ERPE EXCERPTS

Bi-MONTHLY MARKET ANALYSIS &

ECONOMIC UPDATES

February 9, 2023

2023 Best Online Brokers

IBD’s 11th Annual Best Custodian Report

As an independent Registered Investment Advisor (RIA), I am required to have an investment account custodian (aka brokerage firm). Further, RIA’s are responsible for applying a diligent selection process that demonstrates a “best efforts” approach to the custodian choice on behalf their clients. Through recent decades of consolidation in the brokerage business, the pool of custodians to choose from has shrunk. The few left are extremely large, measured by investor accounts they hold and the amount of assets they custody. It has been a “big got bigger” business experience, and hopefully those big got better.

Since the inception of my RIA firm, I have partnered with both Charles Schwab and TD Ameritrade as chosen custodians. I often refer to custodians as the “garage”. Using that metaphor, I refer to a client’s investment account as a “car” and myself as their “mechanic”. To best service the car, as the mechanic I need the best garage available equipped with the best tools. This year’s annual IBD Best Online Brokers survey shows that I’m working with the best “garage”. The 2023 Investor’s Business Daily Best Online Broker report was released last week. Based on the overall scores of the seven brokerages that qualified for the survey analysis, IBD announced the Best Online Brokers for 2023 was Charles Schwab, followed by Fidelity (which held the top spot in 2022’s report), and TD Ameritrade was #3. We’ve got 2 of the top 3 custodians. You could say the best of the top two because later this year the merger between Schwab and TDA will be completed, resulting in one very big “garage”!

Investor’s Business Daily’s annual survey (this year’s was the 11th), conducted with polling partner TechnoMetrica, asked investors to rank their custodian on 18 key attributes. These 18 categories were what investors said were most important to them. Included in that list were trade execution and speed, website security, equity trading platform, site performance, customer service, portfolio analysis and reports, and much more. Charles Schwab or TD Ameritrade ranked #1 in 13 of the 18 categories (Schwab 7 and TDA 6).

In studying the 2023 Best Online Broker report, I found an irony. The survey polled nearly 3,500 “do-it-yourself” investors. The results showed that what these investors “crave” most is advice and portfolio analysis. If you know of anyone looking for a good “mechanic” aligned with the best “garage”, I know one….

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote: “This taught me a lesson, but I’m not sure what it is.”

~~ John McEnroe, 1987

What Happened On this Day, 1870 – United States Weather Bureau is established by President Ulysses S. Grant.

MARKET ANALYSIS

INDICATORS OF INTEREST:

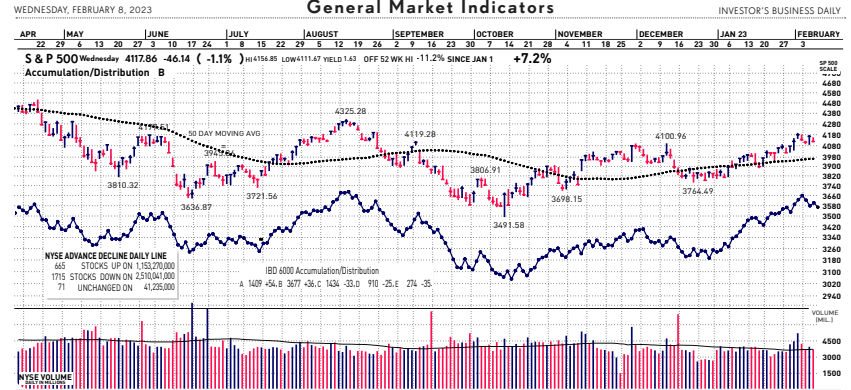

- Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. I analogize this to a traffic signal’s changing colors from green to yellow and then to red. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal is Confirmed Uptrend.

The Stock Market Trend: Market in Confirmed Uptrend. The market’s current trend indicator swung back to a bullish Confirmed Uptrend last Friday, January 6. It had been in Correction mode prior, as the month of December was bearish. The SP 500 fell almost 6% in December. The major stock index reversed direction in January climbing up over 6%. Clearly volatility is persistent.

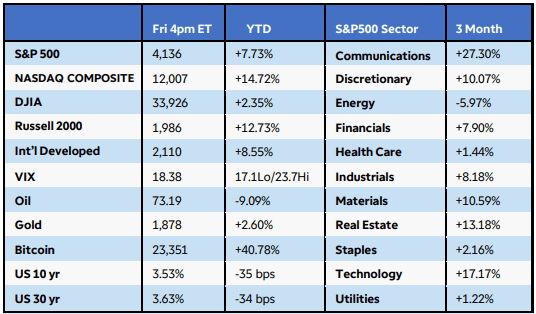

Here are key market levels as of Monday, February 6:

