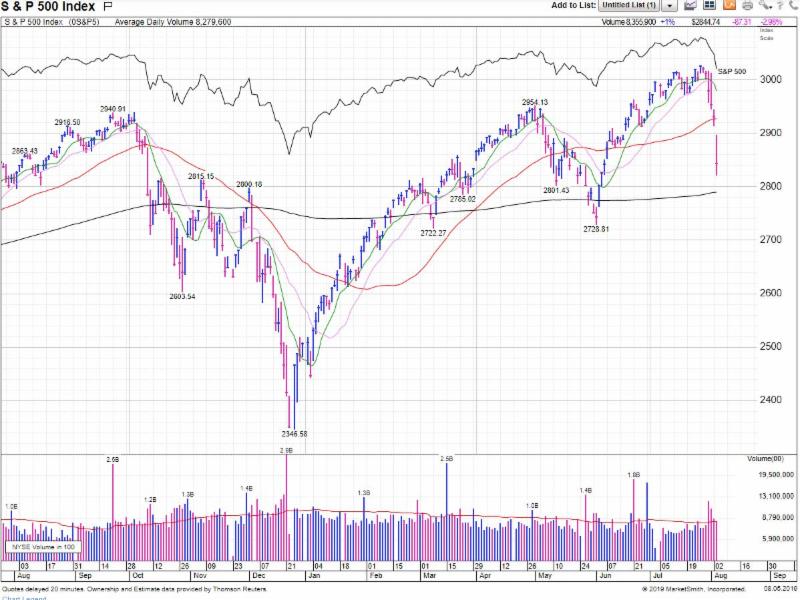

It began with a quick, unexpected, sharp reversal last Thursday morning. After a widely anticipated quarter-point interest rate cut Wednesday, the major U.S. stock indexes all reacted with a classic “sell-on-the-news” move. The Dow closed down about 330 points. Most of a that was recovered Thursday shortly after the opening bell with a 300 point pop. Then came the tweet. President Trump tweeted mid-morning that he would impose an additional 10% tariff on $300 billion worth of Chinese imports starting September 1. The list targets products like cellphones, laptops, clothes and shoes. Trump had pledged to halt additional tariffs on China goods when he met with China’s President Xi at the G-20 meeting in June. Trump ups trade tensions and stocks go down. True to that script, the Dow fell 600 points in minutes… from up 300 to down 300. Then came today. As feared, China retaliated. China’s strategy is to use its currency as a weapon in the trade war. On Sunday, the People’s Bank of China, that country’s central bank, took steps to limit the impact of Mr. Trump’s next round of tariffs by letting its currency weaken below 7 to the American dollar for the first time in more than a decade. The U.S. Treasury declared China is a currency manipulator. This is the first time the Treasury department has done that since 1994. The Treasury will seek the International Monetary Fund to stop China’s unfair use of its currency (the yuan). All the above sunk stocks as the major indices all fell 3% or more. The tech laded NASDAQ fell the most, losing about 3.5%. The chart below shows the S & P 500. The sell-off since Wednesday’s of the Fed’s announcement has been sharp and steep. The decline has been about 6%.

The best offense has been a good defense. While I heard today,

“There is no place to hide,” I know better.

Blackhawk Asset Management’s (BAM) equity portfolios holds real estate investments trusts (REITs) and aerospace/defense contractors that were up today. The strongest gains came from our most defensive position, the VIX. The VIX, which gains as volatility spikes was up over 14% today. Additionally, the option strategy is working by adding cash flow and reducing risk. So, rest assured not all was down today in your account.

BAM’s risk strategy with options and the VXX are adding value.

As always please call anytime you have a concern or question. I am happy to help. We are in store for more volatility, which means uncomfortable price swings. I am 100% aware, prepared and have seen this type of stock market episode many times over the last 35 years.

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.

John