Bi-Monthly ERPE Excerpts

January 12, 2023

A Good News is Bad News Market…

Last year’s counterintuitive stock market

As I mentioned in my December Market Monthly podcast, the stock market in 2022 could be summed up as a “good news is bad news market”. In 1984 my first mentor in business told me, “Logical people are usually not good investors.” As a rookie in my profession back then, I may not have been logical enough to fully understand that wisdom then. I do now. Because the nature of the investment markets is often counterintuitive, logic does not always prevail when investing. This is especially true in the stock market. So, last year was no exception.

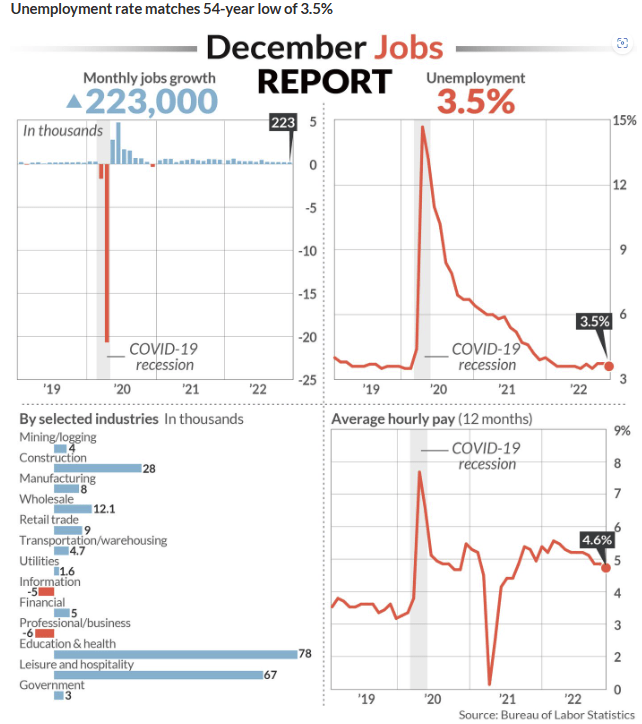

2022 repeatedly showed good news after good news with respect to the economy. This was bad news for the stock market. All year long the market fell sharply on days when data such as job growth, wage increases, consumer confidence, retail spending and industrial production was strong. One clear example of this occurred October 7 of last year. It was what the “Street” calls “Jobs Friday”. The market plunged when the labor market report was released. The Payroll report number was +263,000, right around the expected level. But what was unexpected was the fall in the unemployment rate from 3.7% to 3.5%. Remember previously, the Fed itself had forecast a 4.4% unemployment rate by December. The Nasdaq dropped almost 4% and the S&P 500 sank nearly 3%. This “good news is bad news market” had long been established by then. The market’s reaction was consistent with the ongoing expectation that good economic numbers would give the Fed even more reason to stay “hawkish” – keep raising rates. The market’s reaction to news events goes both ways.

Recently a rare, opposite side of the good news is bad news market, event occurred. Last week’s release of the December Jobs report showed wage increases are slowing. Though not terrible, the news was “bad” enough for the economy that it was good news for the stock market. All the major stock market indexes jumped almost 3%, volume was high, and the general stock market trend turned more bullish, signaling “Market in Confirmed Uptrend”.

Yes, the nature of the stock market is counterintuitive and often benefits contrarian thinking. Another chrematistic of the market is its forward looking perspective. The market tends to discount future events as it essentially prices them in the present. Take for example the highly expected and anticipated U.S. economic recession. Almost all market analysts and economists predict it this year. The only debate is its impact. Many investors think – logically – now is not the time to invest in stocks. The market is telling us something different, discounting a recession in current prices. Here is what it knows:

- The Conference Board’s Leading Economic Indicator Index (LEI) through last August was down six months in a row and in seven of the previous eight. Historically, when the LEI is negative for six straight months, a recession occurs 100% of the time.

- The rule of thumb definition of a recession is two consecutive quarters of negative GDP growth. The reason for the rule of thumb is that when two such consecutive negative GDP quarters occur, a Recession results 100% of the time.

- When a 40+ basis point yield curve inversion between 2-year and 10-year Treasuries occurs, a recession follows 100% of the time.

- When the equity market falls more than -30%, which both the Nasdaq and Russell 2000 did last year, a recession occurs 100% of the time.

Do not be surprised when you hear, “The U.S. economy has fallen into a recession.” And, do not be surprised if the U.S. stock market is going up before and after that news. Wouldn’t you rather have a “bad news is good news market”?

