Bi-Monthly ERPE Excerpts

Nov 17, 2022

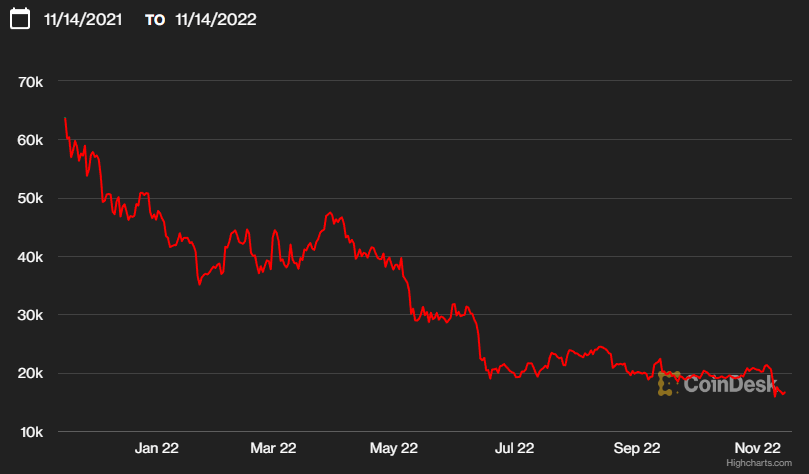

Cryptocurrency Collapse

FTX Bankrupt

I saw an article in Barron’s over the weekend that quickly got me my attention after reading the opening sentence. This is it: “How long does it take to wipe out a $32 billion company, shatter confidence in an entire industry, and leave a trail of destruction from Wall Street to Silicon Valley? In crypto, about a week.” I had to continue reading the rest of the article. The phenomenal near-overnight collapse of the cryptocurrency exchange company, FTX, is a story that is hard not to read – – like when you can’t look away from a car crash on the road. Except in this case, a lesson can be learned, so it’s worth looking into.

In my office early Monday, I searched for the FTX website and was surprised it was there. I expected it to find it taken down. It was part “as seen on TV” and the leveraging of celebrity names “who trust FTX”. It says, “Join over 1 million who choose FTX, as seen in “Bloomberg” “CNN” and “CNBC”. Then displayed are the faces of Tom Brady and Steph Curry. I don’t think Brady, Curry or the million users “trust” FTX now. Further, nor do the U.S. regulators who enforce the laws that govern trading and how investments are sold to the public. In fact they are now on the hunt for Sam Bankman-Fried, the FTX CEO. His capture may be like a re-do of “Catch me if you can” as Sam, (“SBF”, as he is known) was last seen in the Bahamas and speculation is he has since escaped to Argentina. I don’t know, other than it won’t end well for SBF and it’s already been horrible for the quoted million customers of SBF’s company, who have lost billions.

The who and the what of the story:

As noted above, Sam Bankman-Fried is the CEO of FTX. His recently estimated worth was $23 billion. That has all but evaporated. FTX is (was) the third-largest cryptocurrency exchange in the world. It is now bankrupt. As an exchange, it was the “house” where customers traded crytocurrencies. These customers were not, it turns out, the only ones gambling with their money. FTX was, too. That’s a big no no. An Exchange can not commingle customer’s money with its own. FTX did. It is now estimated FTX moved $10 billion of customer funds to Alameda Research, an affiliate of FTX, that traded crytocurrencies. Alameda made bad bets with the money, and lost it. What’s worse is FTX also invented its own cryptocurrency “token” called FTT. Alameda had $14.6 billion in FTT. FTT is now nearly worthless, trading just over $1. It was over $50 a year ago.

What’s next for FTX and SBF?

The crypto exchange FTX filed for Chapter 11 bankruptcy protection last Friday following its precipitous collapse, saying it could owe money to more than 1 million creditors. Already, another 130 FTX affiliates have filed for bankruptcy. The crytocurrency wunderkind, SBF, has an imploded empire that has left him totally broke, is the target of multiple investigations and faces the strong possibility of going to prison. The domino effect of this fiasco involving FTX, FTT, SBF and the exchange’s customers has crippled trust in the cryptocurrency system, sparked a run on deposits by customers and all but stalled crpyto trading to a halt.

