ERPE EXCERPTS

Bi-MONTHLY MARKET ANALYSIS &

ECONOMIC UPDATES

June 8, 2023

The Passing of a Legend

March 25, 1933 – May 28, 2023

I am lucky to have started my professional career when I did nearly 40 years ago, in 1984. Perhaps the greatest investors of all time were doing their best work, leading by example, and nearing their prime as I was just starting to increase my knowledge and gaining experience as an investment advisor. True Wall Street legends such as Jack McCarthy – the “Raging Bull”, Sir John Templeton, Peter Lynch, John Bogle, Warren Buffet, Carl Icahn, Marty Zweig and many more were there for me to learn from. Legends. Marty Zweig called the 1987 stock market plunge on a national TV financial program just days before it happened. But, the one that to me was the GOAT just passed a way at 90; William O’Neil. O’Neil died on May 28, 2023. William O’Neil was a legendary investor and one of the true great American success stories. His entrepreneurial spirit and strong work ethic led him to develop his own unique method of stock picking and launch his own companies, which have helped millions of investors improve their investment skills. I have learned more from Mr. O’Neil about stocks and the market of stocks than from anyone. O’Neil created an enduring and expanding legacy built around educating and empowering investors. I was fortunate to have met him when I was a rookie in 1986. He had just before that launched Investor’s Daily in 1984, which later became Investor’s Business Daily (IBD). It was the first national business newspaper to compete successfully with The Wall Street Journal. It was considered by many to be a far better publication, dedicated to providing investor education, research and methodology. Ironically, William O’Neil’s Investor’s Business Daily was bought by the parent company of the Wall Street Journal in May of 2021 for $275 million.

So, sadly, another legend has passed. Though, I choose to believe the spirit of William O’Neil will remain with us. As a great optimist, Mr. O’Neil dedicated a page in his daily investor newspaper to what he called, “Leaders & Success”. In memory of William O’Neil, I am dedicating this issue of ERPE Excerpts to him and want to share his “10 Secrets of Success”. For decades Investor’s Business Daily has analyzed leaders and successful people in all walks of life. They discovered most have 10 traits that, when combined, can turn dreams into reality. Now, every week they highlight one. Here are IBD’s Secrets of Success:

1 HOW YOU THINK IS EVERYTHING: Always be positive. Think success, not failure. Beware of negativity.

2 DECIDE UPON YOUR TRUE DREAMS AND GOALS: Write down your specific goals and develop a plan to reach them.

3 TAKE ACTION: Goals are nothing without action. Don’t be afraid to get started. Just do it.

4 NEVER STOP LEARNING: Go back to school or read books. Get training and acquire new skills.

5 BE PERSISTENT AND WORK HARD: Success is a marathon, not a sprint. Never give up.

6 LEARN TO ANALYZE DETAILS: Get all the facts, all the input. Learn from your mistakes.

7 FOCUS YOUR TIME AND MONEY: Don’t let other people or things distract you.

8 DON’T BE AFRAID TO INNOVATE, BE DIFFERENT: Following the herd is a sure way to mediocrity.

9 DEAL AND COMMUNICATE WITH PEOPLE EFFECTIVELY: No person is an island. Learn to understand and motivate others.

10 BE HONEST AND DEPENDABLE; TAKE RESPONSIBILITY: Otherwise, No’s. 1-9 won’t matter.

Today’s team at IBD think an 11th secret that would best sum up O’Neil would be:

Stay humble. No matter how big you’ve hit it, be modest.

William O’Neil stressed that it’s crucial to listen and learn from the very best in their respective fields. I am lucky to have learned a lot from him.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day: “The market is not an invention of capitalism. It has existed for centuries. It is an invention of civilization.”

~ ~ Mikhail Gorbachev, 1990

What Happened On This Day, June 8, – 1937 – The world’s largest flower, a 12 foot tall calla lily, blooms in NY Botanical Garden.

