Bi-Monthly ERPE Excerpts

Dec 1, 2022

Turkey 5 2022

Just when you thought you had heard the last of “Black Friday”, “Cyber Monday” and the rest of the retail exhale since Thanksgiving…wait there’s more. You can blame it on Amazon. The king of the ring in retail has named the days from Thanksgiving Thursday to the following Monday “The Turkey 5” (T5). T5 is a major shopping event. Retailers and e-commerce stores are paying more attention to T5, and with good reason: Sales. Lots of sales. T5 2022 saw a record number of holiday shoppers – 196.7 million – flocked back to stores and hunted for deals from Thanksgiving Day to Cyber Monday, according to a survey by the National Retail Federation (NRF), which tracks figures for in-store and online shopping. Shoppers spent an average of about $325 on holiday-related purchases over the weekend. That’s higher than last year’s average of $301. Figures from Adobe Analytics showed that online spending hit record highs on key days during the holiday shopping weekend. Black Friday sales rose 2.3% to hit $9.12 billion and Cyber Monday sales rose 5.8% to $11.3 billion, according to the company, which tracks sales on retailers’ websites. However, one of the weekend’s biggest takeaways is that Americans are eager to shop in-person again and that they’re hungry for big bargains. More than 122.7 million people visited brick-and-mortar stores over the weekend, a jump of 17% from 2021.

What Recession?

Consumers are consuming. The strong job market has encouraged Americans to keep spending. The trend in retail spending is bullish with consumers not expressing much concern over a widely expected recession other than shopping for deep discount merchandise. This year’s holiday shopping season so far has scored record spending and a bigger-than-expected turnout at the stores. The pre-pandemic holiday shopping habits have returned and could portend to a robust 2023 retail spending year. That, though, does depend on macro economic developments. So far, consumers have shaken off concerns about a recession.

There is a 6th day of spending from Thanksgiving day. That is “Giving Tuesday”. Giving Tuesday estimates this year’s giving in the United States alone totaled $3.1 billion representing a 15% increase compared to Giving Tuesday 2021, and a 25% increase since 2020.

‘Tis the season…

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day December 1: “Fellow-Citizens, we cannot escape history.”

~ ~ Abraham Lincoln, 1862

What Happened On this Day, 1955 – Rosa Parks refuses to give up bus seat, sparking Civil Rights Movement.

MARKET ANALYSIS

INDICATORS OF INTEREST:

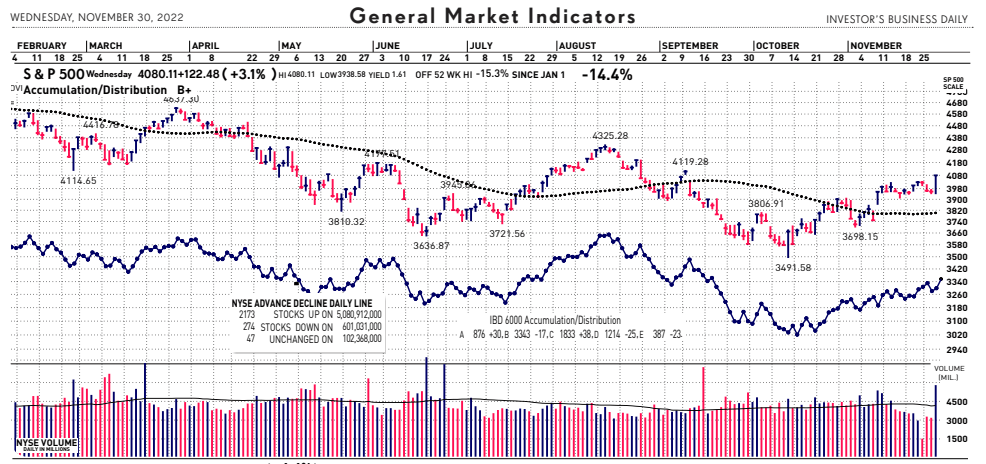

- Market’s Current Signal: Market in Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal turned more bullish November 10 as a better-than-expected CPI report triggered a change from Uptrend Under Pressure to Confirmed Uptrend.

The Stock Market Trend: Market in Confirmed Uptrend. The market’s current uptrend has been intact since November 10 when weaker-than-expected CPI data sparked a strong rally in the U.S. stock market. The Nasdaq soared over 7%, its 14th best day in history. Yesterday’s “Powell Pop” strengthened the rally. Today’s cooler inflation data gave the market another lift at this morning’s open, but that has since faded.

As I wrote to clients after yesterday’s market close, when the Fed speaks the market listens. Fed Chair Jerome Powell said the pace of rate hikes could start to slow at the December meeting, providing more-explicit support for a smaller increase. The probability the Fed will raise rates by 0.5% in December is pegged at 79.4%, while odds for a 75-basis-point hike are 20.6%, according to the CME FedWatch tool.