Lessons learned?

#1 – It is not prudent to invest in unregulated instruments that seek a decentralized structure, and lack the safety that comes with the laws and regulations to which financial assets must comply with.

#2 – What I wrote in #1 in is more of a reminder. So is #2: if you must speculate, which totally is what all things crypto have ever been, then do it with a small amount of your money. 5% -10% of your investable funds should be the max you allow when overcome by FOMO.

These reminders are as good as lessons. The inherent investment fraud and collapse experienced by FTX’s customers is nothing new. Charles Ponzi, famous for his pyramid scheme, robbed investors of $20 million in the 1920’s. Bernie Madoff stole $65 billion from investors. Another reminder; crime doesn’t pay. Bernie was sentenced to 150 years in prison at the age of 82. That’s a death sentence.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day October 20: “Even though people may be well known they still hold in their hearts the emotions of a simple person.”

~ ~ Jacqueline Kennedy Onassis, 1968

What Happened On this Day, 1979 – The John F Kennedy library is opened in Boston, Massachusetts.

MARKET ANALYSIS

INDICATORS OF INTEREST:

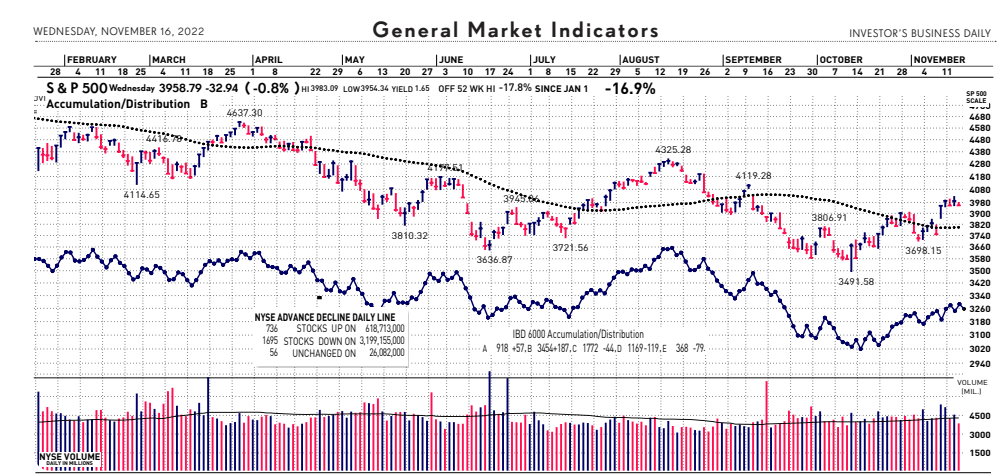

Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal turned more bullish last Thursday, November 10 as a better-than-expected CPI report triggered a change from Uptrend Under Pressure to Confirmed Uptrend.

The Stock Market Trend: Market in Confirmed Uptrend. Last week’s CPI data sparked a strong rally in the U.S. stock market. The Nasdaq soared over 7%!, its 14th best day in history. All major stock indexes up 4% of better. The Dow Jones ran up 1,200 points.

The market is asking critical questions now: Have we seen peak inflation? Is the Fed going to slow its role on aggressive rate hikes? Will China re-open enough, soon enough to release the pressure on supply chain conditions? Will a likely economic recession be navigated with a soft landing? Can we avoid an earnings recession? Will gridlock in DC reduce the flood of money flowing from the government? The market’s trend tells us what it thinks those answers might be. The current confirmed uptrend indicates the market’s discounting its future view of less-bad scenarios ahead. Certainly there are other questions. However, whatever we can think of the market already has.

The Nasdaq rallied nearly 11% in the prior four sessions, leading up to yesterday’s pullback. Yesterday does not disturb the current upward trend. Plus, volume fell sharply on the Nasdaq vs. Tuesday’s session. That’s bullish. Speaking of bulls, the latest Investors Intelligence weekly poll of market newsletter writers found bullishness rise to 38.6% in the past week from 35.2%. The bears ratio dropped to 32.8% from 36.6% and hit a two-month low. Remember, from a contrarian point of view, high bullishness is bearish.

