Bi-Monthly ERPE Excerpts

Bi-MONTHLY MARKET ANALYSIS & ECONOMIC UPDATES

September 22, 2022

The Fed Said…

Interest Rates Higher Longer

When the Fed speaks, the market listens. That may never have been more true than now as the U.S. economy is facing the highest inflation in 40 years and the Fed is committed to taking aggressive action to “restoring price stability”.

Yesterday the Fed spoke, the market listened and did not like what it heard. As I have always asserted, it is not what the Fed does, but what it says it will do, that the market cares most about. That was evident yesterday. The Federal Reserve’s FOMC (Federal Open Market Committee) raised its fed funds interest rate by another 75 basis points (bps). That was nearly 100% expected – other than a slim expectation that the Fed might raise rates by a full percent (100bps). So, no surprise there. In fact the market rallied higher with the FOMC announcement. Then came what the Fed said they will do… causing about a 700 point reversal in the Dow index and a significant selloff nearly everywhere in the stock market. Volatility spiked as the market finished at its lows for the day. The Fed’s move yesterday hiked its benchmark short-term rate, which affects many consumer and business loans, to a range of 3% to 3.25%, the highest level since early 2008.

The takeaway from yesterday’s rate hike decision, Summary of Economic Projections, and Fed Chair Powell’s press conference was that the Fed will be raising rates further and will keep them higher for longer. Powell conceded that there is likely to be another 100 or 125 basis points of tightening this year and that he thinks it is very likely the fed funds rate will get to 4.60%, which is the Fed’s median estimate for 2023 and presumably the new terminal rate (the terminal rate is defined as the peak spot where the benchmark interest rate — the federal funds rate — will come to rest before the central bank begins trimming it back). The message the market heard was that inflation will be beat by the Fed’s rate hikes at the cost of a material slowdown in economy.

After the FOMC’s previous comments, the market heard the message wrong. Powell has been crystal clear since. At yesterday’s news conference, Chair Jerome Powell said that before Fed officials would consider halting their rate hikes, they would “want to be very confident that inflation is moving back down” to their 2% inflation target. He noted that the strength of the job market is fueling wage gains that are helping drive up inflation. Now the market seems to think the Fed’s steep rate hikes will lead to job cuts, rising unemployment and a full-blown recession late this year or early next year. Now, the Fed says it sees the economy expanding just 0.2% this year, sharply lower than its forecast of 1.7% growth just three months ago. And it expects sluggish growth below 2% from 2023 through 2025. So, recession expectations are realistic.

Higher for longer is the opposite of the Fed’s mantra just 2 1/2 years. In early 2020, following the onset of the global Covid pandemic, the Fed was fully committed to a “lower for longer” interest rate policy. This was discussed in my March 12, 2020 ERPE Excerpts.

Powell acknowledged in a speech last month that the Fed’s moves will “bring some pain” to households and businesses. I wrote about this in my August 26 Market Update “Powell Points to Pain”. And pain it could be. Research suggests unemployment might have to go as high as 7.5% to get inflation back to the Fed’s 2% target. With the unemployment rate currently at decades-low 3.7%, it would be painful getting back to 7.5%.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day September 22: “There is an awful warmth about my heart like a load of immortality.”

~ ~ John Keats, 1818

What Happened On this Day, 1862 – Lincoln Issues the Emancipation Proclamation.

MARKET ANALYSIS

INDICATORS OF INTEREST:

