Today’s Market Update

October 28, 2020

Market Selloff…

Worst Day Since June 11th

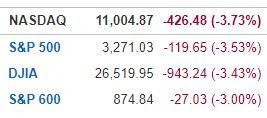

It has been a while. This is the first Market Update since June 11. As you may know by now, I send out my Market Update on days that 2 or more of the major U.S. stock indexes fall greater than 3%. Today they all did. As the table below shows, all four (including the S&P 600) fell more than 3%.

Today’s market action was an eye-opener. While today was bearish, it was not as severe a selloff as June 11. Yet, the major indexes all fell below key areas of support and volume was abnormally high. Other alarms that sounded were the Dow’s close below its’ September low and the broad nature of the selloff. All 11 market sectors closed lower today. Of the Dow 30 stocks, 29 were down. And, as should be expected, volatility spiked with the “Fear Index” (the VIX) soaring over 20%.

COVID-19 news was one reason for today’s stock selloff. The fear of increasing lockdowns in the U.S., like occurring now in parts of Europe, has the market again worried about economic recovery. The total number of confirmed Covid-19 cases in the U.S. topped 9 million on Wednesday, according to the Worldometer data. Hospitalizations in the U.S. related to Covid-19 rose by 10% over the past week in 32 U.S. states, according to data compiled by Bloomberg. Further, total worldwide coronavirus cases reached over 44.6 million since the start of the outbreak.

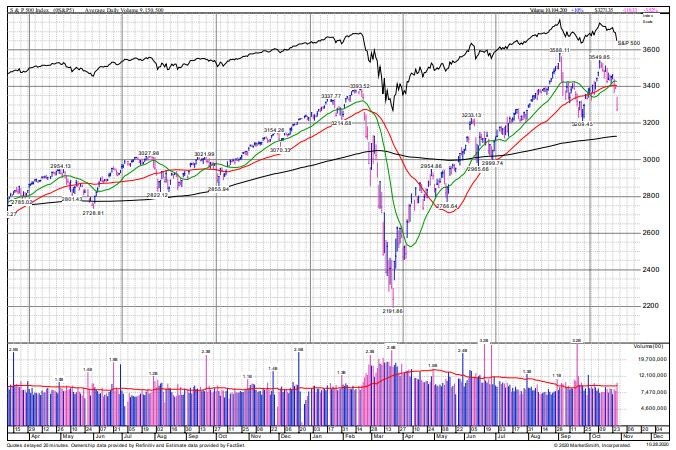

After a ‘V’ shaped pattern formed in the stock market’s chart, profit taking was to be expected. After falling around 35% from its late February high to late March low, the S & P 500 soared over 45% through yesterday. Here’s the chart:

Earnings are another market catalyst contributing to today’s increased volatility and stock slide. This week is huge for third quarter earnings results. So far, 206 S&P 500 members that have reported Q3 results, with total earnings are down -11.3% from the same period last year on -3.5% lower revenues. At the same time, 83.5% of the companies have beat EPS estimates and 78.2% beat revenue estimates. Microsoft announced after yesterday’s close and was in part to blame for today’s market weakness in the tech sector. Tomorrow Google, Amazon, Apple and Facebook report – so expect these mega-cap tech companies to fan the flames of market volatility more.

I stated this in the last Market Update April 1, “One of the most alarming traits of the stock market in the first quarter – with respect to the Dow – was the frequency of 1,000 point daily moves.” That did not happen today, but it was close. Expect big market point swings near-term with the daily flow of earnings reports, next Tuesday’s election, continued concerns over economic stimulus and winter weather’s affect on COVID.

Here are some words of wisdom from a great investor, Sir John Templeton:

“The four most dangerous words in investing are: ‘This time it’s different.'”

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®