ERPE EXCERPTS

Bi-MONTHLY MARKET ANALYSIS &

ECONOMIC UPDATES

March 9, 2023

2023, The Year of AI

Within the endless pages of research I read, I have recently read that 2023 has already been summed up as “The Year of AI”. If that’s the case, it is about time AI got it’s due. Artificial intelligence has been around a long time. John McCarthy, an American computer scientist and mathematician coined the term ‘artificial intelligence’ and hosted the first AI conference in 1956. He is known as one of the “founding fathers” of AI. Since then, the technology software science has had an amazing impact on what people do and how they do it, nearly everywhere, all the time. From 2005 to now. we use many innovations such as speech recognition, smart homes and self-driving cars thanks to AI. Artificial intelligence is currently one of the hottest buzzwords in tech, whether 2023 is the year of AI or not. And with its’ ears tuned-in to anything buzzing, Wall Street is always poised to capitalize. Current estimates predict that AI could potentially contribute $15.7 trillion to the global economy by 2035. That kind of talk gets Wall Street’s attention quickly. For certain, AI is the present and the future.

What is it?

Artificial Intelligence is a method of making a computer, a computer-controlled robot, or a software think intelligently like the human mind. AI is accomplished by studying the patterns of the human brain and by analyzing the cognitive process. The outcome of these studies develops intelligent software and systems. One way to understand how AI is being used is through “Machine Learning”. It is machine learning that gives AI the ability to learn. This is done by using algorithms to discover patterns and generate insights from the data they are exposed to. The last time my ERPE Excerpts covered AI was October 24,2019.

Driving with AI drives AI

Nearly every part of our day is touched by AI. Examples of artificial intelligence show why AI is talked about everywhere; it’s used everywhere. Here’s an example of AI and driving – it has drastically improved traveling. Instead of having to rely on printed maps or directions, you can use Google or Apple Maps on your phone and type in your destination. You will get the optimal route, avoid road barriers and traffic congestions. Not too long ago, only satellite-based GPS was available. Now, artificial intelligence is being incorporated to give users a much more enhanced experience. Using machine learning, the algorithms remember the edges of the buildings that it has learned, which allows for better visuals on the map, and recognition and understanding of house and building numbers. The application has also been taught to understand and identify changes in traffic flow so that it can recommend a route that avoids roadblocks and congestion.

ChatGPT

All the buzz now, and why some are calling 2023 the year of AI, is because of ChatGPT. This super hyped technology is a recent creation by OpenAI, an SF based AI company. In just the short first months of its birth, ChatGPT has become a global phenomenon. Over 100 million people are already using it and it has set off a feeding frenzy of investors trying to get in on the next wave of the A.I. boom. ChatGPT is basically an AI chatbot. A chatbot is a computer program that simulates and processes human conversation (either written or spoken), allowing humans to interact with digital devices as if they were communicating with a real person. Think of the last time you were on your computer researching a product, and a window pops up on your screen asking if you need help. When you add in GPT (generative pre-trained transformer) you get a supercharged chatbot that is a natural language processing tool powered by AI. The model’s function possibilities are endless. The range can be thought of as basic as a simple internet “search” (which is why Microsoft made a big investment in OpenAI to improve its Bing search engine to compete with Google) to writing computer code.

Why you should care

As I wrote in my October 24,2019 Excerpts, titled The 4th Industrial Revolution, “the current and developing environment in which disruptive technologies and trends such as the Internet of Things (IoT), robotics, virtual reality (VR) and artificial intelligence (AI) are changing the way we live and work.” This is more true today than it was then. To gain perspective on this, just “google” chatgpt and the future of ______. There is more. ChatGPT is only one of many generative AI technologies. Likely all industries will be impacted. The future of these technological advancements should also change the way we invest. Growth opportunities in semiconductor chip makers, chip equipment makers, software, hardware and cybersecurity companies are all beneficiaries of the computing power required by the newest industrial revolution.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day: “The proper role of the judiciary is one of interpreting and applying the law, not making it.”

~~ Sandra Day O’Connor, 1984

What Happened On This Day, March 9, – Boston is incorporated as a city. It was first a ‘town’ (in 1630) and grew into one of the largest cities in America centuries later.

MARKET ANALYSIS

INDICATORS OF INTEREST:

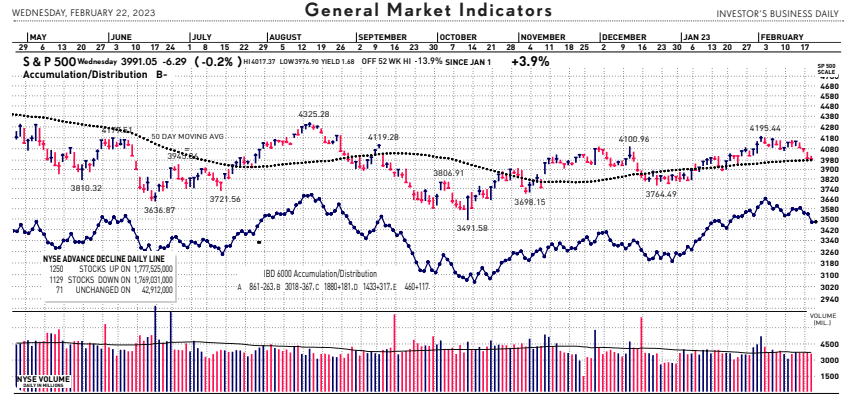

- Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. I analogize this to a traffic signal’s changing colors from green to yellow and then to red. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal is Market in Confirmed Uptrend.