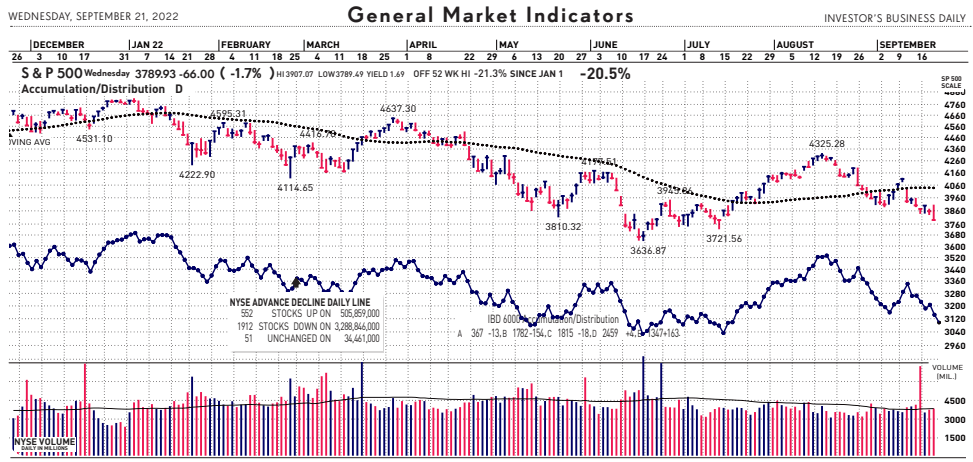

- Market’s Current Signal: Market in Correction. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal weakened again on September 16 to Market in Correction from August 26 when the trend weakened to Uptrend Under Pressure.

-

The Stock Market Trend: Market in Correction. Last Friday, September 16, the market’s trend weakened to Market in Correction. Just as the last weaker market trend signal occurred the last time Fed chairman Jerome Powell spoke on August 26 – then his short speech at the Jackson Hole Economic Symposium. Using the word “pain” when referring to the effect of further interest rate hikes by the Fed to fight inflation crushed the market. All indexes fell more that 3%. The Nasdaq cratered almost 4%. Yesterday he and the FOMC spoke again, again delivering a blow to the bulls and knocking the market lower. In a bear market, investors can expect trading sessions to end badly. Yesterday’s reaction to another steep jump in short-term interest rates and what the Fed said reaffirmed this unwritten law of Wall Street.

Last Friday, the Nasdaq and S&P 500 closed below their late July lows, even if they did come off intraday lows. The heavy volume, high volatility session triggered a the market’s weaker trend change. Last week was the worst week for the market since June. On the week, the S&P 500 closed down 4.8%, the Nasdaq dropped 5.5% and the Dow closed down 4.1% A high-inflation, high-wage, low-growth environment is a huge challenge for any company. The major indexes have now retraced more than half their gains from the mid-June to mid-August advance. The big concern now is the market undercutting June’s lows .

The Fed is clear it is willing to have the U.S. fall into recession in order to wring out inflation.

I referred often to “TINA” over the last several years. The “There Is No Alternative” notion was that stocks were the best investment – with no attractive alternative investments. TINA is gone. Some investors now believe they have an alternative to stocks for investment as they see 4% interest from a 2-year U.S. Treasury bond attractive. With the Fed now saying interest rates will be higher for longer, today’s bonds may not be a good alternative.

- Industry Group Strength: BEARISH. As of yesterday, 28 out the 197 groups I monitor are up year-to-date. 169 groups are down for the year.

- New Highs vs. New Lows: BEARISH. In yesterday’s session, there were 51 new 52-week highs and 671 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.17%. The 10-year Treasury now 3.67%, up from3% 4 weeks ago and 1.6% at the beginning of the year.

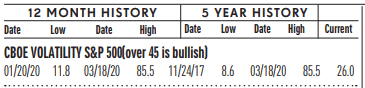

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 28, up from 24 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

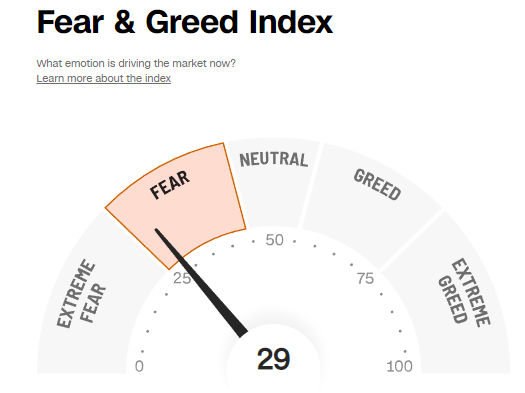

- Fear / Greed Index: BULLISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 29, the Fear & Greed Index is down from 40 two weeks ago. This investor sentiment indicator was 14 in mid-June, just near the market’s low for the year.

