NEW YEAR MARKET & ECONOMIC OUTLOOK

December 30, 2022

2023 New Year Outlook

The Bear Should Flee in 2023

Last year I titled my New Year Outlook, “Welcome the New in 2022“. One of the new conditions I expected the last year was new health. The good news is we got that. Covid cases, for example, dropped dramatically year-over-year. In late December 2021 there were over 2.7 million new confirmed Covid cases in a week. This week new cases were about 450,000. I also called for a new market trend in 2022. The bad news is we got that, too, though I had no expectations for such a vicious bear market for stocks and bonds. For stocks, the SP 500 major market index declined 20% for only the fourth time since 1940. The bond market suffered its worst year ever.

This year my New Year Outlook is titled, “The Bear Should Flee in 2023”. Bull markets often follow bear markets. Is this just wishful thinking? No, not entirely. There is historical precedent pointing to a better year for stocks next year. Back-to-back down years are rare. Two consecutive years of decline in the SP 500 has only occurred once; 1973 and 1974. It took the Great Depression to keep stocks down four years in a row (1929 – 1932).

While 2022 was the year of the bear, it was also the year of inflation, rising interest rates, declining corporate earnings, war in Ukraine, and value stocks. With a reversal in some of these trends, the bear could flee in 2023.

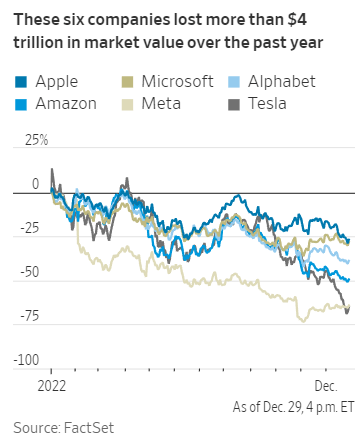

As I look ahead to 2023, I am reminded of the folly of forecasting. This is best displayed with the failed predictions for 2022. From Wall Street to Washington, nearly everyone got 2022 wrong, including me. The Fed expected inflation to be “transitory”. For from it. Inflation in 2022 soared to a level not seen in 40 years and nearly tripled the Fed’s forecast. Many on Wall Street were optimistic with bullish 2022 market forecasts as 2021 ended with the U.S. stock market in a confirmed uptrend. Wrong prediction, as 2022 was the worst year for the stock market since 2008. My call for a decreasing rate of stock market growth, though still growth, was based on increased earnings. Wrong. The surprise spike in inflation and rapid rise in rates, plus a strong dollar hurt earnings in 2022. Ultimately, earnings determine stock prices. By definition the future is uncertain, but heading into 2023 uncertainty among investment market analysts is greater than usual. Wall Street as a whole hasn’t been so divided about the prospects for the next year since the global financial crisis, reflecting deep uncertainty over U.S. monetary policy, corporate profits and a wider debate about whether the world’s biggest economy will fall into recession. I think soaring interest rates was one of the most overlooked phenomena’s of 2022. The rate of change in rates was dramatic. When you quantify interest rates rising from near 0% (.25) to 4.5% in the benchmark rate, you get a 1,700% jump! Another stunning statistic from 2022 comes from the meltdown in the largest “mega-cap” growth stocks. The graph below shows that.

Each of those six companies saw their stocks lose more than $600 billion in market capitalization last year. As I noted above, clearly 2022 was a much better year for value stocks than growth.

Here’s are the highlights of my expectations for 2023.