MARKET ANALYSIS

INDICATORS OF INTEREST:

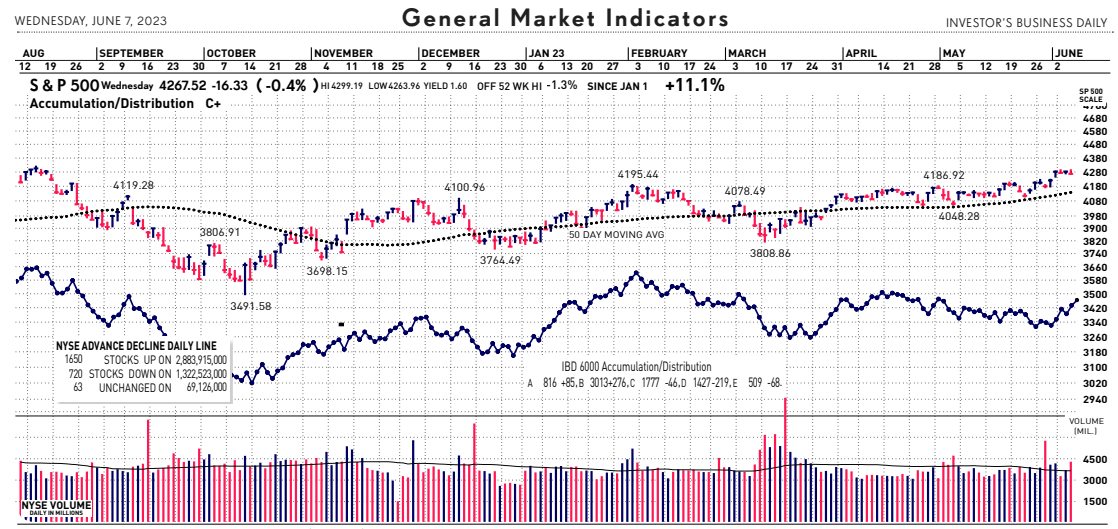

- Market’s Current Signal: Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. I analogize this to a traffic signal’s changing colors from green to yellow and then to red. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal is Confirmed Uptrend.

The Stock Market Trend: Confirmed Uptrend. After the regional banking crisis in mid-March, the general market weakened to Market in Correction March 15. In a resilient rally, the trend turned bullish with a signal change to Market in Confirmed Uptrend on March 29. That trend signal flashed caution and indicated weakness on April 25 as the market’s trend changed to Uptrend Under Pressure. Then, on May 10 the market’s trend changed again, to Confirmed Uptrend.

Here are key market levels as of Monday, June 5:

