Bi-Monthly ERPE Excerpts

Dec 15, 2022

2022: The Year of Rising Rates

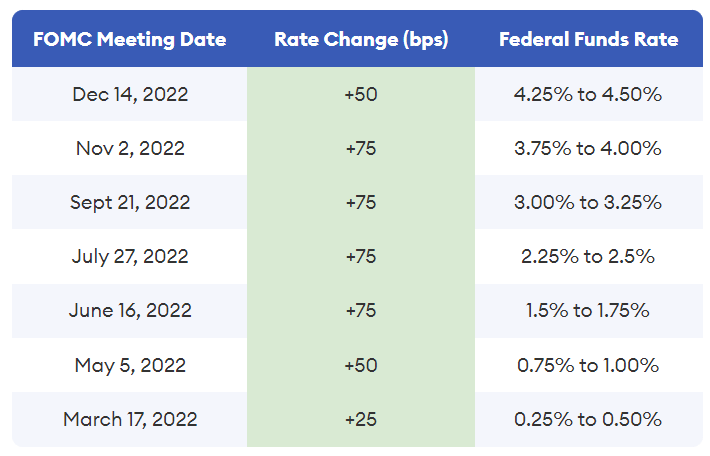

7 Raises & a 15 Year High

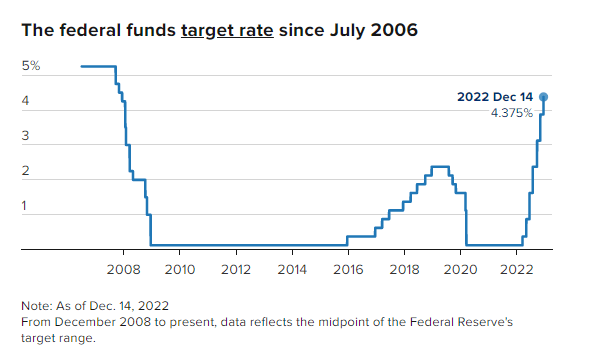

As we have become too accustomed to this year, yesterday the Federal Reserve raised interest rates again. The pace of US interest rate hikes this year is the fastest of any time in recent history; nearly twice as fast as in 1988-89. Yesterday’s 50 basis point (half of 1%) increase broke a string of four straight three-quarter point hikes, the most aggressive policy moves since the early 1980s. That was the 7th rate hike this year, underscoring the Fed’s continued battle against inflation by raising its benchmark interest rate to the highest level in 15 years. In case you’re not used to it yet, you likely will be soon. Along with yesterday’s increase came an indication that the Fed will keep rates higher through next year, with no reductions until 2024. For anyone who follows financial markets, an awareness of Fed monetary policy decisions and the reasoning behind them is critical.

It’s easy to forget and can be a harsh reminder to look back at what has happened to interest rates this year. As the table below shows, in early 2022 – before the first Fed increase – interest rates were essentially zero (0%).

Then, once the Fed changed its mind from thinking inflation was only “transitory”, its policy turned quickly to fighting red-hot, runaway inflation that our economy had not experienced in over 40 years. In August, Federal Reserve Chair Jerome Powell said, “Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all.”

The new fed funds interest rate level marks the highest it has been since December 2007, just ahead of the global financial crisis and as the Fed was loosening policy aggressively to combat what would turn into the worst economic downturn since the Great Depression. This time around, the Fed is raising rates into what is expected to be a weaker economy in 2023.

