2019 Outlook

It is that time of year when I want to spread some cheer,

and a few thoughts of what I expect in the markets next year.

Good-bye 2018. Hello 2019.

Here’s hoping for a year ahead for stocks that is not so mean.

Though the last quarter of ’18 was bad,

I hope you have many reasons when pondering the year to be glad.

With the past year in mind, we truly have much to be thankful,

for the opportunity to serve our clients another year, we are grateful.

With each tick of the clock, the New Year is closer as this year ends,

I hope you ring in a happy 2019 with family and friends!

Happy 2019!

John Gardner

We Wish You a Happy & Healthy New Year!

John and Greg

Winds of Change…

Tailwinds of tax cuts and strong earnings shifted to headwinds of trade tariffs, global economic slowdown and tighter monetary policy in 2018. What’s it mean for 2019?

U.S. Stock Market:

Gauging the investment and economic climate is always challenging, at least it has been for me over the last 35 years. But, ’tis the season! It is with every new year that economists, research analysts, market experts and my type, portfolio managers, offer their outlook and forecast for the year ahead. This year’s theme is “Winds of Change”. It is certainly true that the weather is easier to forecast than the stock market. While I wouldn’t trade my job to be a weather man, the weather’s wind predictions might have a higher success rate than foretelling the changing winds moving the stock market. With that, back to my job. Here’s my outlook for the U.S. stock market in 2019, along with a view of the U.S. economy. My 2019 OUTLOOK for the global markets and economy will be printed here next month.

What I know…

In March, the bull market we have enjoyed turns 10. It is the longest bull market in history. It is instructive to remember what Sir John Templeton said about bull markets. “Bull markets are born out of pessimism, grow on skepticism, mature on optimism and die on euphoria,” he said. Euphoria is an emotion that leads to greed and excess. That makes for the most helpless animal of the Wall Street bunch; pigs. According to the Chinese calendar, 2019 is the Year of the Pig.

Coincidence? Essentially, bull markets don’t end of old age. They end with piggishness. Let’s remember, “Bulls can make money and bears can make money, but pigs get slaughtered.” The old Wall Street sage sounds grim, but it’s true. So, let’s not be the pig. We know that investor sentiment, a key psychological indicator of the stock market, is far from euphoric. In fact, the “Bull/Bear Barometer” has flashed decreasing bullish and increasing bearish sentiment since early October. This development is good; it’s bullish, from a contrarian perspective. Simply put, in contrarian thinking bad is good and good is bad. Therefore, it is bullish that market sentiment has recently turned bearish. What caused the market sentiment swing that began in early October? The tailwinds of tax cuts and strong earnings shifted to headwinds of trade tariffs, global economic slowdown and tighter monetary policy. We also know stocks’ historically strong post-midterm-election performance trend is a tailwind, but mounting trade uncertainty and the political landscape have created offsetting headwinds. Discipline around diversification and rebalancing will be important in 2019. Recession risk is rising, and we know stocks historically have posted their weakest performance during the six months leading up to recessions. Over the last 50 years, U.S. equities have never peaked more than 13 months before an economic recession, so if we learn in the near term that the market topped with its October highs, the next recession is no sooner than late 2019.

What I think…

Earnings will be key. I expect earnings growth to decelerate sharply in 2019. Year-over-year comparisons will be more challenging relative to the tax-cut-related boost 2018 earnings received. Last year’s fourth quarter volatility was in large part driven by a growing conviction that 2018 would be “peak” earnings for companies. Also, I see the continued strength in the U.S. dollar and the impact of trade tariffs imposing additional headwinds for earnings, even though stock valuations have become more reasonable as prices have dropped. The winds of change affecting the market will further influence investor sentiment, which is likely to move the stock market in 2019, as volatility persists. As I write this 2019 OUTLOOK, the major U.S. stock indexes are struggling to recapture key support levels. After slicing through their respective 200-day moving averages, the major market indexes have attempted – and twice failed – to climb back above those meaningful levels. Having clearly fallen enough to be in “correction” mode, the looming question is will the U.S. stock market fall further into the throes of a bear market? I don’t think so. With the notion that bull markets do not simply die of old age, as a strategist I think it is too early to become overly defensive given that 2020 seems the recession danger zone. Ultimately, stock prices are all about earnings. Adopting the consensus view, I expect earnings growth to drop significantly from last year’s growth rate. With a forecast of 9% earnings growth for the S&P 500 in 2019, I have a price target of 3000 for the major index. Not bad from the current level of 2600 in mid-December, but for proper perspective, only a 2% price gain from 2940 in early October. Do the potential returns justify the risks? It’s the most fundamental investment question. I think they do. Again, as said above, discipline around diversification and rebalancing will be important in 2019 to contend successfully with the winds of change. I often contend,

