China’s Retaliation Takes Market’s ABC’s Down

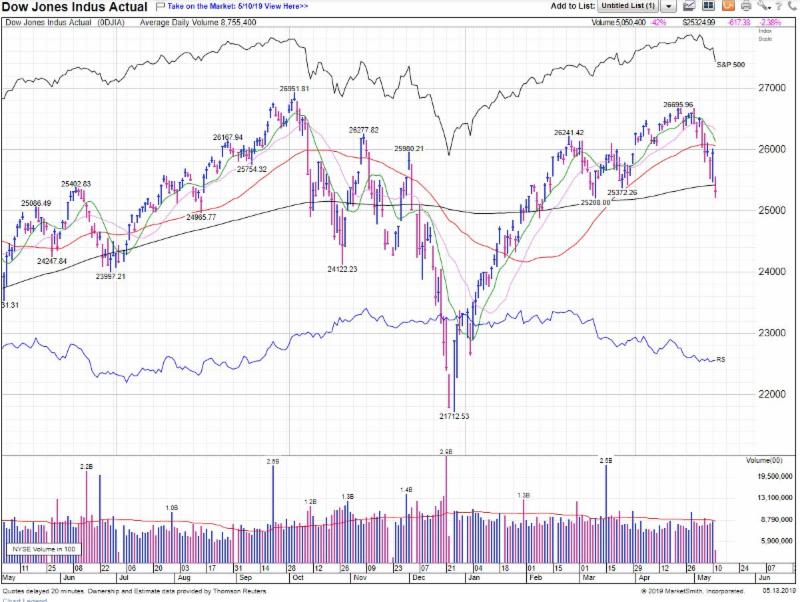

After the worst week of the year, today was the worst day of the year for the major U.S. stock indexes. As stated, my policy on writing a “Market Update” is to share my take on the U.S. stock market on days that at least 2 of the 3 major indices falls 3%, or more. That did not quite happen today, but it was close. Nonetheless, I thought today’s market action was worthy of an update, especially relative to what fell the hardest and why. The three U.S. majors were all down, led by the Nasdaq, which tumbled -3.41%. It was joined by the S&P 500 and the Dow, which both declined about -2.4%. The Dow’s health chart is below, and shows its worsening condition. It was the Dow’s ABC’s that took the biggest hit – – and impacted the 30 stock index the most. The are: Apple, Boeing & Caterpillar. They fell -5.81%, -4.88%, and -4.6%, respectively. No other of the 30 fell 4%. Boeing has by far the biggest influence on the Dow given the index is price weighted. In other words, a higher share price will have a greater impact on the Dow. This is precisely why I have always least liked the Dow as a fair U.S. stock market barometer. It is feared that those three, the “Dow’s ABC’s”, are most at risk in a trade war with China.

What is most disappointing to me is today’s action after such a bullish move made Friday. Friday’s price movement was what is referred to as a positive reversal. The Dow, for example, was down over 350 points intra-day before closing up almost 115. Same bullish pattern for other two stock indexes Friday. Not today. Like a repeat from last Monday, the market was signalling a severe down open based on fears over trade and tariffs with China. It was worse before today’s open, and, unlike Friday, the major indices closed near their lows for the day. Last Monday’s Trump threat tweet that he would impose a greater tariff on China (from 10% to 25% tariff on $200 billion of certain Chinese exports) was realized Friday at 12:10AM. That led to a statement from Trump saying another $325 billion of China goods could be subjected to tariffs. To that, China retaliated against higher U.S. tariffs with plans to increase levies on $60 billion in U.S. imports. Trade war!

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.

John