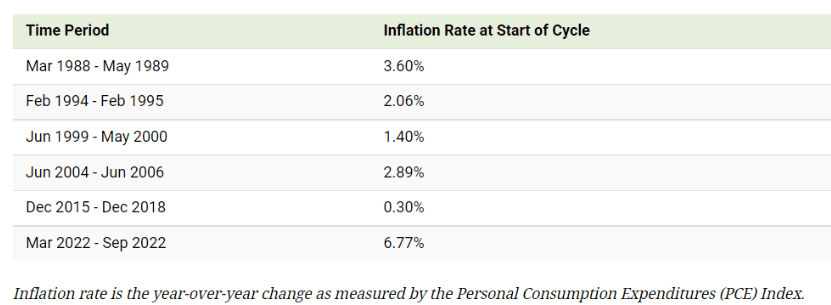

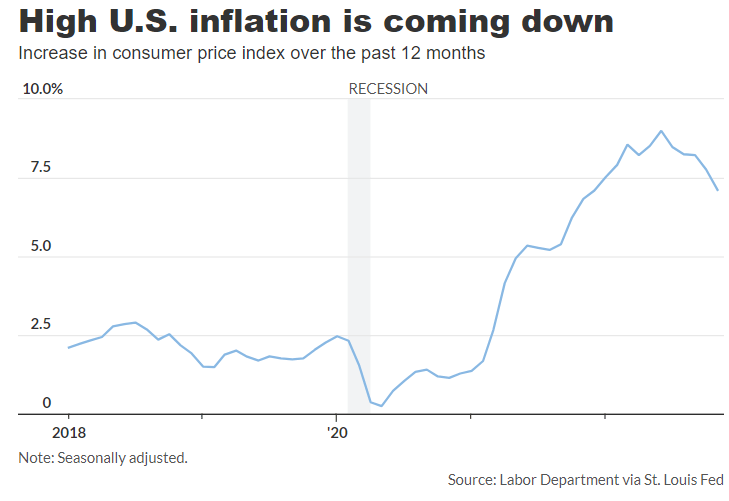

Why are 2022’s interest rate hikes so rapid? U.S. inflation far exceeds the Fed’s long-term target of 2%. In fact, when the hikes started in March 2022, inflation was the highest it’s ever been in the last six rate hike cycles.

Race to raise to forced to fall?

This year’s rapid interest rate hikes could lead to perhaps an unintended consequence: a world economic breakdown. Risks of a global recession have increased as other central banks raise their rates too. So, winning the war with inflation could come at the cost of a global recession. Fed chairman Alan Greenspan was called the “Maestro”. Chair Powell will have to be a magician to navigate an economic soft landing to avoid an harsh recession, let alone stag-flation. He may be forced to let rates fall to work his magic.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day December 15: “Impartiality is a pompous name for indifference, which is an elegant name for ignorance.”

~ ~ G. K. Chesterton, 1900

What Happened On this Day, 1797 – The Bill of Rights becomes law, following ratification by the state of Virginia.

MARKET ANALYSIS

INDICATORS OF INTEREST:

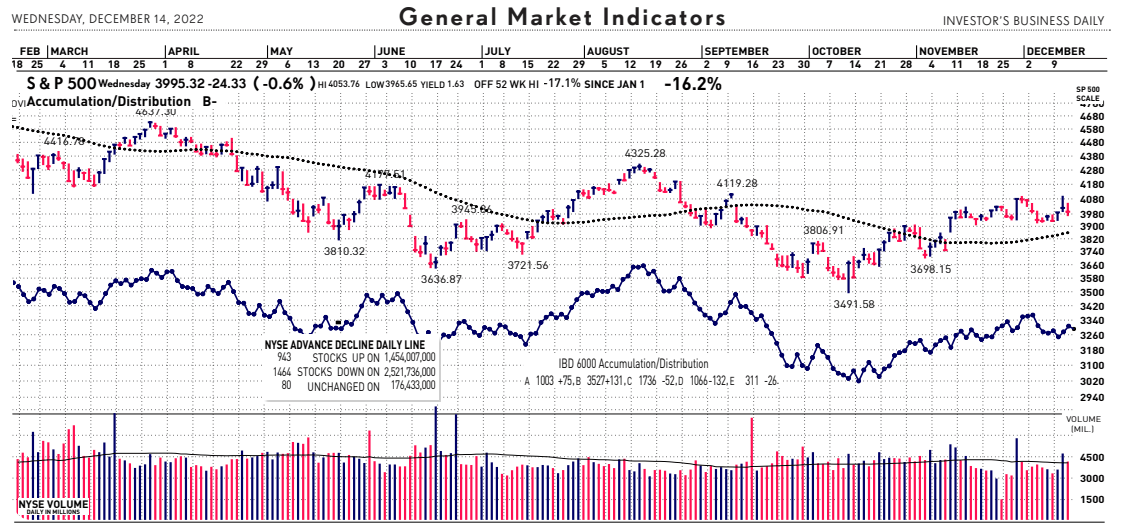

- Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal turned more bullish November 10 as a better-than-expected CPI report triggered a change from Uptrend Under Pressure to Confirmed Uptrend.