Industry Group Strength: BEARISH. As of yesterday, 45 out the 197 groups I monitor are up year-to-date. 152 groups are down for the year.

New Highs vs. New Lows: BULLISH. In yesterday’s session, there were 102 new 52-week highs and 89 new 52-week lows.

Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.19%. The 10-year Treasury now 3.77%, down from over 4% two weeks ago.

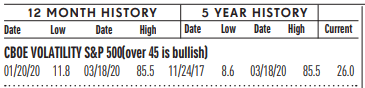

Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 24, down from 31 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

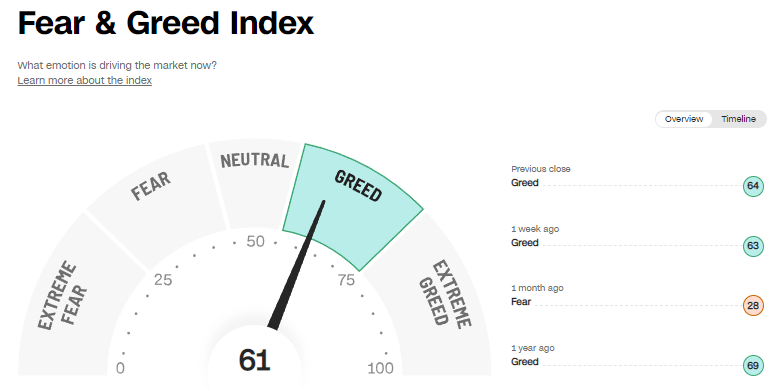

Fear / Greed Index: BEARISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 61, the Fear & Greed Index is up from 34 two weeks ago.

Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, the bulls increased to 38.6% from 31.3% 2 weeks ago. The bears have slumped to 32.8% from 40.3%. The bearish read roughly the same as 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

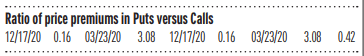

Put / Call Ratio: BEARISH. The ratio of put-to-call options is 0.63, down from 1.28 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Jobless Claims Down: Today the Labor Department reported the number of Americans who applied for unemployment benefits in mid-November fell slightly to 222,000 — a low number historically — but layoffs have edged higher in the past month as the economy slows. Economists polled by the Wall Street Journal had forecast new claims to total 225,000 in the last week. The figures are seasonally adjusted. The number of people applying for jobless benefits is one of the best barometers of whether the economy is getting better or worse. The jobs market is quite strong, but may be starting to flag. Job openings have declined, hiring has slowed and layoffs have started to increase.

Retail Sales Up: Retail sales jumped 1.3% in October, according to a report yesterday. This signals U.S. consumers are still spending plenty of money despite efforts by the Federal Reserve to slow the economy. Retail sales were forecast to rise 1.2% last month, according to economists polled by The Wall Street Journal. That’s the biggest increase in eight months. Receipts rose a robust 0.9% if auto dealers and gas stations are excluded. Auto and gasoline purchases can exaggerate the ups and downs in overall retail spending. Retail sales are a big part of consumer spending and offer clues on the strength of the economy. Sales rose in almost ever major retail segment in October. Yet a big part of the increase in spending over the past year is due to inflation. Sales have risen 8.3% in the last 12 months vs. a 7.7% increase in the cost of living.

CPI Down: U.S. inflation shows signs of easing, perhaps giving Fed ammo to go slower. The cost of living rose a relatively modest 0.4% in October, a sign that price pressures in the U.S. are easing after the biggest surge in inflation in 40 years. Economists polled by The Wall Street Journal had forecast a 0.6% increase in the consumer price index. The smaller-than-expected rise in the CPI gave a huge boost to stock prices early last Thursday. The yearly rate of inflation fell to 7.7% from 8.2%, down from a nearly 41-year high of 9.1% in June. In another positive sign, the so-called core rate of inflation, which omits food and energy, rose just 0.3%. Wall Street had forecast a 0.5% increase.

