Every year, the premiere investment publication, Wall Street’s Best, invites investment strategists across the country to select their top growth stock picks for the year. In 2020, Blackhawk Wealth Advisor’s John Gardner, relying on insights by his stock research division, Equity Research & Portfolio Evaluation, selected The Trade Desk (TTD).

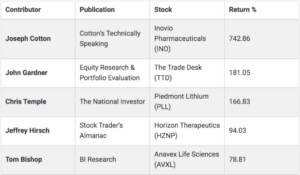

John’s selection, despite extreme market volatility triggered by the global pandemic, was the second best performing stock among all analysts stock picks for 2020 (see the table below). The Trade Desk stock soared last year, gaining 181.05%. In his recommendation, he noted, “The Trade Desk provides a self-service platform for advertising buyers to purchase and manage data-driven ad campaigns. The Trade Desk uses artificial intelligence to give marketers a clearer picture of where their programmatic dollars actually go. Smart ad budgets are managed using The Trade Desk. The company helps big brands deliver a more insightful and relevant ad experience for consumers. The Trade Desk has been a big winner, and this growth stock will continue to deliver in 2020.”

Wall Street’s Best noted this in there new year publication looking back at 2020…

“Our Top Picks of 2020 Returned an Average 180.19%

What a year! The markets began 2020 with a bang but suffered a big surprise when COVID-19 rocked the world in March.

Fortunately, they staged a comeback, with the Dow Jones Industrial Average generating a 9.7% total return including dividends, the S&P 500 gaining 18.4%, but both came up far short than the Nasdaq Composite’s 45% amazing gain.

But that was nothing…

Our contributors at Wall Street’s Best Investments beat them all, hands-down, averaging a return of 180.19%! And as you can see from the following table, our top five contributors posted stellar returns, averaging a very healthy 252.72%.”

A little more about Wall Street’s Best. Wall Street’s Best Investments presents news, information, opinions and recommendations of individuals or organizations whose views are deemed of interest. It should not be assumed that such recommendations, past or future, will be profitable or will equal past performance. Wall Street’s Best Investments does not itself give investment advice, act as investment advisor or advocate the purchase or sale of any security or investment. All contents are derived from data believed reliable, but accuracy cannot be guaranteed. Excerpted material represents only part of the total information or viewpoint found in the original source and should not necessarily be relied on as a sole source of information and opinion for making investment decisions. Officers, directors and employees of Cabot Wealth Network may own securities of the companies reported on in Wall Street’s Best Investments. Keep in mind that any selection does not guarantee or imply any returns for other clients.

Every year, a premiere investment publication, Wall Street’s Best, annually asks investment strategists across the country to select their top stock picks for the year.

Check Out John’s Pick For 2021

John was invited back by Wall Street’s Best to submit his top pick for the new year. After careful analysis and research, John’s Top Growth Stock Pick 2021 is expected to benefit from continued worldwide demand for electric vehicles (EV’s). His selection? Blink Charging Co. (BLNK)

Here’s what wrote for Wall Street’s Best Top Growth Stock 2021 publication in circulation now.

“Do you drive an electric vehicle (EV)? Or know anyone who does? Chances are you do. As of August 2020, it was estimated that cumulative sales of EV’s in the U.S. since 2010 is 1 million. All “plug-in” vehicles exceed 1.6 million. This number now exceeds 2 million globally. You can safely bet on many more soon. The future of cars is electric. As of late 2019, auto manufacturers had pledged to spend a total of $225 billion developing new EV’s in the near future. Recently, Toyota announced plans to generate half of its sales from electrified vehicles by 2025. Expectations are that there will be 550 EV models by 2022. One prediction for gross vehicle usage by 2040 is that 500 million passenger EV’s will be on the roads globally. Charging stations will keep them rolling. Blink Charging is a leading owner, operator, and provider of electric vehicle charging. Blink has over 23,000 EV charging stations throughout the U.S., Europe, and the Middle East. Blink stations are conveniently located at airports universities, stadiums, supermarkets, workplaces and other locations. Invest in Blink as they charge EV’s and boost your portfolio.”

Connect with John

Should you have investment questions or want to get your investments and financial plans in order, contact John Gardner of Blackhawk Wealth Advisors. He can be reached 888-985-PLAN (7526). He is a Certified Financial Planner and Certified Portfolio Manager and has been an investment advisory serving clients for nearly 37 years.