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence. bulls and bears are nearly even. The bullish read is now 30%and the bearish level is 31.4%. This investor psychological indicator is little changed over the last two weeks. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

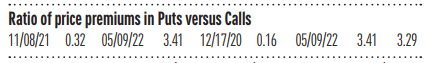

- Put / Call Ratio: BULLISH. The ratio of put-to-call options is 1.49, down from 1.6 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Keep in mind this is also a contrarian indicator. Note below, the 5-year high is 3.41 just hit in May.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

PPI Down: The cost of U.S. wholesale goods and services fell 0.1% in August largely due to cheaper gasoline, but there were also scattered signs of easing inflation even as persistent price pressures has moved through much of the economy. The back-to-back drop in the product price index (PPI)reported last Wednesday was the first since early 2020, just as the pandemic was emerging globally. Economists polled by The Wall Street Journal had forecast a 0.1% decline. The increase in wholesale prices over the past year slowed to 8.7% from 9.8% in the prior month.

Consumer Sentiment Up: A survey of consumer sentiment announced last Friday rose to 59.5 in September and hit a five-month high, reflecting public relief at falling gasoline prices. But Americans still feel uncertain about the future of the economy. The sentiment poll moved up from 58.2 in August, marking the third increase in a row. In June, high inflation and record gas prices drove sentiment down to its lowest level since the index began being published on a monthly basis in 1978. The report is produced by the University of Michigan.

Empire State Index Up: The Empire State Index released last Thursday showed an improved of reading of negative 1.5 in September from negative 31.3 in the prior month, the New York Federal Reserve said. Economists had expected a reading of negative 13.8, according to the Wall Street Journal. New orders in the New York region rebounded 33.3 points to 3.7 in September. Shipments soared 43.7 points to 19.6 in the region.

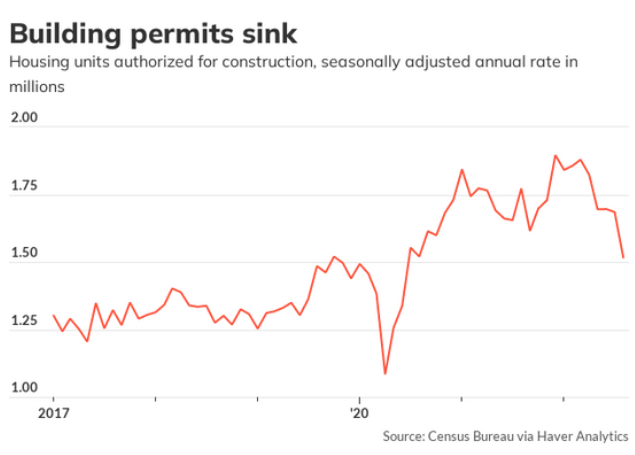

New Home Construction Up – but Permits Down: Construction on new U.S. homes rose a seasonally adjusted 12.2% in August to 1.58 million, the Commerce Department said Tuesday. The rise in construction on homes reverses a steep fall in July, where housing starts fell a revised 10.9%. Economists polled by the Wall Street Journal expected housing starts to rise to a 1.5 million rate from June’s initial estimate of 1.45 million. The annual rate of total housing starts fell from 0.1% from the previous year. In June, housing starts were revised to a steeper drop of 10.9% of 1.4 million, as compared to a previous drop of 9.6%. Building permits for new homes fell 10% to 1.52 million in August. Permits for single-family homes fell 3.5% in August, while permits in buildings with at least five units dropped 18.5%.

Home Builder’s Confidence Index Up: The National Association of Home Builders’ (NAHB) monthly confidence index fell 3 points to 46 in September, the trade group said on Monday. It’s the ninth month in a row that the index has fallen, and excluding the pandemic, the September reading of 46 is the lowest since May 2014. A year ago, the index stood at 76.All three gauges that underpin the overall builder-confidence index fell. All four NAHB regions posted drops in builder confidence. Declines were led by the West, which saw a 10-point drop. New-home builders are struggling to attract buyers due to high interest rates and home prices.