2023 U.S. Stock Market Outlook

Higher interest rates in 2022 was in large part why many asset classes were lower. Large cap growth was one of the hardest hit asset classes in the year. They led the Nasdaq stock index to its fourth worst year in its’ history, down 34%. While it is unlikely for this to repeat in 2023, it’s very likely that future returns will differ significantly from the past decade. Many asset prices were boosted by ZIRP (zero interest rate policy). With rates rising now to fight inflation, and a “higher for longer” Fed attitude, the strong tailwinds and smooth sailing from the easy money era are gone. “The trend is your friend” and, “Don’t fight the Fed” are two proven principals of investing. These should guide investors in 2023 and affect asset allocation. While a contrarian approach to investing can be successful, 2023 is likely to be a year, like 2022, where value outperforms growth stocks and interest rate sensitive investments underperform. Apple, a great growth company, saw its stock lose 30%. On the other hand, classic value stocks like Coca Cola and Chevron gained value in 2022, both with impressive positive returns. My portfolio management efforts echoed the value-beat-growth experience in the past year. My BAMDV (diversified value) stocks significantly outperformed my BAMTG (growth) portfolio. This is the trend to adopt as your friend in 2023. I expect next year’s earnings to be $210 for the SP 500. Don’t forget the Fed, it will impact that outcome. My 2023 SP 500 target, based on my earnings expectations and a slightly below average price-to-earnings ratio of 19, is 4,000. Then add in a healthy dose of dividends for a decent ROI from stocks in 2023. Beyond earnings and the Fed’s monetary policy, risks facing the stock market in 2023 are many. These could impact the economy, too, which I address below. For one, there’s the “China factor”. Renewed supply chain constraints, rebound in Covid cases and additional geopolitical issues could all come from China next year.

U.S. Economy in 2023

As I said in my last two New Year’s Outlook’s, the pandemic would most impact the U.S. economy. Thankfully, that was less the case in 2022. High inflation and rising interest rates were the one-two punch to the U.S. economy last year. Any outlook commentary on the the U.S. economy in 2023 could be summed up in one word: recession. My 2023 economic outlook for the U.S is defined by decelerating growth, rapid monetary tightening and moderating inflation. Relatively healthy consumer and business balance sheets, however, could help keep some momentum. Americans love to spend. 2022 reminded us of that, even as inflation’s effect drove the price of almost everything up. And, the jobs market remains strong with unemployment likely to stay low again in 2023. The U.S. will likely enter a recession by the end of 2023 as higher interest rates slow demand for goods, services and the workers to produce them. However, I expect the recession to me mild. So, I expect the economy to avoid a “hard landing” and grow at slowing rate. My 2023 GDP forecast is 1%. The most optimistic outlook I have for next year’s economy is that the inflationary overheating can be reversed without a recession. The most effective plan in the battle to reduce inflation is to raise interest rates. The Federal Reserve is aggressively doing that. If that plan is executed with precision, a recession can be averted. That is a big “if”. At end of 2021 the fed was just beginning to raise interest rates. Ending 2022, the Fed may be near the end of its rate hikes. What would derail this hopeful outcome would be if new global supply shocks surface or if there’s another big jump in energy prices which would fuel more inflation. Those conditions would make the Fed’s task even harder and force them to hike rates higher. For perspective, the stats below show how my muted, yet positive GDP growth for 2023 compares to recent years:

U.S. GDP growth rate for 2021 was 5.67%, a 9.08% increase from 2020.

U.S. GDP growth rate for 2020 was -3.40%, a 5.69% decline from 2019.

U.S. GDP growth rate for 2019 was 2.29%, a 0.63% decline from 2018.

U.S. GDP growth rate for 2018 was 2.92%, a 0.66% increase from 2017.

Overall, these are my asset class implications for 2023:

-Equities outperform bonds. The “higher-for-longer” Fed interest rate policy will harm long duration, fixed income instruments in 2023.

-Long-term bond yields should rise. A steeper yield curve will be a function of persistent inflation pressure and Fed action.

-U.S. equities outperform international.

-The rotation to value stocks continues, generally outperforming the growth class.

-Overweight managed futures to benefit from continued price volatility in energy, currencies, industrial metals, agricultural goods and other commodities.

At the start of 2023, investors should reassess their portfolio positioning, both with regard to their own goals and the opportunities that distorted valuations present for active portfolio management and security selection across broadly diversified portfolios. That is a prudent plan for all as 2023 will be another volatile year in the investment markets.

I hope you reflect back on 2022 and think of the good things that happened in your life, and I wish you a happy new year and a healthy 2023!

Happy 2023! Expect the bear to flee…

John

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN · Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.