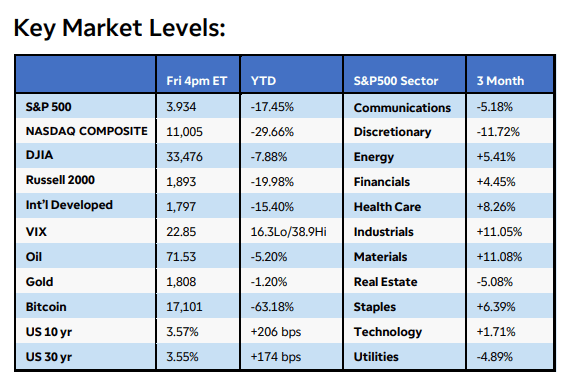

The Stock Market Trend: Market in Confirmed Uptrend. The market’s current uptrend has been intact since November 10 when weaker-than-expected CPI data sparked a strong rally in the U.S. stock market. The Nasdaq soared over 7%, its 14th best day in history. Yesterday’s “Powell Pop” strengthened the rally. Today’s cooler inflation data gave the market another lift at this morning’s open, but that has since faded.

Last week, the U.S. equities market retreated from technical resistance as inflation and recession headlines continued to weigh on investor sentiment. The Russell 2000 Index sank 5%, while the Nasdaq Composite and S&P 500 fell 3-4%. Ten of 11 S&P sectors were lower as energy plunged 8.5%, while communications and consumer discretionary slid 4.5%+. Despite OPEC sticking to existing production cuts and a shutdown of the Keystone Pipeline, crude oil tumbled 11% to $71.50 per barrel, pressured by weak global economic prospects and waning demand.

This week is a massive week ahead of the holiday season, focusing on inflation and central banks. It all kicked off with U.S. CPI Tuesday, Then the final FOMC meeting yesterday, as noted above. Today the major stock market indexes continue to sell off from yesterday’s drop, now near the lows of the day. As I write this note, the Dow is down nearly 1,000 points. This adds to yesterday’s losses as investors digest Jerome Powell’s hawkish comments. Declining November retail sales added to growing recession fears, in addition to other weaker-than-expected economic indicators.

December has historically been a good month for stocks. Since 1950, the SP 500 has gained 1.4%, on average, and has been up 73% of the time in that period. December up 2.9%, 3.7% and 4.4% in the past three years. So far this December, the S&P 500 is down almost 5%. A Santa Clause rally could still come to town.

- Industry Group Strength: BEARISH. As of yesterday, 34 out the 197 groups I monitor are up year-to-date. 163 In yesterday’s session, there were 116 new 52-week highs and 137 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.16%. The 10-year Treasury now 3.45%.

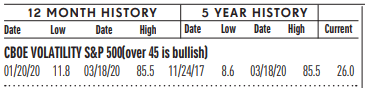

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 23, up from 21 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

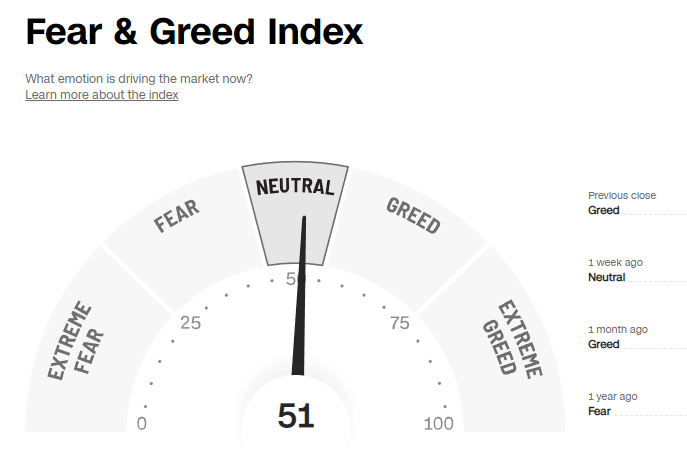

- Fear / Greed Index: NEUTRAL. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 51, the Fear & Greed Index is down from 70 two weeks ago.

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 42.9% and the bears came in at 31.4%. The bullish read is up from 2-weeks ago. The bearish read roughly the same as 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

- Put / Call Ratio: NEUTRAL. The ratio of put-to-call options is 0.74, near the same as two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Jobless Claims Down: The number of Americans who applied for unemployment benefits in early December fell to a nearly three-month low of 211,000, indicating layoffs around the holiday season remain low even as the economy softens. New unemployment filings declined by 20,000 from 231,000 in the prior week, the government said today. Economists polled by the Wall Street Journal had forecast new claims would total 232,000 in the last week. The figures are seasonally adjusted.

