Today’s Market Update

January 5, 2022

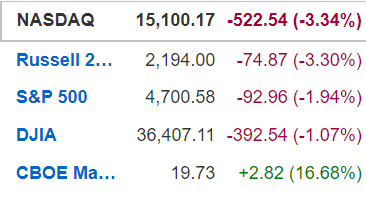

Fed Speaks… Market Sinks

Yesterday the U.S. stock market seemed unsure of itself. It was a mixed day, with the Dow up and the Nasdaq down. What mattered the most was the Nasdaq’s (growth stock index) drop. It fell 1.3% after gaining 1.2% Monday. Today the market was clear of its direction. DOWN! As I am committed to doing, I send out my Market Update on days that 2 or more of the major U.S. stock indexes fall greater than 3%. This occurred today – as the graphic below shows. It was the first time since October 28, 2020. See my Market Update 10/28/20.

The Nasdaq’s -3.3% fall was its worst since a -4.9% loss 9/2/2020. It was what the Fed said it said that knocked the market down today. Late morning Pacific time, the Federal Reserve Bank released its last meeting minutes. This shocked the market, as it took policymakers tone as unexpectedly hawkish. More rate hikes, and sooner, this year was read into the meeting minutes. The market interpreted the message to be that the Fed will soon hit the brakes on the economy as it signaled it is increasingly concerned about inflation. The harsh sell-off occurred as the minutes of the last Fed meeting were released – another sharp reversal day in the market, as the Dow was up before the release. The next Fed meeting is on January 25-26. Surely, the market will be anxiously awaiting that. The market’s biggest threat today seems to be the Fed, not Omicron. With today’s decline, the market trend signal weakened to “uptrend under pressure”.

All is not down in correction – or worse yet – bear territory. As you can see from today’s price action in the major indexes, the Dow held up relatively well. This has been the case since November 30. “Real economy” stocks are up now. Meanwhile enterprise software and highly valued tech stocks are down. Can you touch it? Those tangible companies producing steel, oil, copper, lumber and such are benefiting as market rotation is going their way. The intangibles, think cloud, software and AI, are seeing investment capital outflows. As fast as this rotation occurs it can rotate the other way. Remember 2021? So, stay diversified!

“When picking a list of growth stocks for long-term investment, broad diversification of the risk is the first and most important principle to follow. No one can look ahead five or ten years and say what is the most promising industry or the best stock to own.”

T. Rowe Price

Hope this was helpful! Wishing You a Happy & Healthy New Year!

John

Contact us at 888-985-PLAN (7526) or visit www.blackhawkwealthadvisors.com