Recapping Last Week

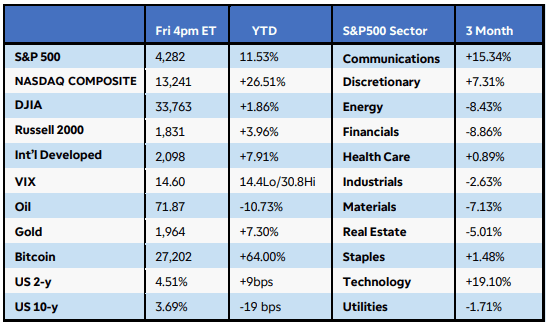

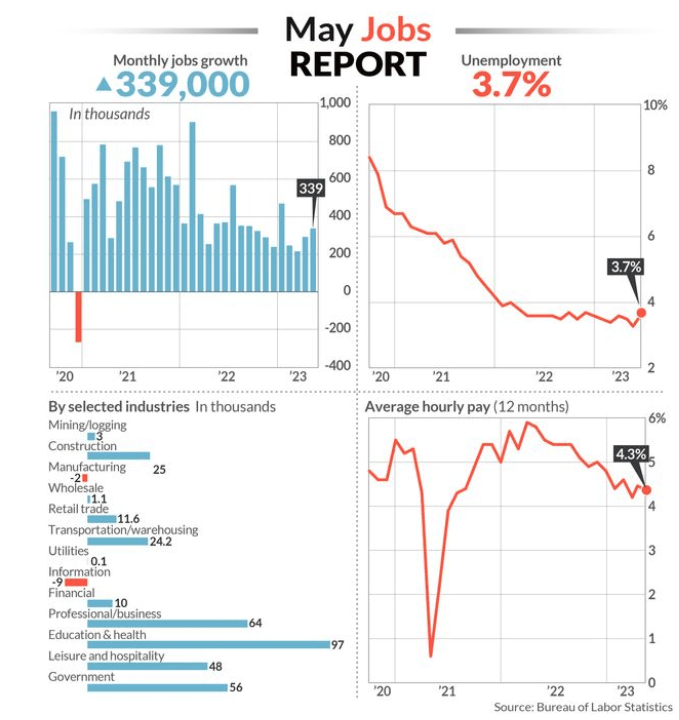

U.S. equities advanced as investors celebrated the debt ceiling bill’s passage, while a strong jobs report complicated the Federal Reserve’s signaled policy path. The Russell 2000 Index jumped 3.3%, while the Nasdaq Composite and S&P500 rose 2%, with the latter reaching a nine-month high. All 11 S&P500 sectors finished positive, led by consumer discretionary, real estate, and basic materials. Most commodities were little changed as the U.S. dollar eased from recent highs. U.S. Treasury yields fell after several FOMC members, including vice chair nominee Jefferson, suggested that skipping a rate hike at the June meeting would allow policymakers time to assess data, without precluding future tightening. However, an exceptionally strong labor market likely keeps the door open to more rate hikes in June and beyond. As noted above, nonfarm payrolls surged by 339K in May, beating expectations for the 14th consecutive month, even as the unemployment rate ticked up to 3.7% from 3.4%. There was good news on the inflation front as average hourly earnings gains slipped to +4.3% year-over-year, albeit still well above the 2.8% pre-pandemic average.

Internationally, Eurozone inflation fell more than forecast in May, tumbling to 6.1% year-over-year from 7% the prior month. Consumer prices dropped month-to-month in Germany for the first time this year. In China, a report Friday that regulators are considering new measures to boost the real estate market fueled speculation of additional economic stimulus. Factory activity withered more than expected in May and services expansion slowed. Finally, Australia’s April CPI rose to +6.8% YoY from +6.3%, driven by soaring fuel prices, while Japan’s factory output and retail sales missed the mark in April.

Current View

The stock market’s general trend remains in Confirmed Uptrend. If the Nasdaq index is your barometer, the stock market is obsoletely in a bull market . Heading into yesterday’s session, it had scored a 26.8% year-to-date gain. It is on track to be up this week for the sixth straight week, the longest winning streak since 2019. As I mentioned in my recent Market Monthly podcast, we have a tale of two markets. At the end of May, the Nasdaq index was up over 23% for the year, while over the same time the Dow was negative -0.7%. This was the largest 5-month performance gap between the two indices in history.

In a confirmed stock market uptrend, you want to see indexes rise in higher volume vs. the prior session and fall in lower turnover. yesterday’s case was the opposite. It turned out to be a session of earnest profit taking by mutual funds, hedge funds, banks, pension plans and the like. Nasdaq volume jumped 10% while the NYSE saw turnover bulge nearly 14% vs. Tuesday. After such a strong advance as the broad market has seen since late April, yesterday’s action is to be expected.

With a debt ceiling agreement accomplished and 1Q23 mostly earnings behind in the books, the market’s wall of worry is a shorter hurdle. Next weeks Fed meeting, though, is still a stock market concern. The probability of a fourth quarter-point rate hike has increased. According to the CME FedWatch tool, futures traders see a 33.8% chance of a quarter-point hike to a 5.25%-5.5% target range, up from 8.5% a month ago.

- Industry Group Strength: BULLISH. As of yesterday, 134 out the 197 groups I monitor are up year-to-date. 63 are down.

- New Highs vs. New Lows: BULLISH. In yesterday’s session, there were 291 new 52-week highs and 34 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.24%. The 10-year Treasury now 3.73%.