The Stock Market Trend: Market in Confirmed Uptrend. The market’s current trend indicator strengthened last Friday. It had flashed Under Pressure about three weeks ago. The SP 500 fell almost 6% in December. The major stock index reversed direction in January climbing up over 6%. It is now negative for February and now up in March. Clearly volatility is persistent.

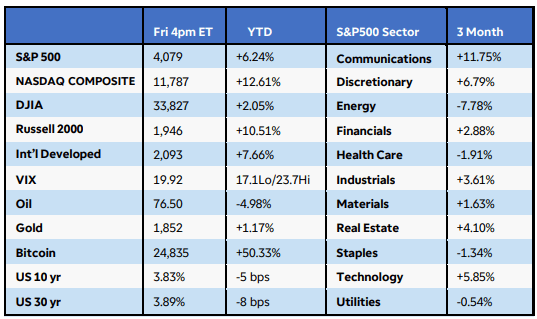

Here are key market levels as of Monday, March 6:

Recapping Last Week

Despite rising interest rates, U.S. equities clawed back earlier losses to finish positive for the week as signs of strength emerged in the global economy. The Nasdaq Composite index rose 2.5%, while the S&P500 and Russell 2000 Indexes gained 2%. Nine of 11 S&P500 sectors ended higher, led by advances in basic materials and industrials. Crude oil and gold posted solid gains, while Bitcoin tumbled 3.5%+ after crypto-friendly U.S. bank Silvergate cast doubts on its ability to stay in business. U.S. Treasury yields eased Friday but not before the 10-year note reached 4% for the first time since November as labor market strength and global inflation persisted.

Jobless claims remained below 200K for the seventh straight week. U.S. durable goods orders sank in January due to an expected large drop in aircraft bookings, but underlying business investment climbed 0.8%, the fastest gains since August. U.S. manufacturing contracted again in February and prices paid ticked up, but the ISM services index continued to expand at a robust pace. Recession fears remained elevated however, as consumer confidence worsened in February on a deteriorating short-term outlook.

Overseas, China’s February factory activity boosted hopes for stronger global growth in 2023, with manufacturing PMI surging to 52.6 and services PMI lifting to 56.3. Moody’s quickly upgraded its GDP estimates for China’s economy to 5% for this year from 4% previously. In Europe, January producer prices declined much more than expected, but February’s CPI stayed stubbornly high at 8.5% year-over-year and core prices rose from the prior month, making a 50bps rate hike all but certain for the March 16 ECB meeting. Australia’s central bank may reconsider how aggressive it needs to be at this week’s meeting after inflation eased in January and Q4 GDP came in lower than expected. Finally, Bank of Japan governor nominee Kazuo Ueda reiterated a likely steady course for monetary policy in parliamentary testimony. Tokyo’s core consumer inflation slowed in February as government energy subsidies kicked in, while industrial production and export growth fell sharply in January.

Current View

Last week’s snap-back market action triggered a more bullish change in my major market indicator to “Confirmed Uptrend.” Interest rates have been driving equity markets recently and will remain in focus with the U.S. jobs report released tomorrow.

- Industry Group Strength: BULLISH. As of yesterday, 171 out the 197 groups I monitor are up year-to-date. 26 are down.

- New Highs vs. New Lows: BEARISH. In yesterday’s session, there were 36 new 52-week highs and 59 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.22%. The 10-year Treasury now 3.97%.

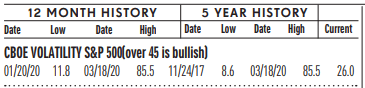

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 21, about the same as 22 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

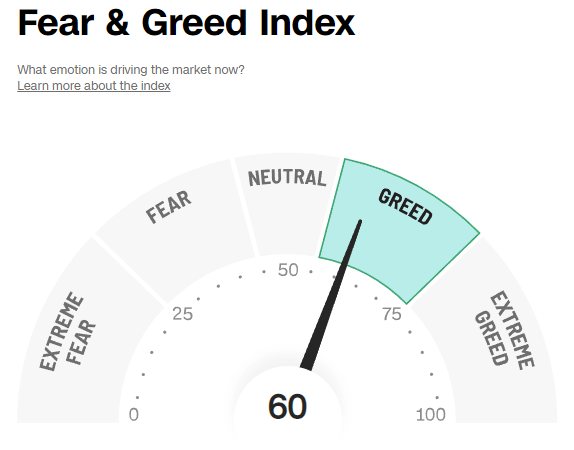

Fear / Greed Index: NEUTRAL. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 60, the Fear & Greed Index is up from 73 two weeks ago.