Service Sector Up: A barometer of U.S. business conditions at service-sector companies such as banks and restaurants rose to 56.5% in November, a strong showing that signals the economy is still expanding at a steady pace. Numbers over 50% are a sign the economy is growing, and figures above 55% are viewed as exceptional. The closely followed ISM reports, produced by the Institute for Supply Management, are the first major indicators of each month and offer clues on how well the economy is performing. “Overall business is stable,” a retail executive told ISM. “Employment is low and inflation is lower than last month. Supply-chain issues are stabilizing.” Economists polled by The Wall Street Journal had expected the index to drop to 53.7% from 54.4% in October.

U.S. Productivity Up: U.S. productivity in the third quarter was better than initially reported — but it’s still weak. The productivity of American workers rose by a revised 0.8% annual rate in the third quarter, but the increase was still historically weak and does not bode well for the economy. The increase was originally put at 0.3% in the government’s preliminary report last month. Over the past year, productivity has declined by 1.3%, but the data has been distorted since the pandemic and is still being affected, economists say.

Consumer Sentiment Up: U.S. consumer sentiment improved in early December as inflation worries eased. The University of Michigan’s gauge of consumer sentiment rose to a preliminary December reading of 59.1 from a November reading of 56.8. Economists polled by the Wall Street Journal had expected a December reading of 56.5.

CPI Declines: U.S. inflation is slowing, the CPI shows. The cost of living rose slightly, up 0.1% in November. This was the latest in a string of mild readings that suggest the worst U.S. inflation in 40 years is receding. Economists polled by The Wall Street Journal had forecast a 0.3% increase in the consumer price index. Falling gas prices have helped tug inflation lower since last summer. The annual rate of inflation, meanwhile, fell to 7.1 % from 7.7% in the prior month, marking the lowest level since the end of 2021. Inflation peaked at 9.1% in June. The so-called core rate of inflation, which omits food and energy, rose 0.2%. That’s the smallest gain since August 2021. Wall Street had forecast a 0.3% increase. The advance in the core rate over the past year dropped to 6% from 6.3%.

Global Economic Indicators & Analysis:

WEAK INDICATORS

Trade Deficit Up: U.S. trade deficit jumped 5% to a four-month high as global economy weakened. The nation’s trade deficit rose 5.4% in October to a four-month high of $78.2 billion, reflecting a small decline in the appetite for American goods and services as the global economy weakens. Economists polled by The Wall Street Journal had forecast a $80 billion shortfall. The deficit widened from $74.1 billion in September, the government said last Tuesday. Exports declined for the second month in a row after reaching a record high in August.

Retail Sales Down: Today’s retail sales showed sales at U.S. retailers fell 0.6% in November to mark their biggest decline in almost a year, largely because of weak car sales. Higher interest rates and a slowing economy also appeared to play a role. Retail sales were forecast to decline 0.3% last month, according to economists polled by The Wall Street Journal. Receipts dropped a smaller 0.2% if auto dealers and gas stations are excluded. Car and gasoline purchases can exaggerate the ups and downs in overall retail spending. Retail sales are a big part of consumer spending and offer clues about the strength of the economy. Although sales sank in November, they rose a sharp 1.3% in October.

Industrial Production Down: Industrial production fell 0.2% in November, the Federal Reserve reported Thursday. It is the second straight monthly decline. The gain was below Wall Street expectations of a 0.1% gain, according to a survey by The Wall Street Journal. Capacity utilization slipped to 79.7% in November from 79.9% in the prior month. The capacity utilization rate reflects the limits to operating the nation’s factories, mines and utilities. Economists had forecast a 79.8% rate. The decline in production was broad based in November. The only bright spots were energy products and defense goods. Manufacturing fell 0.6% in November after a 0.3% gain in the prior month.

Empire State & Philly Fed Down: Two regional gauges of manufacturing activity indicated weakness in December, according to data released today. The Philadelphia Fed manufacturing index improved to a reading of negative 13.8 in December from negative 19.4 in the prior month. Economists had expected a reading of negative 12 according to a Wall Street Journal survey of economists. The Empire State Index, meanwhile, declined sharply to a reading of negative 11.2 in December from 4.5 in the prior month, the New York Fed said. Economists had expected a reading of negative 0.5, according to the Wall Street Journal. Any reading below zero indicates deteriorating conditions. The national reading on manufacturing activity from the Institute for Supply Management moved into contractionary territory last month. Higher interest rates are curbing business investment.

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpeexcerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN · Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.