Nasdaq in Bear Market. S & P 500 and Dow Close Behind.

The closing bell sounded and then the day’s stock market recap began. The commentary within 2 minutes of today’s session close was what you would expect to hear in a bear market. Though emotional and with a splash of hyperbole, the comments were again indicative of the current down-trend and bear market that stocks are now in. Here’s just a sampling of what one panel of market watchers had to say as today’s closing bell rang…”Just a brutal close.” “What a very ugly day.” “This closes out the worst week since November of 2008.” “The selling was relentless.” “This is the worst December for the market since 1931.” And, there were others…all in just 2 minutes. So much for cooler heads prevail.

My policy of writing a “Market Update” is to compose and send clients my take on the market when at least two of the major U.S. stock indexes decline 3% or more in one day. That did not happen today, though the Nasdaq index did fall nearly 3% (2.99%), while the Dow and the S&P 500 each fell about 2%. So, with the current negative tone, the stock market’s down-trend, and as the Dow capped off its worst week since the GFC (Great Financial Crisis) and a December reminiscent of the Great Depression, I thought today was a “Market Update” day.

There is a

looming Government shutdown. The Fed’s stated monetary policy, the pricing in of an expected global economic slowdown, an absence of buyers, a collapse in investor sentiment, abbreviated trading sessions ahead along with many market participants away in the days ahead for Christmas and New Year’s, and other concerns colliding all at once are sending stocks lower. Definitely a day for a “

Market Update.” The list of issues just mentioned creates a fearful market with spiking volatility. That always leads to a stock sell-off. This is also a time for proper perspective. A look at the 5-year picture of the stock market will hopefully help achieve that.

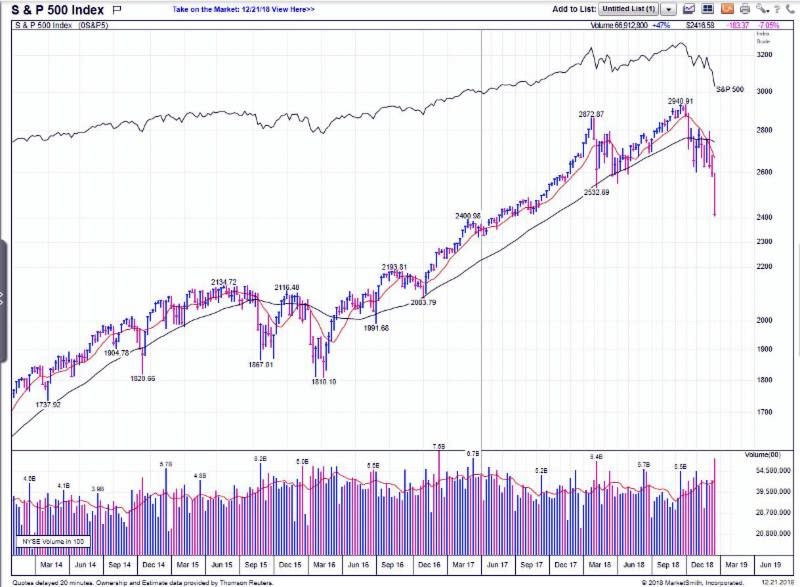

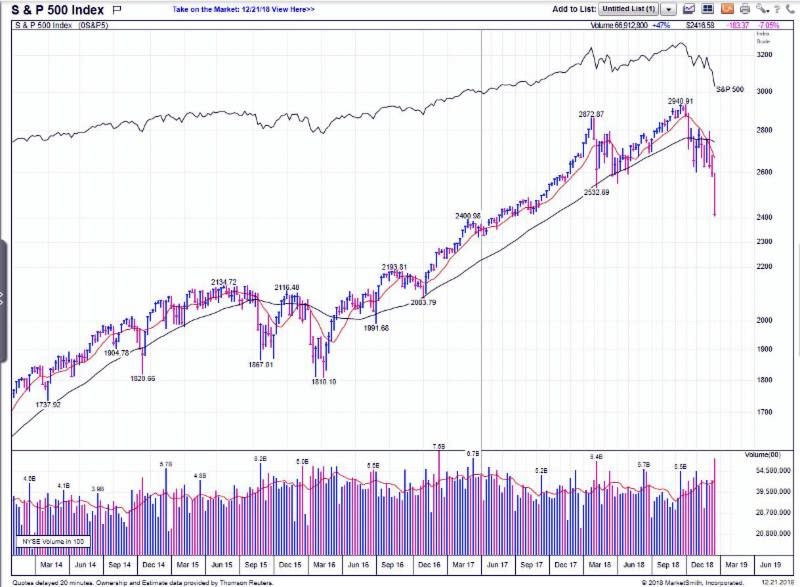

The chart above is of the S&P 500 over 5-years. Down now about 18% from its’ October peak, it is just behind the Nasdaq, which has fallen more than 20% and now labeled with the “bear market” moniker. Do your best to ignore all the “bear” jokes…I just saw one starring Dorothy in the Wizard of Oz as she was aghast at the thought of encountering “lions and tigers and….” The perspective to keep is the bigger picture and longer view. As the 5-year chart shows, the S&P 500 was near 1700 in December of 2013. That’s about a 42% from today’s price. In simple terms, a CAGR of more than 8%. While that’s not the historical market average return of about 10% annually, interest rates were near zero over that period, making the real rate of return greater than the historical norm. Keep in mind, too, as the chart shows, now is the first time since January of 2016 that the S&P 500 has breached its key support level represented by the 200-day moving average.

On Shut-Downs and Sell-Offs…

A government shutdown sounds scary, though the reality is it has historically been a non-event for stock market. If it shuts down this weekend, it will be the 21st since 1976 and the third time this year. The stock market, on average, was flat during those times. A non-event. In the 16 days of 2013 shutdown, the S&P 500 went up 3.1%. And, don’t worry. This time, if it happens, shutting down the government will not leave Social Security-receiving senior citizens without their checks. As the Committee for a Responsible Federal Budget stated, “the ‘essential services’, many of which are related to public safety, will continue to operate, with payments covering any obligations.” Congress has already funded 75% of the government through September 2019, which means that many major departments like Defense, Veterans Affairs, Energy and Education will remain open and fully functioning.

Above all, be clear, there are simply more sellers than buyers in the stock market now. It is a good time for cash and defensive investment strategies. It is a great time to screen for over-sold, under-valued stocks. Keep perspective, and keep emotions in control. We have quickly gone from a FOMO (Fear of Missing Out) market driven by a greed, to a FUD (Fear, Uncertainty & Doubt) market driven by fear.

Not all was down today.

Nike stock jumped higher than 7% on a strong earnings report. The stock is now up more than 15% for the year in the face of losses in all major stock indices. Nike is a core position in the

BAM Thematic Growth portfolio.

Merry Christmas & Happy New Year!!

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.

John