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 44.4% and the bears came in at 26.4%. The bullish read is down from 2-weeks ago when it was about 49%. The bearish read is up from 25.7% 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

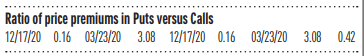

- Put / Call Ratio: NEUTRAL. The ratio of put-to-call options is 1.02, about the same as two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

![]()

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Home Sales Up: U.S. pending home sales rose 8.1% in January, according to the monthly index released last Monday by the National Association of Realtors (NAR), with sales rising for the second month in a row. Pending home sales last rose by this much in June 2020, fueled by pandemic buying. Pending home sales beat analyst expectations. Analysts polled by the Wall Street Journal had forecast the pending home sales index to rise by 0.9%. Contract signings rose in all four regions on a monthly basis. Pending home sales reflect transactions for which a contract has been signed for an existing home but the sale has not yet closed. Economists view it as an indicator of the direction of existing-home sales in subsequent months. But mortgage rates are back up and applications for mortgages are down, hinting at weakness in the coming weeks for home sales. Compared with a year earlier, transactions were down by 24.1%. On a monthly basis, pending sales rose in all four regions, led by the West, which saw a 10.1% increase in January. The NAR attributed the bump to lower home prices. Yet the West also saw the largest drop in pending home sales since last January, by 29.3%. Rates for 30-year fixed-rate mortgages were averaging 6.88% as of last Monday morning, according to Mortgage News Daily. The NAR expects existing-home sales to drop in 2023 by 11.1%, to a total of 4.47 million units.

ISM Up: A barometer of business conditions at service-style companies such as hotels and hospitals held steady at a robust 55.1% in February, showing the U.S. economy is still in expansion mode. Numbers above 50% are a positive sign. The closely followed ISM reports are the first major indicators of each month to offer clues on how well the economy is performing. Economists polled by The Wall Street Journal had expected the index to drop to 54% from 55.2% in January.

WEAK INDICATORS

Jobless Claims Up: New U.S. applications for benefits rose 21,000 from 190,000 in the prior week, the government said today. The number of Americans who applied for unemployment benefits in early March jumped to a 10-week high of 211,000 It’s the first time in eight weeks claims have topped the 200,000 mark. So far, jobless claims remain remarkably low and the economy is still adding plenty of jobs. Economists estimate that the U.S. gained 225,000 new jobs in February. We will get that report tomorrow.

Consumer Confidence Down: A survey of consumer confidence fell to a three-month low of 102.9 in February, signaling worries about the future path of the economy as high inflation and rising interest rates depress U.S. growth. The closely followed index slid 3.1 points from 106 in January, the Conference Board said last Tuesday. Economists polled by The Wall Street Journal had forecast the index to rise to 108.5. Consumer confidence tends to signal whether the economy is getting better or worse. The index remains well below the levels associated with a healthy economy.

Construction Spending Down: Outlays for U.S. construction projects fell 0.1% in January to $1.826 trillion, the Commerce Department reported last Wednesday. Wall Street was expecting construction spending to rise 0.3%. Spending in December rose a revised 0.7% to $1.828 trillion, down from the prior estimate of a 0.4% drop. Over the past year, construction spending is up 5.7%. Total private construction was flat in January.

Factory Orders Down: U.S. factory orders dropped 1.6% in January because of fewer contracts for large Boeing passenger planes. Most other manufacturers recorded somewhat higher bookings. Economists surveyed by the Wall Street Journal had forecast a 1.8% decline. If transportation is excluded, orders for manufactured goods rose 1.2%. Durable-goods orders sank 4.5%, the Commerce Department said Monday. That’s the same as the government’s initial estimate.

JOLTS Down: Job openings in the U.S. fell in January to 10.8 million, but the still-high number of available jobs suggested the labor market remained extremely strong —too strong for the Federal Reserve. Job listings slipped from 11.2 million in December, the Labor Department said Wednesday. Previously the government had estimated 11 million job openings in the final month of 2022. The number of job openings is seen as a cue to the health of the labor market and the broader U.S. economy. Last year they hit a record of 12 million. The Fed wants to see a big decline in job openings, however, to help loosen up a tight labor market and ease the upward pressure on wages as it battles high inflation. The tight labor market threatens to keep wage growth high and make it harder for the Fed to tame rampant price increases. The still-high number of job quitters suggests the labor market remains quite resilient. People quit more often when they think it’s easy to get a better job, but they tend to stay put when the economy weakens. The labor market holds the key to how high the Fed raises interest rates.

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpe excerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN ·

Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.