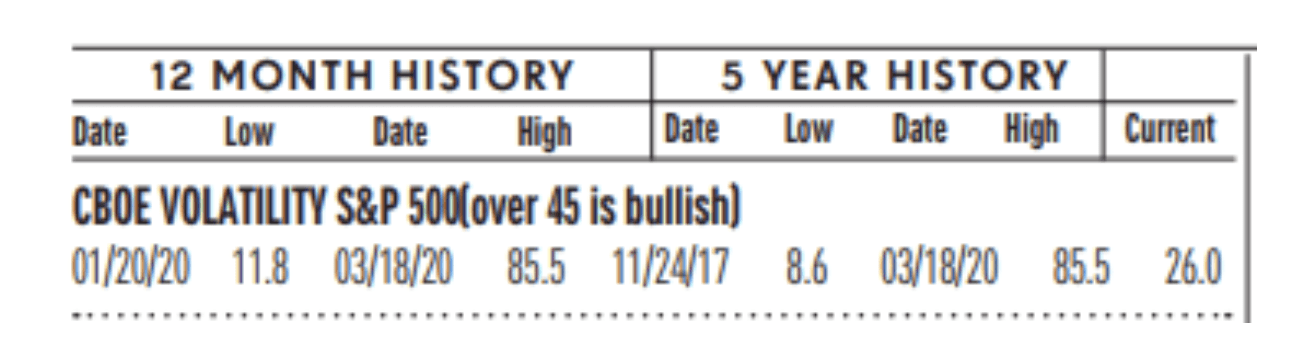

- Volatility Index: BEARISH. Volatility has been volatile. The “VIX” is now 13, down from 16 two weeks ago. It is now at its lowest level since February 20, of 2020. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

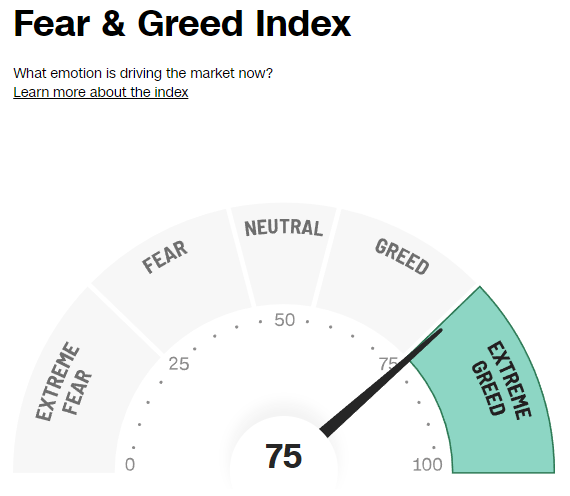

- Fear / Greed Index: BEARISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 75, the Fear & Greed Index is up from 61 two weeks ago.

- Bull / Bear Barometer: BEARISH. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 51.3% and the bears came in at 21.6%. These readings are near the same as two weeks ago. Bullish sentiment is up from 45.2% and the bearish read is down from 24.7%, both in the last two weeks. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

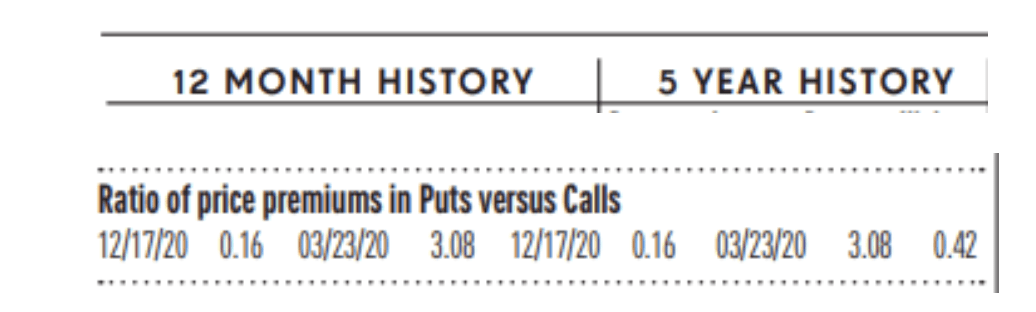

- Put / Call Ratio: NEUTRAL. The ratio of put-to-call options is 0.50, up from 0.67 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Factory Orders Up: Orders for manufactured goods rose 0.4% in April, the Commerce Department said Monday. It is the fourth increase in factory-goods orders in the past five months. Economists surveyed by the Wall Street Journal were expecting a 0.6% rise. The gain was led by transportation equipment. Excluding that sector, orders were down 0.2%. Durable-goods orders rose 1.1% in April.

