Bi-MONTHLY MARKET ANALYSIS & ECONOMIC UPDATES

October 20, 2022

Rate’s Rapid Rise…

Fastest Fed Funds Rate Hike Pace Ever.

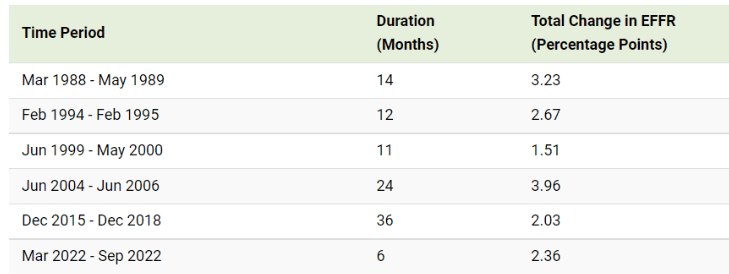

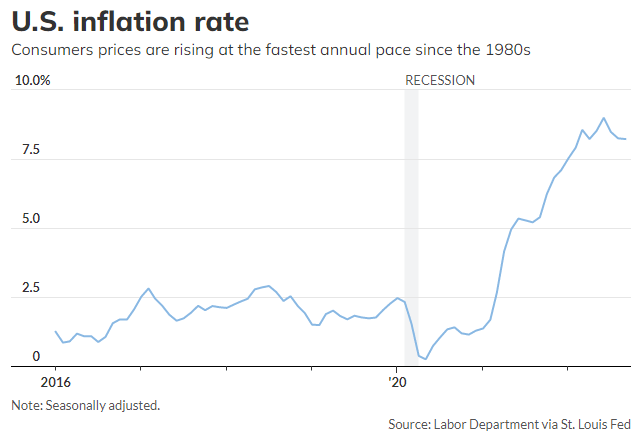

Interest rates have risen rapidly. As U.S. inflation remains at multi-decade highs, the Federal Reserve has been aggressive with its interest rate hikes. In fact, rates have risen more than two percentage points in just six months. Why are 2022’s interest rate hikes so rapid? Again, inflation. The Fed clearly got it wrong late last year – – not my opinion. The fact is the FOMC’s (Federal Open Market Committee) contention that inflation then was “transitory” was wrong. Inflation in general is the highest in 40 years. U.S. inflation far exceeds the Fed’s long-term target of 2%. In fact, when the hikes started in March 2022, inflation was the highest it’s ever been in the last six rate hike cycles. So the Fed has been busy hiking rates. As the graph below shows, the Fed has taken rates up nearly as much as the 1988-1989 rate hike cycle in less than half the time. EFFR is the Effective Federal Funds Rate. Expect another 75 basis point EFFR increase in early November.

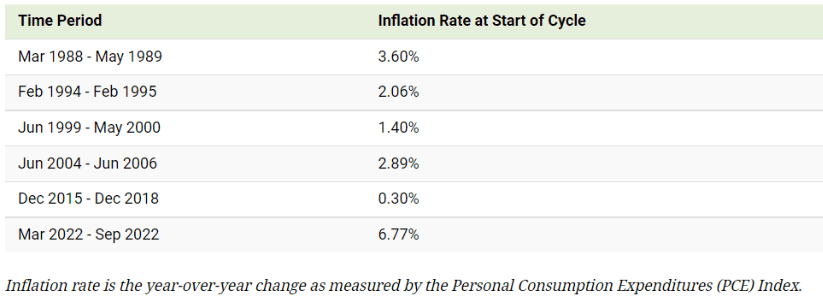

Here’s more on the “why?” At the start of this aggressive interest rate hiking effort, inflation was the higher than at the beginning of any prior interest rate raising cycle. This graph shows that…

The economy is headed for recession. A majority of economists think a downturn is coming and most CEOs are preparing for one, as leading economic indicators like I note below point to. The reason? Rapidly rising interest rates. It is perhaps only a matter of when, not if, the U.S. economy enters a “Fed induced recession”.