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote: “Darkness cannot drive out darkness, only light can do that. Hate cannot drive out hate, only love can do that.”

~ ~ Martin Luther King, Jr. 1963

What Happened On this Day, 1948 – Supreme Court Rules Against Racism in Education.

MARKET ANALYSIS

INDICATORS OF INTEREST:

- Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal is Confirmed Uptrend.

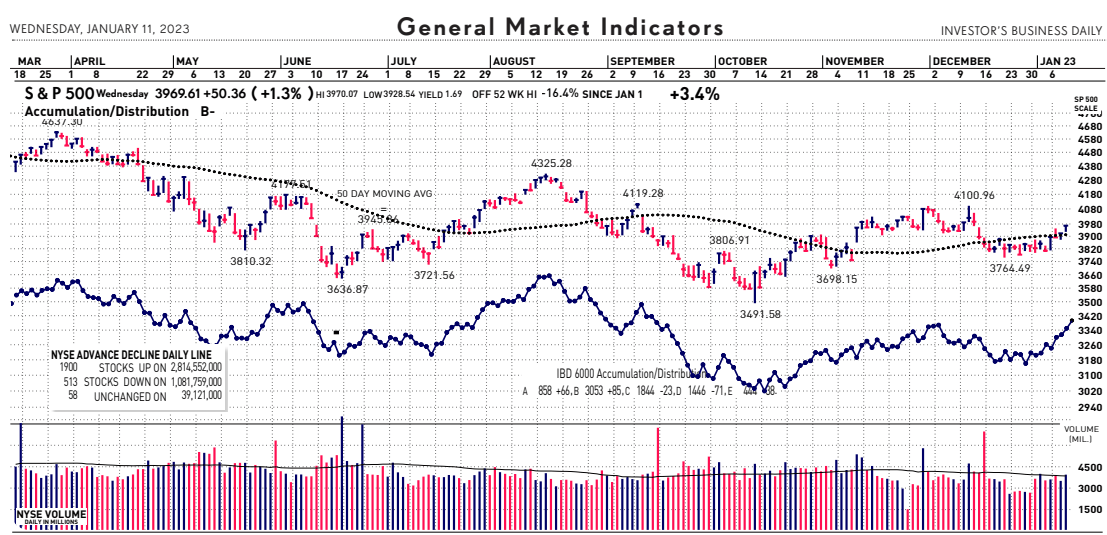

The Stock Market Trend: Market in Confirmed Uptrend. The market’s current trend indicator swung back to a bullish Confirmed Uptrend last Friday, January 6. It had been in Correction mode prior, as the month of December was bearish. The SP 500 fell almost 6% last month.

Here are key market levels as of Monday, January 9:

Recapping Last Week

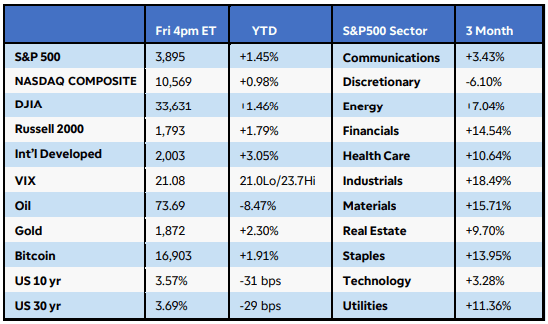

The first week of 2023 saw U.S. equities seesaw to modest gains after economic data revealed positive developments in the Federal Reserve’s efforts to bring inflation down. The S&P 500 Index gained 1.5%, while the Russell 2000 added 1.8% and the Nasdaq Composite rose 1%. Ten of 11 S&P500 sectors finished positive, led by communications, basic materials, and financials. Technology lagged as mega-cap names like Apple, Tesla, and Microsoft struggled. Crude oil sank 8.5% as demand concerns lingered, while gold prices gained 2.3% to reach a 7-month high. U.S. Treasury yields sank along with the U.S. dollar after Friday’s non-farm payrolls for December showed slowing wage growth despite historically low unemployment and solid job gains (see more below). Santa Clause did come to Wall St. as hoped, bringing the “Santa Clause Rally”. That period covers the last five trading sessions of a year and first two of the next year. The S&P 500 rose 0.8% during the 2022-2023 Santa Claus rally period. That marked the seventh straight Santa Claus rally for the index. According to the Stock Trader’s Almanac, the stock market has risen 1.3% on average during those 7 trading days since both 1950.