earnings matter. That was a potential risk to the market I noted in my

2016 Outlook. In my

2017 OUTLOOK, I stated earnings could be the catalyst to a positive stock market upside surprise. At this time last year, I forecasted strong earnings would again support gains in the stock market in my

2018 OUTLOOK.

US Economy:

As some think 2018 was peak earnings year, some also think the U.S. economy is now as good as it gets for the cycle. Real GDP growth in the middle quarters of 2018 logged north of 3%, roughly double estimate of the U.S. economy’s long-term potential at the year’s start. Earnings growth for the S&P 500 index has been 25% or higher in every quarter this year (through Q3) – a remarkable rate seen usually when coming out of recessions. And, the unemployment rate stands near a 50-year low. U.S. fundamentals are unequivocally strong right now.

- Interest Rates: 1 & 4, or 1 & no more? The inference is, will the Fed raise their key federal funds rate one more time in late December, as they have signaled, and hike four more times in 2019, or will they raise one and be done (with no rate increases in ’19)? That’s the great debate over the Fed’s target interest rate. Certainly “ZIRP” (zero interest rate policy) is a thing of the past as the Fed has raised rates eight times since December of 2015. Many believed through most of 2018 that the Federal Reserve was on a mission to get interest rates to normal levels. ZIRP was far from normal and so is today’s still low rate level. Interest rates in the United States averaged 5.70% from 1971 until 2006, reaching an all-time high of 20% in March of 1980 and a record low of 0.25% in December of 2008. As I write this is mid-December, I see the Fed’s playbook as “1 + 1 = done”. They will hike rates late December 2018 and at the June 2019 scheduled FOMC meeting. The wild card? Chairman Jerome Powell & Co. at the Fed decide NOT to raise in December…

- Inflation: Labor costs are the biggest component of inflation in the U.S. With unemployment near 50-year lows, labor costs can only go up. Expect this in 2019, and inflation pressures to ensue. As I said this time last year, the jobs market is just too strong for another year of below average inflation measured by the CPI (Consumer Price Index). Historically, inflation has averaged about 3.2%. As of late 2018, the “core” rate – all prices except food and energy – picked up to a 2.2% yearly rate. This rate will likely edge up to near 3% by the end of 2019 as the economic expansion generates small inflationary pressures, the healthy jobs market the catalyst. Speaking of health, U.S. health care inflation rate was at 2.03% (2018), compared to 1.68% last year (2017). This is lower than the long-term average of 5.32%. Expect inflation approaching 3% in 2019.

Global Markets:

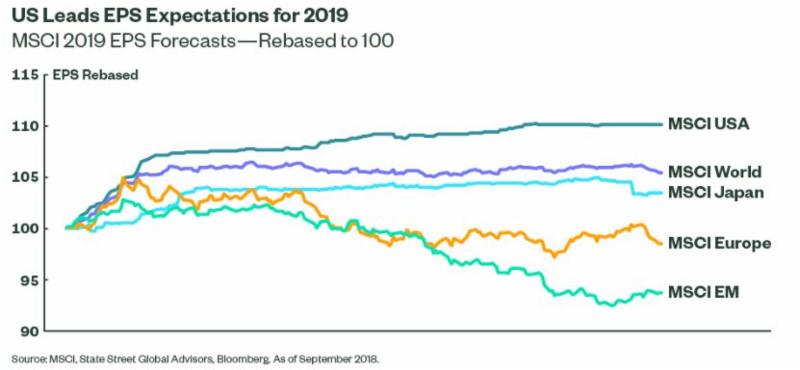

My Global Market Outlook for 2019 is thematically one of increased uncertainty. Uncertainty breeds volatility. In 2018, volatility was the world investment market’s dominant driver of investor fear. Price swings were dramatic, especially in the 4th quarter as global stock market gains were erased in weeks. The role of increasing uncertainty and risk factors for investors pose challenges and opportunities in the year ahead. Although global GDP growth is expected to slow in 2019, economic fundamentals should continue to support earnings growth in equity markets, though most notably in the US.