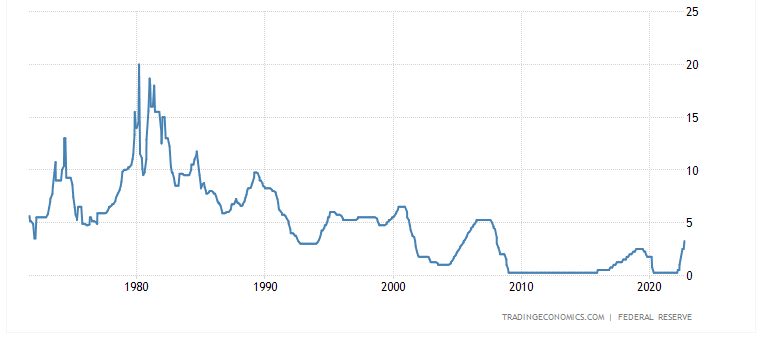

While no doubt interest have been on a rapid rise this year considering the Fed Funds rate has been increased from near zero to 3% now, the 2-year Treasury has soared from 0.07% to 4.25%, and the average 30-year mortgage rate has more than doubled from 3% to over 7%, rates are still relatively low. Here’s perspective on the Fed Funds rate. As the chart below shows, the Fed Funds rate has been abnormally low for about two decades. Like the dramatic spike in the late 70’s, inflation is why we see rate’s rapid rise now.

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day October 20: “Even though people may be well known they still hold in their hearts the emotions of a simple person.”

~ ~ Jacqueline Kennedy Onassis, 1968

What Happened On this Day, 1979 – The John F Kennedy library is opened in Boston, Massachusetts.

MARKET ANALYSIS

INDICATORS OF INTEREST:

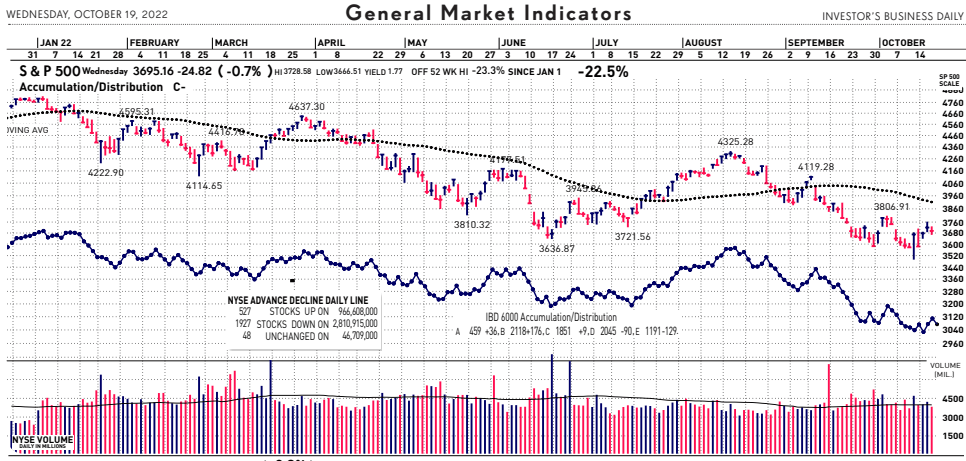

- Market’s Current Signal: Market in Correction. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal weakened again on September 16 to Market in Correction from August 26 when the trend weakened to Uptrend Under Pressure.

-

The Stock Market Trend: Market in Correction. The U.S. stock market remains in correction mode within an overall bear market. The current trend was triggered Friday, September 16. From there, the market weakened further to end the month and quarter at near new lows for the year. As I detailed in my for clients only “Stock/Market Alert” September 30, the U.S. stock market closed harshly lower as volume spiked and investor sentiment plummeted. Then, as the calendar turned to Q4, the market turned higher. There has been a solid advance from the September closing low of about 4% through yesterday.

A new market rally attempt started October 13. Today is day 6 of that attempt. A “Confirmed Market Rally” will be established any day now that the market’s major indices close up 1.5% and on higher volume than the previous day. If instead the market first rolls over and closes below the level before October 13, then we wait and watch for a new rally attempt and ultimate confirmed rally.

We are certainly not out of a bear market yet. As said, the market has not signaled a new confirmed rally yet. Volatility has been extreme. I wrote to clients 3 consecutive days with my Stock/Market Alert as the market swung up and down and back up about 3% each day. That was the first time my updates have gone out 3 days in a row.