The S&P 500 lost about 20% of its value in 2022 but has risen about 3% ahead of today’s inflation report, which will set the tone for January’s trading environment. All major indexes closed at highs for the new year on yesterday. Yesterday’s volume posted strong percentage gains on the NYSE and Nasdaq exchanges, signaling increased speculation ahead of market-moving data. Major benchmarks added about 1.5% to recent gains, but everyone was waiting and watching for today’s CPI data. The S&P 500 is back above the 50-day moving average but still below the 200-day moving average, which many view as the dividing line between bull and bear markets. The “January Effect” has arrived on cue, with investors scooping up last year’s biggest losers. The January Effect is the belief that the stock market has a tendency to rise in January more than any other month. While there are many potential causes, it’s mostly thought to be a function of investors reentering the market after selling some of their stocks at year end to lock in their losses for tax purposes. There was a lot of that going into end of last year. Then there’s the “January Barometer”. This seasonal stock market indicator suggests that “as the S&P 500 goes in January, the market goes the year.” Going back to 1950 through 2022, the January barometer has proven correct 61 out of those 73 years, with the SP 500 going up 5% or more. This gives it an 83.56% win rate.

Now that the market received today’s inflation news and had a couple of hours to digest it, all eyes are quickly turning to the fast approaching earnings season and the February 1 Fed meeting. Odds for a 25-basis-point hike stand at about 80%.

Industry Group Strength: BULLISH. As of yesterday, 176 out the 197 groups I monitor are up year-to-date. 21 are down.

New Highs vs. New Lows: BULLISH. In yesterday’s session, there were 174 new 52-week highs and 17 new 52-week lows.

Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.20%. The 10-year Treasury now 3.50%.

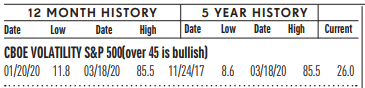

Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 19, down from 23 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

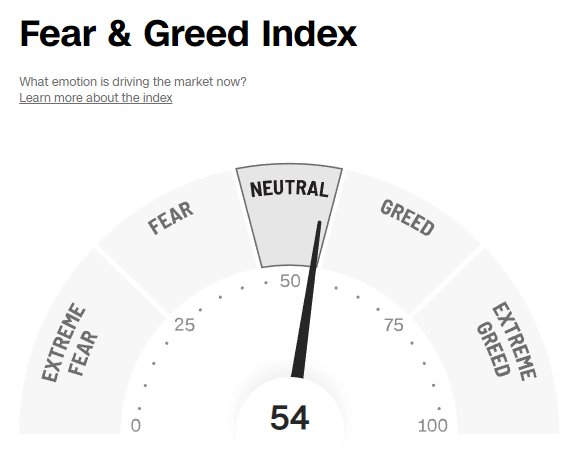

- Fear / Greed Index: NEUTRAL. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 51, the Fear & Greed Index is down from 70 two weeks ago.

Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 41.4% and the bears came in at 32.9%. The bullish read is up from 2-weeks ago. The bearish read roughly the same as 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

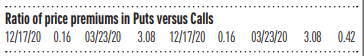

Put / Call Ratio: NEUTRAL. The ratio of put-to-call options is 1.03, up from 0.74 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Construction Spending Up: Outlays for construction projects rose 0.2% in November to $1.81 trillion, the Commerce Department reported last Tuesday. Wall Street was expecting a drop of 0.4%. Spending in October fell a revised 0.2% to $1.8 trillion, up from the prior estimate of a 0.3% drop. Over the past year, construction spending was still up 8.5%. Total private construction rose 0.3% in November. Private residential construction fell 0.5%, with single-family construction dropping by 2.9%. Private nonresidential spending rose by 1.7%. Total public construction fell by 0.1%. Residential public construction fell by 0.1%, while nonresidential public construction also fell by 0.1% last month.

JOLTS Up: Job openings in the U.S. fell slightly to 10.46 million in November, but workers were still quitting in droves in a sign the labor market remains quite strong, perhaps too strong for the Federal Reserve. Job listings declined from 10.51 million in October, the Labor Department said last Wednesday. But openings in October were also revised higher. The number of job openings is seen as a cue on the health of the labor market and broader U.S. economy. Job postings have slowly receded since hitting an all-time high of 11.9 million last spring. The jobs market is still too hot for the Fed, however. The Fed is worried high inflation will persist unless hiring slows and a rapid increase in wages tapers off. There were 1.7 job openings for each unemployed worker in November, well above pre-pandemic levels of 1.2. The Fed is watching that ratio closely and wants to see if fall back to pre-pandemic norms.

