BABA vs. AMZN

A great question was posed to me today about Amazon.com. “Is Amazon still a good stock investment?” This was asked by a “barista” (aka. “bartender in a coffee shop”) at Starbucks who I see a few times a week when a go for a cup. My answer was Amazon.com is a proven leading tech company and has been a great stock for a long time. Then, asked the barista, “Should I buy it now?” “You are still young,” I said. “So yes!,” I concluded. When I mentioned to the barista what the current share price of Amazon is, he said, “WOW! That is more that I have to invest right now.” I made it a point to remind this hard working young person that he was doing just fine for now to keep buying his company stock – Starbucks – in his 40lk every payday. You should have seen the look on his face when I said Starbucks stock was about .50 cents a share in 1993 and is $58 per share today!

While handing over my “extra hot, no whip, grande mocha,” the barista (real name Chad) asked me if I recommended Amazon to my clients. I said, “Yeah, some. For those who it is suitable for.” My next words were, “Have a great weekend Chad,” and I headed out to make my walk back to my office and enjoy that mocha. Then this thought hit me, “Amazon really has been an amazing stock, but not all my clients own it. Some do. But better yet, they almost all own Alibaba. And Alibaba has done a lot better. With those thoughts going through my head on my short walk, I decided to share this with you.

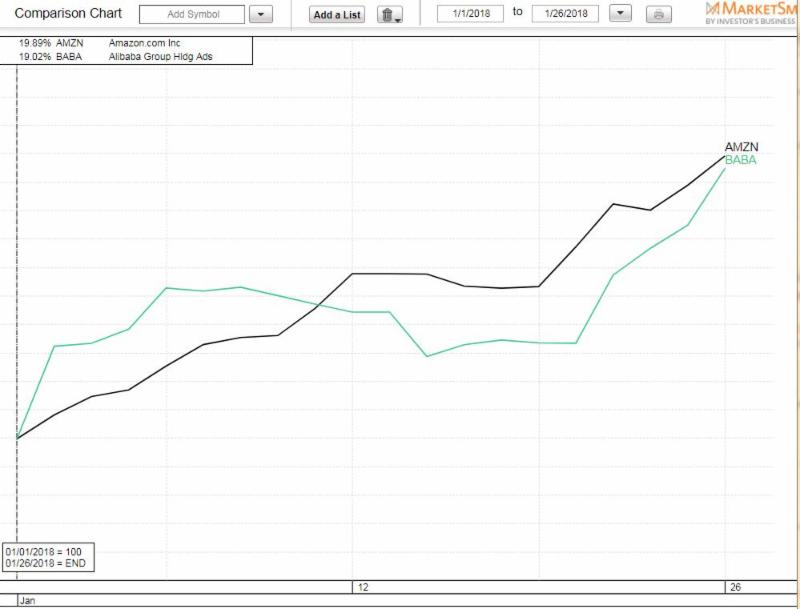

This images below may be a little unclear. The first chart below is a comparison of Amazon (AMZN) to Alibaba (BABA) price change in 2017. The small upper-left corner box shows the results in percent terms: AMZN up 58.56%. BABA was up 109.14%. Alibaba was better!

This is the same comparison chart for the two stocks year-to-date, through today’s market close. It’s a tie! As the upper-left corner ROR box shows, both stocks are already up an amazing 19% in just this short new year.

As you can see, the “Amazon of China” has been a better stock investment than Amazon itself. BABA is a the best example I have of the ERPE Global Opportunities Portfolio. AMZN, where held, is a position in the ERPE Thematic Growth Portfolio.

Hope you enjoyed this thought that I wanted to share with you. And, oh, that Starbucks stock that Chad has, it is in your ERPE Diversified Value Portfolio.

Enjoy your weekend!

John