Beyond the Fed’s rapid rate rise to fight persistently high inflation, the market facing a daily downpour of company earnings reports. Third-quarter results will give stock investors more clues to how much high inflation, and a definite slowdown in the U.S. economy, is affecting profits, perhaps the No. 1 factor in stock prices. Netflix’s and Tesla’s reports have proven that yesterday and today. At the end of June, the Street had been expecting an 8.5% increase in earnings among S&P 500 companies. That estimate has now fallen to a measly 2.5%.

As I wrote to clients in recent note, October is known as the “Bear Killer” month. However, it has also delivered some spooky days like Black Monday of 1987 and Black Tuesday of 1929 – two to the worst single stock sell-off days in history. Hopefully the market will conjure up the Bear Killer again this year.

Industry Group Strength: BEARISH. As of yesterday, 27 out the 197 groups I monitor are up year-to-date. 170 groups are down for the year.

New Highs vs. New Lows: BEARISH. In yesterday’s session, there were 131 new 52-week highs and 236 new 52-week lows.

Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.48%. The 10-year Treasury now 4.18%, is up from 3.81% two weeks ago and near 1.6% at the start of the year.

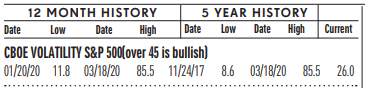

Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 31, up from 29 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

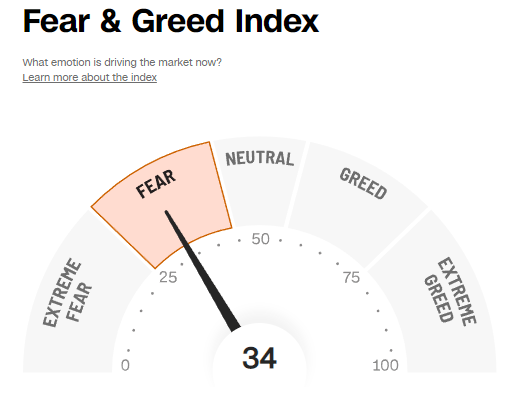

- Fear / Greed Index: BULLISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 34, the Fear & Greed Index is up from 31 two weeks ago.

- Bull / Bear Barometer: BULLISH. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, the bulls increased to 31.3% from 25.4% 2 weeks ago. The bears have jumped to 40.3%. The bearish read roughly the same as 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

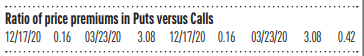

- Put / Call Ratio: BULLISH. The ratio of put-to-call options is 1.28, down from 1.42 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Jobless Claims Down: The number of people who applied for unemployment benefits fell by 12,000 in mid-October to a three-week low of 214,000, as today’s jobless claims report indicated. More people who couldn’t work after Hurricane Ian returned to their jobs. Economists polled by the Wall Street Journal had forecast new claims to total 230,000 in the last week. The figures are seasonally adjusted. The number of people applying for jobless benefits is one of the best barometers of whether the economy is getting better or worse. New unemployment filings had crept higher in the past month, but they are extremely low and signal the labor market is still tight.

Small Business Confidence Up- but concerned: Confidence among small-business owners in the U.S. increased slightly in September but remained depressed as inflation continues being a huge problem for businesses. The NFIB Small Business Optimism Index rose to 92.1 in September from 91.8 in August, according to data from a survey released last Tuesday by the National Federation of Independent Business. The reading beats the 91.8 consensus forecast from economists polled by The Wall Street Journal. “Inflation and worker shortages continue to be the hardest challenges facing small business owners,” the NFIB Chief Economist said. The NFIB survey is a monthly snapshot of small businesses in the U.S., which account for nearly half of private sector jobs.

Consumer Sentiment Up: Consumer sentiment rose slightly to 59.8 in October even as Americans’ expectations for inflation worsened, according to a survey last Friday. The University of Michigan’s gauge of consumer attitudes added 1.2 index points from 58.6 in September. Economists were expecting a reading of 59, according to a Wall Street Journal poll. Consumer expectations for inflation over the next year rose to 5.1% from September’s one-year low of 4.7%, while expectations for inflation over the next 5 years ticked up to 2.9% from 2.7% last month. A gauge of consumer’s views of current conditions rose in October to 65.3 from 59.7 in September, while an indicator of expectations for the next six months fell to 56.2 from 58 last month.