With concerns of higher interest rates just now lessening, yields falling, the dollar dropping to foreign currencies and inflation cooling, the market’s trend should stay on track. Another bullish set-up for the stock market is a potential seasonal tailwind. December has historically been a good month for stocks. Since 1950, the SP 500 has gained 1.4%, on average, and has been up 73% of the time in that period. December up 2.9%, 3.7% and 4.4% in the past three years.

- Industry Group Strength: BEARISH. As of yesterday, 53 out the 197 groups I monitor are up year-to-date. 144 groups are down for the year.

- New Highs vs. New Lows: BEARISH. In yesterday’s session, there were 86 new 52-week highs and 104 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.17%. The 10-year Treasury now 3.55%.

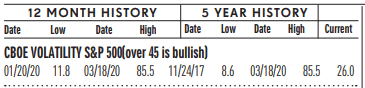

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 21, down from 24 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

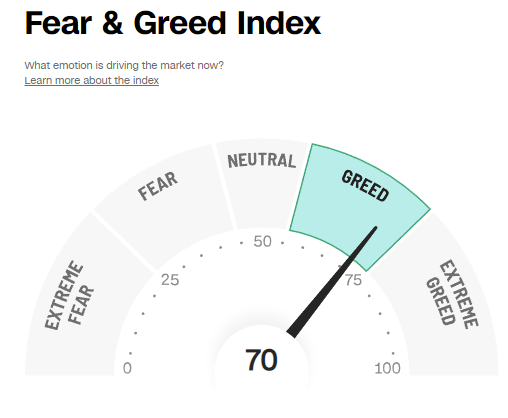

- Fear / Greed Index: BEARISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 70, the Fear & Greed Index is up from 61 two weeks ago.

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, bullish sentiment is 38.4% and the bears came in at 31.5%. Both are about unchanged from 2-weeks ago. The bearish read roughly the same as 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

- Put / Call Ratio: NEUTRAL. The ratio of put-to-call options is 0.78, upfrom 0.63 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Jobless Claims Down: Initial jobless claims fell 16,000 to 225,000 in the week ended November 26, the Labor Department said today. Economists polled by The Wall Street Journal had estimated new claims would fall 5,000. The decline reverses a revised gain of 18,000 to 241,000 in the prior week. The number of people already collecting jobless benefits rose by 57,000 to 1.61 million. That’s the highest level since February. On an unadjusted basis, claims fell 50,512 to 198.557.

New Home Sales Up: U.S. new home sales rose 7.5% to a seasonally-adjusted annual rate of 632,000 in October from a revised 588,000 in the prior month, the Commerce Department reported last Wednesday. Analysts polled by The Wall Street Journal had forecast new-home sales to fall to a seasonally-adjusted annual rate of 570,000. The data are often volatile. Sales in September were initially reported at 603,000. The median sales price of new houses sold in October jumped to a record $493,000, up from $455,700 in the prior month. The supply of new homes for sale rose 1.5% between September and October, equating to a 8.9-month supply at the current sales pace. This is up from a 5.7-month supply in January. Regionally, sales rose sharply in the Northeast and the South but dropped in the Midwest and the South.

U.S. GDP Up: The economy grew at an annual 2.9% pace in the third quarter, updated figures show, and the U.S. is on track to expand again in the waning months of 2022 despite growing worries of recession. Gross domestic product (GDP), the official scorecard for the economy, was revised up from a 2.6% rate of growth in the preliminary reading issued last month. GDP had shrunk in the first two quarters of the year. The economy is forecast to expand again in the fourth quarter running from October to December, but estimates vary from as much as 4% to less than 1%. All figures are adjusted for inflation. The main engine of the economy, consumer spending, increased at a solid 1.7% annual clip in the third quarter, the government said. Previously the increase was put at a softer 1.4%. Business spending was weak, however. Investment fell sharply in large structures such as office buildings and oil rigs. The housing market also slumped due to soaring interest rates. Corporate profits also fell 1.1% in the third quarter. Adjusted pretax earnings declined to an annualized $2.97 trillion.

Fed Rate Increases Slowing: Federal Reserve Chairman Jerome Powell indicated Wednesday the central bank may decide to raise interest rates at a slower pace at its next policy meeting. “The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said, in a speech to the Brookings Institution. While slowing the pace of interest rate hikes is dovish, Powell tried to balance his message by making make two hawkish points. He said the ultimate level of rates would have to be higher than was thought a few months ago and he tried to keep any talk of rate cuts off the table. “History cautions strongly against prematurely loosening policy,” he warned. Markets expect the Fed will lift the Fed funds rate by a half percentage point (50bp) at its meeting in mid-December. That would bring the Fed’s benchmark rate to 4.25%-4.5% range.