Small Business Owner’s Confidence Up: Confidence among small-business owners in the U.S. increased in August as expectations over business conditions in the short-term improved somewhat and concerns about inflation moderated. The NFIB Small Business Optimism Index report last Tuesday rose to 91.8 in August from 89.9 in July, according to data from a survey released Tuesday by the National Federation of Independent Business. The reading beats the 90.5 consensus forecast from economists polled by The Wall Street Journal. Inflation remained the most important problem for small-business owners, but less so than in July. The percentage of respondents who mentioned it fell to 29% in August from 37% in July, which was the highest level since the fourth quarter of 1979.

Global Economic Indicators & Analysis:

WEAK INDICATORS

CPI Up: The Consumer Price Index (CPI) released last Tuesday showed persistent inflation pressure as measured by the “core rate”, a more accurate measure of future inflation trends. The increase in the core rate over the past year escalated to 6.3% from 5.9%, underscoring how much inflation has become embedded in the economy. For the last month, the core rate jumped 0.6%, double economists’ expectations. The cost of groceries jumped again last month and they are up 13.5% in the past year — the biggest increase since 1979. Rent surged 0.7% in August, as did housing. The Fed is especially worried about rising rent since it’s one of the biggest contributors to inflation and shows little sign of reversing. Rents have risen 6.3% in the past year to mark the biggest gain since 1990.

Jobless Claims Up: Today the Department of Labor reported the number of people who applied for unemployment benefits last week rose by 5,000 to 213,000, but new jobless claims are still quite low and reflect strong demand for labor even in a weakening U.S. economy. The increase in new claims was the first in five weeks, but it was basically a statistical fluke. That’s because unemployment filings from two weeks ago were revised down to 208,000 from a preliminary 213,000. Economists polled by the Wall Street Journal had forecast new claims to total 214,000 in the seven days ended September 17.

LEI Down: The U.S. leading index fell in August for the sixth month in a row, “potentially signaling a recession.” The Conference Board’s leading index released today dropped 0.3% last month, extending a stretch of declines that began in March. The LEI is a gauge of 10 indicators designed to show whether the economy is getting better or worse. Economists polled by The Wall Street Journal had forecast a 0.1% decline. The economy has slowed from last year’s blistering pace. Gross domestic product, the scorecard for the economy, shrank in the first two quarters of the year. Now the Federal Reserve is sharply raising interest rates to try to squelch the highest inflation in almost 40 years, and higher rates slow the economy. Many economists even think a recession is likely by next year.

Retail Sales Mild/Flat: Last Thursday’s report on U.S. retailers showed sales rose a mild 0.3% in August as Americans spent more on new cars and trucks and went out to eat more, suggesting the economy grew at at a steady if lackluster pace toward the end of the summer. Retail sales are a big part of consumer spending and offer clues on the strength of the economy. The amount of money Americans are spending is still quite high, but it largely reflects the higher prices they are paying because of soaring inflation. Adjusted for inflation, retail spending has basically been flat for the past year.

Industrial Production Down: Industrial production inched down 0.2% in August, the Federal Reserve reported last Thursday. The gain was below Wall Street expectations of a flat reading, according to a survey by The Wall Street Journal. Capacity utilization also moved slightly lower to 80% in August from 80.2% in the prior month. Economists had forecast a 80.3% rate.

Philly Fed Index Down: The Philadelphia Federal Reserve’s manufacturing index released last Thursday slowed to a reading of negative 9.9 in September from 6.2 in the prior month. Economists had expected a reading of 2.3 according to a Wall Street Journal survey of economists. In key subcomponents in the Philadelphia survey, new orders fell to negative 17.6 in September from negative 5.1 in the previous month. Shipments in Philadelphia fell to 8.8 from 24.8 in August.

Existing Home Sales Down: U.S. existing-home sales fell 0.4% to a seasonally adjusted annual rate of 4.8 million in August, the National Association of Realtors said yesterday. This is the seventh straight monthly decline. Economists polled by the Wall Street Journal were expecting a steeper decline in existing-home sales to 4.68 million. This is the lowest level of existing home sales since May 2020, during the pandemic downturn. Excluding the recession, the level of sales activity was lowest since November 2015. Compared with August 2021, home sales were down 19.9%

|

|