Industrial Production Up: Industrial production rose 0.4% in September, the Federal Reserve reported Tuesday. The gain was above economists’ expectations of a 0.1% gain, according to a survey by The Wall Street Journal. Output in August was revised to a slight decline of 0.1% from the initial estimate of a 0.2% fall. Capacity utilization rose to 80.3% in September from 80.1% in the prior month. The capacity utilization rate reflects the limits to operating the nation’s factories, mines and utilities. Economists had forecast a 80% rate.

Global Economic Indicators & Analysis:

WEAK INDICATORS

LEI Down: The Leading Economic Index compiled by private-research group The Conference Board decreased 0.4% to 115.9 in September after remaining unchanged in August, data published today showed. Economists polled by The Wall Street Journal expected the index to decrease 0.3%. The indicator’s persistent downward trajectory in recent months suggests a recession is increasingly likely before year end. The Conference Board Leading Economic Index is a predictive variable that anticipates turning points in the business cycle by around seven months. The indicator is based on 10 components.

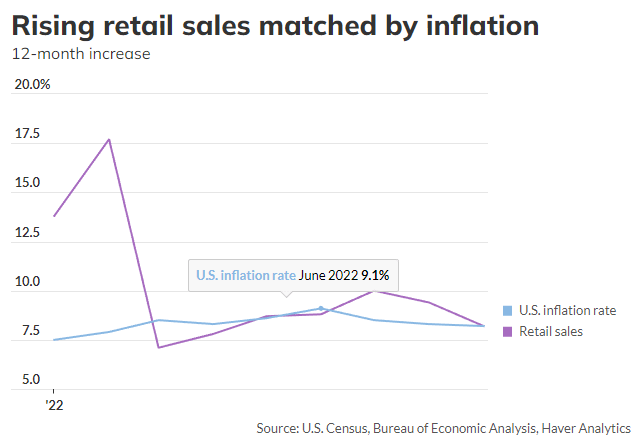

CPI Up. More Consumer Inflation: The U.S. cost of living rose 0.4% in September and pointed to high inflation persisting through the end of the year, reinforcing the view the Federal Reserve will keep raising interest rates aggressively to try to curb rampant price increases. Economists polled by The Wall Street Journal last Thursday’s CPI to increase 0.3%. The yearly rate of inflation slipped to 8.2 from 8.3%. Inflation peaked at a nearly 41-year high of 9.1% in June. In a more worrisome sign, the so-called core rate of inflation that omits food and energy prices jumped a sharp 0.6%. Wall Street had forecast a 0.4% gain. The increase in the core rate over the past year climbed to a new cycle peak of 6.6% from 6.3%, marking the biggest gain in 40 years. The Fed views the core rate as a more accurate measure of future inflation trends. The cost of staples such as food, rent, medical care and new cars all rose last month.

PPI Up. Inflation Persists: U.S. wholesale prices (Producer Price Index) rose 0.4% in September to mark the first increase in three months, signaling little progress in the Federal Reserve’s fight to vanquish high inflation. Economists polled by The Wall Street Journal had forecast a 0.2% gain. Wholesale prices had fallen in August and July entirely because of declining gasoline prices. Last Wednesday’s increase in wholesale prices over the past year, meanwhile, fell slightly to 8.5% from 8.7% in the prior month. Inflation is still running near a 40-year high, however. A separate measure of wholesale prices that strips out volatile food and energy costs also increase 0.4% last month, the government said Wednesday. That was a larger than expected. The increase in these so-called core prices over the past year was flat at 5.6%. The cost of goods rose 0.4% in September, largely because of higher food prices. Energy prices also rose for the first time in three months.