Recapping Last Week

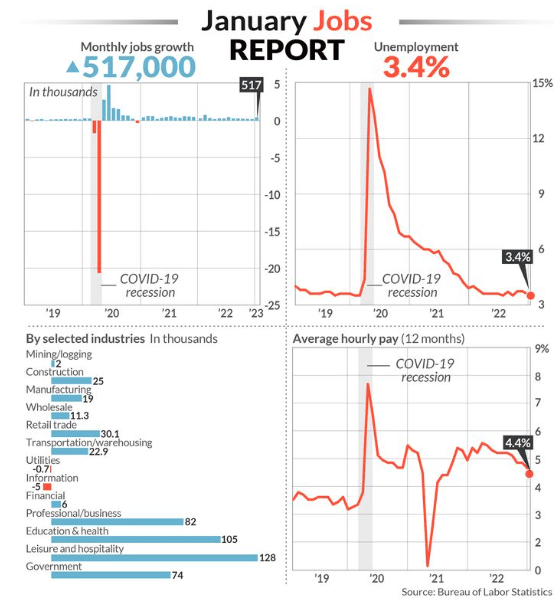

U.S. equities posted a second straight week of solid gains despite a stronger than expected monthly jobs report that kept additional interest rate hikes on the table. The Nasdaq Composite and Russell 2000 Indexes soared 3-4% even as technology earnings disappointed, while the S&P500 rose 1.5%. Eight of 11 S&P500 sectors finished positive, led by communications, technology, and consumer discretionary, while energy stocks struggled as crude oil slumped over 7%. U.S. Treasury yields spiked on Friday as traders repriced year-end fed funds rate expectations. As we note below ,U.S. payrolls jumped by a whopping 517,000 in January, and the unemployment rate fell to 3.4%, the lowest level since 1969. If inflation continues to fall while the labor market remains strong, an economic soft landing is plausible. Job openings rose in December, still hovering near a 2 to 1 ratio for every unemployed person. Earlier in the week, the FOMC raised rates by 25 basis points, and chair Powell gave no indications of a pause but acknowledged disinflationary trends. In other news, U.S. consumer confidence slumped in January as recession concerns lingered, while ISM manufacturing PMI dropped for a fifth straight month as new orders plunged. Services strongly rebounded back into expansion after a brief dip in December, suggesting robust consumer spending in the sector. Internationally, the European Central Bank raised rates by 50 basis points and is likely to do the same at its March meeting. January Eurozone CPI dipped to 8.5% year-over-year but did not include figures from Germany, which delayed its report due to technical issues. German GDP shrank unexpectedly at the end of 2022 as private consumption fell, while December retail sales slipped as inflation weighed on holiday shoppers. The Bank of England signaled a potential slowdown in rate hikes after a 50bps increase and a less pessimistic economic forecast. Finally, China saw activity swing back to growth in January as Covid-19 infections eased during the Lunar New Year holiday.

The “January Effect” has again shown its impact. Since the start of the year, investors have scooped up last year’s biggest losers. The January Effect is the belief that the stock market has a tendency to rise in January more than any other month. While there are many potential causes, it’s mostly thought to be a function of investors reentering the market after selling some of their stocks at year end to lock in their losses for tax purposes. There was a lot of that going into end of last year. Further, the “January Barometer” is a positive now. This seasonal stock market indicator suggests that “as the S&P 500 goes in January, the market goes the year.” Going back to 1950 through 2022, the January barometer has proven correct 61 out of those 73 years, with the SP 500 going up 5% or more. This gives it an 83.56% win rate. This year adds to the win column.

The global investment market’s remain fixated on the U.S Fed. After last week’s Fed move, the markets are speculating on the next move. CME’s Fed Watch calculator currently shows a 65% probability that the U.S. central bank will raise the fed funds rate to at least a target range of 5%-5.25% by May. The current level is 4.5%-4.75%. This means the Fed would ratchet rates up a quarter point both at its March 22 meeting and the next one on May 3. In general, consensus is that that rates may stay higher for longer.

- Industry Group Strength: BULLISH. As of yesterday, 174 out the 197 groups I monitor are up year-to-date. 23 are down.

- New Highs vs. New Lows: BULLISH. In yesterday’s session, there were 131 new 52-week highs and 23 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.20%. The 10-year Treasury now 3.60%.

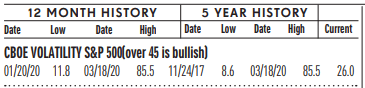

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 19.5, about the same as 19 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

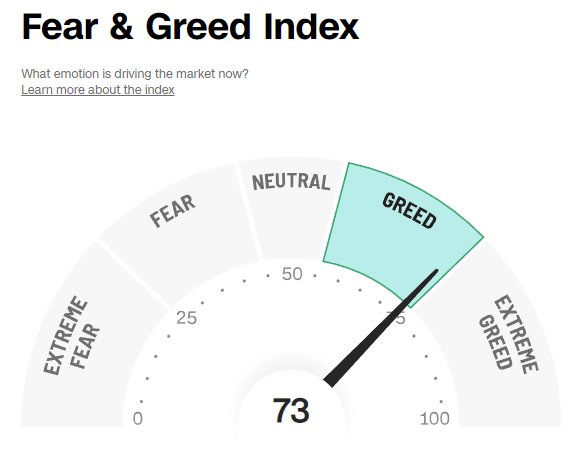

- Fear / Greed Index: NEUTRAL. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 73, the Fear & Greed Index is up from 70 two weeks ago.