Global Economic Indicators & Analysis:

WEAK INDICATORS

PCE Down: A key gauge of U.S. inflation today rose a modest 0.3% in October, adding another piece of evidence that points to slowly easing price pressures. However, the personal consumption expenditures (PCE) index was slightly below Wall Street’s forecast. The yearly rate of inflation slowed to 6% in October from 6.2% in the prior month and a 40-year high of 7% last summer. The PCE index is thought by the Federal Reserve to be the best measure of inflation, especially the core gauge that strips out volatile food and energy costs. The core index rose 0.2% last month. Wall Street had forecast a 0.3% increase in the so-called core PCE index. The core rate of inflation in the past 12 months slipped to 5% from 5.2%. It’s also down from a 40-year high of 5.4% last February.

Manufacturing Index Down: A key barometer of American factories fell to a 30-month low of 49% in November — contracting for the first time since the start of the pandemic — in another sign the U.S. economy is getting weaker. Today’s Institute for Supply Management’s manufacturing survey declined from 50.2% in October. The ISM report is viewed as a window into the health of the economy. Numbers below 50% signal the economy is contracting. The last time the index was this low was in May 2020, near the end of a nationwide lockdown in the early stages of the pandemic. Manufacturers are bearing the brunt of the slowdown in the U.S. economy brought about by higher interest rates.

Construction Spending Down: Outlays for construction projects fell 0.3% in October at a seasonally adjusted annual rate of $1.79 trillion, the Commerce Department reported today. Economists polled by The Wall Street Journal had expected a 0.2% decline. Spending in September was revised up to a 0.1% gain from the prior estimate of a 0.2% rise. Over the past year, construction spending is up 9.2%. Private construction fell 0.5% in October. Residential construction fell 0.3% and nonresidential dropped 0.8%. Public construction was up 0.6% last month, led by power plants and health care.

Existing Home Sales Down: Existing-home sales fell 5.9% to a seasonally adjusted annual rate of 4.43 million in October, the National Association of Realtors said last Friday. Compared with October 2021, home sales were down 28.4%. Economists polled by the Wall Street Journal had expected an decrease to 4.37 million units. The level of sales is the lowest since December 2011 excluding the 2020 pandemic. This is also the ninth straight monthly decline in sales, the longest streak on record. The median price for an existing home was $379,100 up 6.6% from October 2021.But price gains are decelerating. Prices were up over 20% on a year-on-year basis earlier this year.

U.S. Economic Growth Down: Economic growth in the U.S. slowed in October, data from the Federal Reserve Bank of Chicago showed last Monday, adding to signs of weakening activity amid high inflation and rising interest rates. The Chicago Fed National Activity Index decreased to minus 0.05 in October from 0.17 in September. The reading suggests U.S. economic activity grew slightly below its average historical trend over the month. The CFNAI index, designed to gauge overall economic activity and inflationary pressures, is composed of 85 economic indicators

from four broad categories of data: production and income; employment, unemployment and hours; personal consumption and housing; and sales, orders and inventories. Three of the four broad categories of indicators used to construct the index made negative contributions in October, the Chicago Fed said. Production-related indicators contributed by minus 0.05 to the index, driven by a slight decrease in industrial production.

Consumer Confidence Down: A survey of consumer confidence fell to 100.2 in November and touched the lowest level in four months, reflecting growing angst about a softening economy and potential recession. The closely followed index dropped 2 points from 102.2 in the prior month, the nonprofit Conference Board said Tuesday. Economists polled by The Wall Street Journal had forecast the index to fall to 100. Consumer confidence tends to signal whether the economy is getting better or worse. The index began to fall in the spring because of high inflation and now a slowing economy is adding to the worries.

U.S Private Sector Job Growth Down: Private payrolls rose by 127,000 in November, according to the payroll services firm ADP yesterday. It is the slowest pace of growth since January 2021. Economists polled by The Wall Street Journal had forecast a gain of 190,000 private sector jobs. Leisure and hospitality firms added 224,000 workers in November, ADP said. Meanwhile, goods producers shed 86,000 jobs. Manufacturing lost 100,000 jobs. Those changing jobs say they are seeing a median change in annual pay of 15.1%. The labor market expansion may be slowing, but unemployment is still low. Economists expect government data due Friday to show the labor market, including the public sector, added a net 200,000 jobs in November, down from 261,000 in the prior month.

An easy way to get my ERPE Excerpts is by “text-to-subscribe”. By simply texting to the number 22828 and entering the word erpeexcerpts, a prompt is sent to enter an email address and done! You will then receive my bi-monthly market and economic updates. Please pass this on.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

4125 Blackhawk Plaza Circle, Ste. 260 Danville, CA. 94506

Phone: 888-985-PLAN · Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.