Jobs Market Up: Jobs report shows a big 339,000 gain in May. The U.S. economy is still strong. Wall Street had forecast a 190,000 increase in new jobs, based on the government’s survey of business establishments. Employment gains in April and March were also considerably higher than previously reported, the government reported Friday, in another sign the labor market remains unusually strong. The economy averaged a robust 283,000 new jobs in the past three months, but that’s down from 344,000 in the same period in 2022. The unemployment rate, meanwhile, rose to 3.7% from 3.4%. That’s the highest level since last October.

Beige Book Points to Positive Economy: Fed’s Beige Book indicates a slow and steady economy, but maybe not slow enough to tame inflation. The Federal Reserve’s regular survey of the economy, known as the Beige Book, indicated the U.S. is still in decent shape. Yet persistently high inflation remains a big problem. Last Wednesday’s survey release shows the U.S. economy appears to be expanding in the 1% to 2% range. Four of the Fed’s 12 regional banks covering the U.S. posted small increases in economic growth. Six reported no change. And two said activity declined slightly.

WEAK INDICATORS

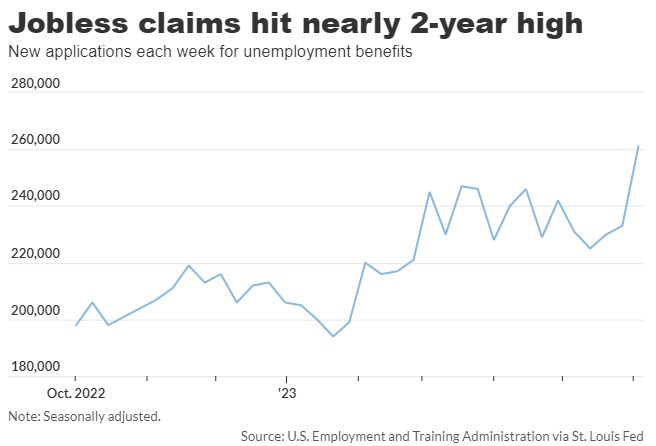

Jobless Claims Up: The number of people who applied for U.S. unemployment benefits in early June jumped to a nearly two-year high of 261,000, but most of the increase took place in just two states: Ohio and California. New jobless claims in the seven days ended June 3 climbed by 28,000 from the prior week, the Labor Department said today. The figures are seasonally adjusted. Of the 53 U.S. states and territories that report jobless claims, 27 showed an increase last week. The other 26 posted a decline.

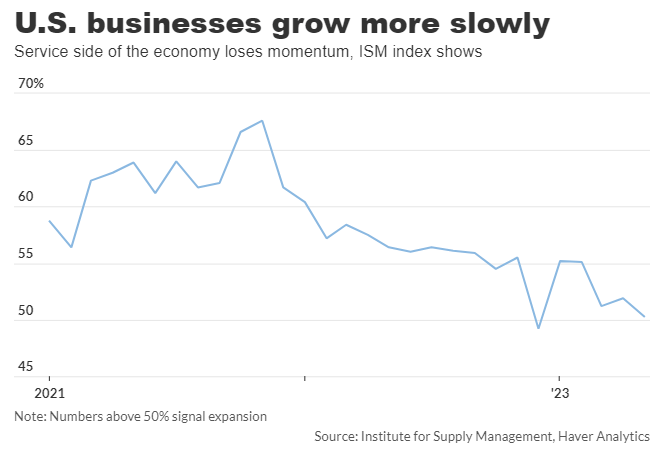

Service Sector Index Down: Most U.S. service businesses grew at a slower pace in May as customer demand leveled off, Monday’s survey showed. The ISM services index fell to a five-month low of 50.3% last month. The Institute for Supply Management’s index of service-oriented businesses dropped from 51.9% in April. Numbers above 50% indicate companies are expanding, but the U.S. economy has slowed markedly from a year ago. Economists polled by The Wall Street Journal had expected the services index to rise to 51.8%. Americans are spending lots of money to eat out, travel and entertain themselves. That’s kept the U.S. economy growing and out of recession.