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 48.6% and the bears came in at 25.7%. The bullish read is up from 2-weeks ago when it was 41.1% The bearish read is down from 32.9% 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

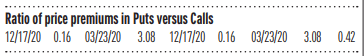

- Put / Call Ratio: BEARISH. The ratio of put-to-call options is .55, down from 1.03 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

![]()

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Fed Takes Rates Up AGAIN- but may be near the end: Last Wednesday the Federal Reserve announced a quarter-percentage-point increase in a key U.S. interest rate and signaled that just a “couple more hikes” are likely before the central bank takes a breather in its fight against inflation. With this 8th rate hike since last March, the Fed lifted its benchmark short-term rate to a range of 4.5% to 4.75%. Fed Chairman Jerome Powell said a “disinflationary” process is under way at a press conference after the decision. Yet he also reiterated the Fed needs to see “substantially more evidence” that price pressures are evaporating. Analysts point to a slowing economy and waning inflation to support the case for the Fed to ease up on the monetary brakes. If it keeps going, they contend, the U.S. could slump into recession. The economy has softened. Hiring has slowed for five straight months, and hiring in January may have been the weakest in two years. A variety of other indicators also point to spreading weakness. The annual rate of inflation, meanwhile, slowed to 6.5% as of December from a four-decade peak of 9.1% last summer, based on the consumer-price index. Powell cautioned again that it would be premature for the Fed to consider cutting rates until it achieves more progress in its fight against inflation. Although inflation is expected to continue to slow, prices are still rising by more than triple the annual average in the decade proceeding the pandemic.

Jobs Market stays Strong: The number of new jobs created in January rose by 517,000 to mark the biggest gain in six months, suggesting persistent strength in a muscular U.S. labor market even though the economy has shown signs of fraying. The increase in new jobs was much stronger than the 187,000 forecast of economists polled by The Wall Street Journal. It could also put more pressure on the Federal Reserve to take sterner measures to combat inflation. One caveat: The government’s formula to adjust for seasonal swings in hiring sometimes exaggerates employment levels in January. It’s unclear whether that was the case last month. Yet employment grew even faster in the waning months of 2022 than previously reported, indicating the labor market is still quite robust. In an additional sign of strength, the unemployment rate slid to a 54-year low of 3.4% from 3.5%, the government said last Friday (see graph below). The only seeming sign of moderation in the report was a 0.3% increase in hourly pay. As a result, the increase in hourly pay over the past year slowed again to 4.4% from 4.8%, indicating some relaxation in wage pressures.

Service Sector Up: The barometer of service business conditions such as restaurants and hotels rebounded to 55.2% in January after falling into contraction of 49.6 in the prior month, according to an ISM report last Friday. Economists polled by the Wall Street Journal had expected the service sector activity index to rise to 50.6%. Numbers over 50% indicate expansion in the economy. New orders jumped to 60.4 in January, which was 15.2 percentage points above the December reading. Business activity rose 6.9 percentage points to 60.4. Ten of the 18 broad industry groups reported growth in January.

WEAK INDICATORS

Jobless Claims Up: The number of Americans filing new claims for unemployment benefits increased more than expected last week, but the underlying trend continued to point to a tight labor market. Initial claims for state unemployment benefits rose 13,000 to a seasonally adjusted 196,000 for the last week , the Labor Department said on today. That was the first increase in claims since the second last week of December. Economists polled by Reuters had forecast 190,000 claims for the latest week.

Consumer Confidence Down: Last Tuesday’s survey of consumer confidence showed a dip in January to 107.1, reflecting growing worries about a potential recession as rising interest rates and high inflation degrade the U.S. economy. The closely followed index fell almost 2 points from 109 in December, the Conference Board said. Economists polled by The Wall Street Journal forecast the index to rise to 109.5. While the index had hit an 11-month high at the end of 2022, it’s well below the levels associated with a healthy economy. Consumer confidence tends to signal whether the economy is getting better or worse. A measure of how consumers feel about the economy right now rose to 150.9 in January from in 147.4 in December. That’s the highest level in nine months, reflecting a resurgent stock market, falling gas prices and easing inflation. The economy has slowed in response to higher interest rates orchestrated by the Federal Reserve to try to quench inflation. Higher borrowing costs depress consumer and business spending.

Manufacturing Down: A key barometer of American factories contracted for the third month in a row and touched the lowest level since early in the pandemic, signaling a loss of momentum in the U.S. economy as it entered the new year. The Institute for Supply Management’s manufacturing survey fell to 47.4% from 48.4% in prior month. Economists polled by The Wall Street Journal had forecast the index to total 48%. The ISM report is viewed as a window into the health of the economy. Numbers below 50% signal the manufacturing sector is contracting. The last time the index was that low was in May 2020 during the early stages of the pandemic. “The ISM report reinforces our view that the U.S. economy is heading for recession,” said one U.S. economist. “The silver lining is that weakening demand is continuing to exert downward pressure on inflation.”

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpe excerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN ·

Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.