Beige Book Mixed: The regular Federal Reserve survey, known as the Beige Book, painted a mixed picture of the economy yesterday. While the U.S. continued to expand “modestly,” pockets of weakness emerged in areas such as housing. The survey covers the period of September through the first week of October. On the macro-economic front, the Beige Book showed the U.S. economy is growing but slowing. Worries about recession have increased, especially in the Boston, Chicago and Philadelphia regions. On inflation, the survey showed price growth remained elevated, though some easing was noted across several districts. Inflation in the 12 months ended in September stood at 8.2%. That’s down from a peak of 9.1% in June, but still near a 40-year high. The U.S. has 12 Federal Reserve banks (districts) blanketing the country.

Retail Sales Down: Sales at retailers fell flat in September, potentially another chink in the armor of a U.S. economy that likely to slow in the months ahead as interest rates keep going up. Last Friday’s retail sales were forecast to rise 0.3% in September, according to economists polled by The Wall Street Journal. Retail sales are a big part of consumer spending and offer clues on the strength of the economy. One caveat: Retail sales tend to be soft in September because the month falls between the back-to-school shopping season and the end-of-the-year holidays. In any case, Americans are still spending plenty of money, but it mostly reflects rising prices they have to pay because of high inflation. Adjusted for inflation, retail spending has basically been unchanged for the past year.

Empire State Index Down: The New York Fed’s Empire State business conditions index, a gauge of manufacturing activity in the state, fell 7.6 points to negative 9.1 in October, the regional Fed bank said Monday. This is the third straight negative reading. Economists had expected a reading of negative 5.0, according to a survey by The Wall Street Journal. Any reading below zero indicates deteriorating conditions. The U.S. factory sector is under pressure from falling orders, thinning backlogs and right-sizing of inventories. The index for new orders was unchanged at 3.7 in October. The shipments index dropped by a sharp 19.9 points to negative 24.1. Unfilled orders rose 3.8 points to negative 3.7.

Philly Fed Index Up – but still negative: The Philadelphia Fed said today its gauge of regional business activity inched up to negative 8.7 in October from negative 9.9 in the prior month. Any reading below zero indicates deteriorating conditions. Economists polled by the Wall Street Journal expected a negative 0.5 reading. The headline index is based on a single stand-alone question about business conditions unlike the national ISM manufacturing sector index which is a composite based on components. The barometer on new orders ticked up 2 points to negative 15.9. The shipments index was essentially unchanged at 8.6, its lowest reading since May 2020. The measure on six-month business outlook fell sharply to negative 14.9 from negative 3.9.

NAHB Index Down: The National Association of Home Builders’ (NAHB) monthly confidence fell 8 points to 38 in October, the trade group said on Tuesday. It’s the tenth month in a row that the index has fallen. Outside of the pandemic, the October reading of 38 is the lowest level since August 2012. A year ago, the index stood at 80. The index’s ten-month drop is a new record. The index last fell for 8 months straight in 2006 and 2007.All three gauges that underpin the overall builder-confidence index fell. The component that assesses sales expectations for the next six months fell by 11 points.

New Home Construction Down: Construction on new U.S. homes fell a seasonally adjusted 8.1% in September to 1.44 million, the Commerce Department said Wednesday. The drop in construction on homes reverses a sharp increase in August, when housing starts rose 13.7%. Economics polled by the Wall Street Journal expected housing starts to fall to a 1.47 million rate from June’s initial estimate of 1.58 million. On a year-on-year basis, housing starts are down 7.7% in September. Building permits for new homes rose 1.4% to 1.56 million in September. Economists had expected building permits to inch up to a 1.54 million rate from August’s initial estimate of 1.52 million. Starts of new holes fell 4.7% in September, while apartment starts fell 13.1%.The housing market is weakening rapidly, exacerbated by affordability concerns. Yesterday, as noted above, the average 30-year mortgage rate climbed to 7.22%, the highest in 22 years.

Existing Home Sales Down: Existing homes are selling at the slowest pace since September 2012, with the exception of a brief drop at the start of the Covid 19 pandemic. Sales of previously owned homes fell 1.5% in September from August to a seasonally adjusted annual rate of 4.71 million units, according to a monthly survey from the National Association of Realtors today. That marked the eighth straight month of sales declines. Sales were lower by 23.8% year over year. Sharply higher mortgage rates are causing an abrupt slowdown in the housing market. The average rate on the 30-year fixed home loan is 7.22% as of yesterday, after starting this year around 3%.

|

|