Jobs Report Robust: The U.S. generated 223,000 new jobs in December to mark the smallest increase in two years, but the labor market still showed surprising vigor even as the economy faced rising headwinds. The unemployment rate, meanwhile, slipped to 3.5% from 3.6%, the government said last Friday. The jobless rate has touched 3.5% several times since 2019, matching the lowest level since 1969. One good sign for Wall Street and the Federal Reserve: Hourly pay rose a modest 0.3% last month, suggesting wages are coming off a boil. The increase in wages over the past year also slowed to 4.6% from 4.8%, marking the smallest gain since the summer of 2021.

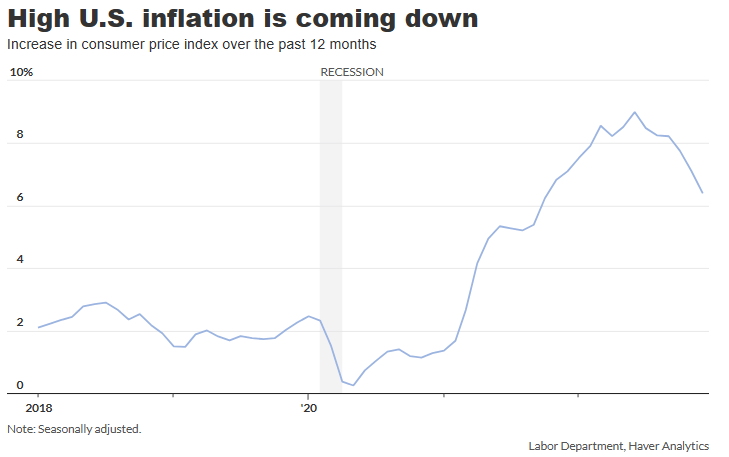

CPI Down: The U.S. cost of living fell 0.1% in December and posted the first decline since the onset of the pandemic in 2020, pointing to a further slowdown inflation after it hit a 40-year peak last summer. Economists polled by The Wall Street Journal had forecast a 0.1% drop in the consumer price index. Lower oil prices largely accounted for the decline. The annual rate of inflation fell for the sixth month in a row to 6.5% from 7.1% . That’s the lowest level in more than a year and down from a 40-year peak of 9.1% last summer. U.S. stocks rose slightly after the report. Here’s a case of bad news is good news… Wall Street hopes easing inflation will allow the Federal Reserve to end a cycle of interest-rate hikes soon before they tip the economy into recession.

Jobless Claims Down: Initial jobless claims fell by a seasonally adjusted 1,000 to 205,000 in the last week, the Labor Department said today. Economists polled by The Wall Street Journal had estimated new claims would rise 6,000 to 210,000. Last week claims fell a revised 17,0000 to 206,000. That compared with the initial estimate of a decline of 19,000 to 204,000. The labor market is running pretty hot. That will keep pressure on wages and keep the Federal Reserve on alert.

Global Economic Indicators & Analysis:

WEAK INDICATORS

U.S. Factory Sector Down: The U.S. manufacturing sector contracted in December at the steepest pace since the onset of the Covid-19 pandemic as demand remained subdued and production weakened, data from a purchasing managers survey showed last Tuesday. The S&P Global U.S. manufacturing PMI decreased to 46.2 in December from 47.7 in November, posting the lowest reading since May 2020. The index suggests factory activity shrank in December for a second consecutive month as any reading below 50.0 indicates contraction.

U.S. Economy Slowing: A barometer of U.S. business conditions at service-oriented companies such as retailers and restaurants fell to 49.6% in December and turned negative for the first time since early in the pandemic, offering further proof the economy is weakening. Last Friday’s reading of under 50% is a sign the economy is contracting. The closely followed ISM reports are the first major indicators of each month to offer clues on how well the economy is performing. Economists polled by The Wall Street Journal had expected the index to drop to 55.1% from 56.5% in November. The report is produced by the Institute for Supply Management. The huge service side of the economy had been growing steadily, but the latest ISM reading suggests erosion in business conditions at the end of the year.

U.S. Small Business Optimism Down: Confidence among owners of small businesses in the U.S. deteriorated in December to a six-month low as short-term expectations over sales and business conditions worsened at year-end. The National Federation of Independent Business (NFIB) said Tuesday that its small-business optimism index fell to 89.8 in December from 91.9 in November, below the index’s historical average of 98 and the lowest level since June. Economists polled by The Wall Street Journal expected the index to increase marginally to 92.0.

Share ERPE Excerpts

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpeexcerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN · Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.