US equities are likely to outperform those in Europe and emerging markets in 2019, as investors face increased volatility amid rising interest rates and trade uncertainty.

US equity return drivers are well supported by several factors, including increases in intended capital expenditures due to US tax reforms, low unemployment and share buybacks.

Political and economic uncertainty is causing risk aversion among global investors, who are demanding higher risk premia from non-US markets. This risk:reward ratio will potentially lower demand for foreign stocks, which I expect to lead to attractive valuations in global companies. Security analysis will prove critical to investment returns resulting in an advantage to single stock selection over prepackaged funds. Any U.S. dollar weakness, downside surprises on U.S. economic growth, signs of Federal Reserve dovishness or a greater impact from China’s looser fiscal and monetary policy stance could provide a catalyst for emerging markets and other global stock markets to strengthen.

- Europe: European equities continue to be hamstrung by regional politics. Leaders in countries such as Germany, France and the UK are preoccupied with their own political survival. Brexit and the immediate financial risks presented by countries such as Italy fuel FUD (Fear Uncertainty & Doubt). This has weakened the energy needed to implement much-needed structural reforms aimed at protecting the eurozone from the next crisis. If Brexit negotiations result in a deal and populists fail to dominate May’s European Parliamentary elections, European markets could make progress in the second half of 2019. European growth remains reasonable and the European Central Bank is set to wind down quantitative easing and may even raise rates towards the end of 2019. Looking ahead to 2019 in the euro-zone financial markets, I expect it to overcome that headwind of the economic and political uncertainty and once again improve relative performance. I believe there is a case for global investors to be overweight stocks in 2019 while remaining alert to increased tail risks. In such an environment, I recommend maintaining a global strategy as part of an overall investment portfolio allocation. Stay focused on stocks and regions with defensive characteristics, own companies likely to benefit from US economic tailwinds.

- Japan: Japanese equities stand out as attractive looking ahead to 2019. Japanese growth should see a boost from reconstruction efforts following a year of natural disasters in 2018, along with construction work ramping up for the 2020 Olympics. The tight labor market should provide a boost to consumption as wages start to rise. This should also bode well for capital expenditure as companies try to improve labor productivity. A key Japan event will be the consumption tax hike that is scheduled for October 2019. I expect Japanese bond yields to gradually edge up from a very low base, as inflation continues to slowly move higher. As was the case in 2018, the consumer will be the investment theme in Japan again in 2019.

- Emerging Markets: Emerging markets (EM) relative equity valuations traded at all-time lows in 2018, with a discount to developed markets of roughly 70%, against a backdrop of trade conflict, idiosyncratic issues in countries such as Turkey and Argentina, fear of contagion and concerns about Chinese banks. Trade tariffs concerns took their toll, too. While the Fed continues to tighten monetary policy and the U.S. dollar remains strong, emerging markets are likely to struggle in aggregate. Earnings-per-share estimates continue to trend downwards for 2019 and will need to stabilize before strength in EM returns. Specific EM opportunities, namely China, could emerge later in 2019, if the risks already priced in to markets do not materialize. China has responded to the trade war with the U.S. by loosening monetary policy to stimulate demand, while Chinese banks are trading close to the low levels not seen since the global financial crisis. Chinese equity valuations in general are very low. However, Chinese retail sales rose 9% year-on-year growth in September, and fixed capital investment (think investments in factories and infrastructure) has gone from roughly 48% of GDP to 44% in just five years. As I said in my 2018 OUTLOOK, China, in my opinion, remains positive. Trade and tariffs will tell.

Wishing you a great 2019!