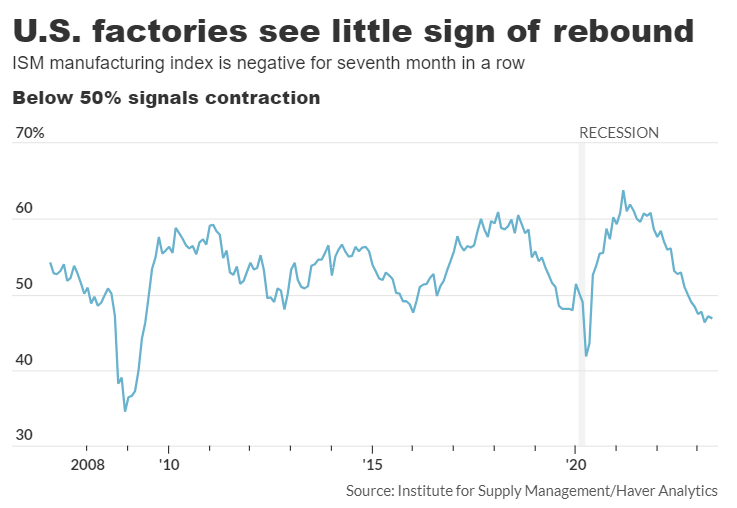

Manufacturing Sector Index Down: Last Thursday’s Institute for Supply Management’s manufacturing survey slipped to 46.9% in May from 47.1% in the prior month. Numbers below 50% signal contraction in the industrial side of the economy. Economists polled by the Wall Street Journal had forecast the index to register 47.0% in May. The last time the index was below that threshold for more than six months was between March 2008 and June 2009 — during the Great Recession. The index of new orders fell 3.1 points to 42.6%, just a tick above the post-pandemic low. Demand remained at a level associated with a recession. “New orders define the future, and right now the future is very cloudy,” said Timothy Fiore, chairman of the survey.

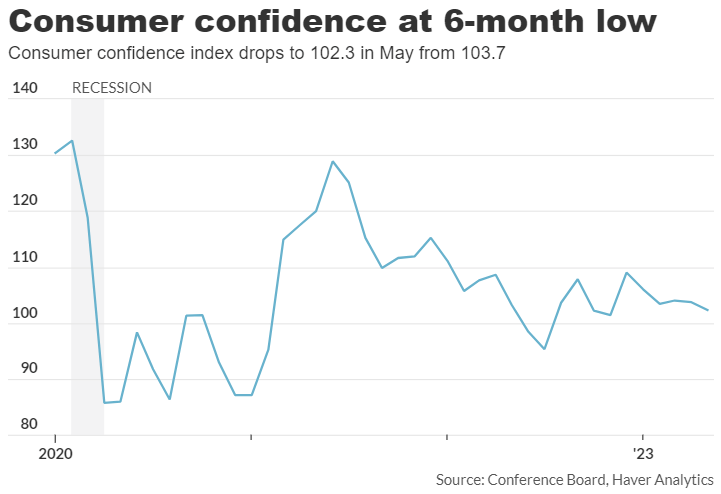

Consumer Confidence Down: Consumer confidence slips to six-month low. Americans ‘gloomy’ about economy. A survey of consumer confidence slipped in May to a six-month low of 102.3. Economists polled by The Wall Street Journal had forecast the index to register 99.Americans remained gloomy about the economy and said jobs were getting harder to find. The closely followed index dipped 1.4 points from a revised 103.7 in the prior month, the Conference Board said Tuesday. The level of confidence in May was the lowest since last November.

Productivity Down (but less than expected): U.S. labor productivity in the first quarter was not as weak as initially reported. The productivity of American workers fell by a revised 2.1% annual rate in the first quarter, according to last Thursday’s report. Expectations were for a decline of 2.7% in the government’s preliminary report last month. Over the past year, productivity has declined by a revised 0.8%. The annual rate has been negative for a record five straight quarters.

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpe excerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN ·

Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.