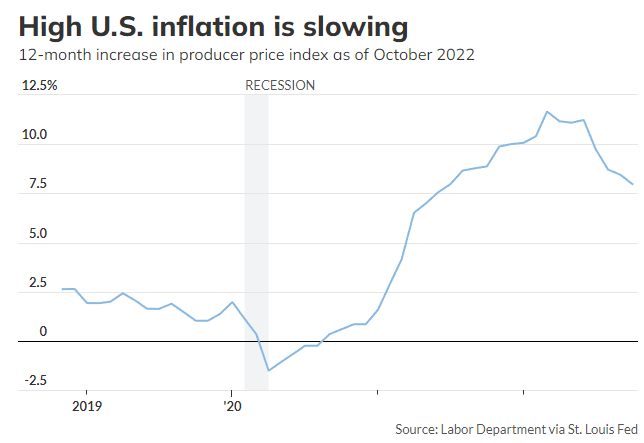

PPI Down: Wholesale prices, measured by the Producer Price Index (PPI) rose slowly again and point to softening U.S. inflation. Tuesday’s report showed U.S. wholesale prices rose just 0.2% in October, a fourth straight soft reading that suggests inflation is on the wane after hitting a 40-year high earlier in the year. Economists polled by The Wall Street Journal had forecast a 0.4% gain. The increase in wholesale prices over the past 12 months, meanwhile, slowed to 8% from 8.4% in the prior month. It peaked at 11.7% in March.

Global Economic Indicators & Analysis:

WEAK INDICATORS

New Housing Starts Down: The Census Bureau said today that construction on new houses fell 4.2% in October as high mortgage rates put off buyers and forced builders to scale back, a situation that’s likely to continue through 2023.U.S. housing starts slowed to an annual pace of 1.43 million last month from 1.49 million in September. That figure reflects how many homes would be built in 2022 if construction took place at same rate over the entire year as it did in October. Economists polled had expected housing starts to register a rate of 1.41 million after adjusting for the typical seasonal swings in demand. New construction hit a record 1.8 million in April before tapering off. The number of permits, meanwhile, slipped 2.4% to a rate of 1.53 million, down sharply from a record 1.9 million last December. Permits foreshadow how many houses are likely to be built in the months ahead, assuming a stable real estate market.

Philly Fed Index Down: The Philadelphia Federal Reserve said today that its gauge of regional business activity sank to negative 19.4 in November from negative 8.7 in the prior month. Any reading below zero indicates deteriorating conditions. Economists polled by the Wall Street Journal expected a negative 6 reading. This is the lowest level of activity since May 2020. Excluding the pandemic, it is the lowest reading since May 2009.

NFIB Index Down: The National Federation of Independent Business (NFIB) said last Tuesday that its small-business optimism index fell to 91.3 in October from 92.1 in September, further below its historical average of 98. The reading matches expectations from economists polled by The Wall Street Journal. The survey, which is a monthly snapshot of small businesses in the U.S., accounts for nearly half of private sector jobs. The recent report suggested owners’ sentiment remained subdued, with short-term expectations for sales and the general economy worsening. “Inflation, supply-chain disruptions, and labor shortages continue to limit the ability of many small businesses to meet the demand for their products and services,” the NFIB’s Chief Economist said.

Consumer Sentiment Down: Consumer sentiment soured in November, hitting its lowest level since July as Americans contended with continued inflation and a worsening economic outlook. Last Friday’s University of Michigan’s gauge of the U.S. consumer’s outlook fell 5.2 index points from 59.9 in October. Economists were expecting a reading of 59.5, according to a Wall Street Journal poll. Inflation expectations for the next year rose to 5.1% from 5% in the prior month, while five-year inflation expectations rose to 3% from 2.9% in October. Inflation eased somewhat in October, but prices for a typical basket of consumer goods are still rising a historically rapid pace even as rising interests rates are weighing on many sectors of the economy. Americans have not been this worried about layoffs since April 2020.

|

|