Bi-MONTHLY MARKET ANALYSIS &

ECONOMIC UPDATES

August 31, 2023

Searching or Reasoning:

The future engines driving information seeking

Today’s ERPE Excerpt has been written by Blackhawk Wealth Advisors’ newest Associate Advisor, Pierce Hanna. We hope you enjoy the content, cheers!

Have you ever wished you could turn to a loved one to freely discuss the thoughts or questions circling your mind, and receive a plethora of answers and infinite insight? Well, unfortunately, your friend is not Yoda. But, almost. You will soon have “reasoning engines”.

Brace yourself for a remarkable transformation in how you seek information online in the future. With the rapid advancement of AI (Artificial Intelligence), soon instead of seeking advice from a friend or family member, you’ll be engaging with a reasoning engine. In the swiftly evolving landscape of the rapidly growing AI field, it’s worth pausing to explore a concept that will soon become a familiar tool for the average person: the distinction between search engines, like Google, and the emerging innovation known as reasoning engines. Delving into these differences allows us to grasp the transformative potential they hold for our online interactions and information retrieval.

Search engines and reasoning engines each have their own set of advantages and drawbacks. When you use a search engine like Google or Bing, you are tapping into a vast collection of web content, receiving a ranked list of relevant webpages. This is great for exploring multiple sources on a topic, but these engines don’t truly understand your queries. They rely on keyword matching, often leading to adjustments and frustration as you refine your search. Reasoning engines, however, are designed to grasp and interpret human language, engaging in meaningful conversations. Unlike search engines, they offer direct, context aware responses and comprehend your question’s intent. Reasoning engines, such as ChatGPT, consider the context of your queries and their relationships, making the process more dynamic and humanlike. Choosing between the two depends on your needs. If you are seeking information for creative purposes or complex ideas, reasoning engines can be more efficient and user friendly. They eliminate the need for additional steps, offering more relevant and contextual answers right away. However, it is important to remain cautious about their results. While reasoning engines seem convincing, they’re not always infallible sources of truth.

The future of online search lies in the integration of these engines. As technology advances, search engines might incorporate reasoning capabilities, streamlining the process of synthesizing and understanding information. The convergence of search and reasoning engines could generate comprehensive and accurate results, enhancing the way we find information online. To harness reasoning engines effectively, prompt engineering is crucial. Crafting precise prompts (questions you ask the AI reasoning engine) determines the quality of generated responses. Clear instructions and examples in prompts guide the model’s output. Learning to manipulate prompts is a skill that improves over time, leading to better and more tailored results. When creating prompts, be specific, provide context, break down complex queries, and use clear language. Experiment with different prompts to explore various creative possibilities. Incorporate role play scenarios, analogies, debate style questions, and creative exercises to enhance your search strategies. There are vast amounts of “how-to” guides available online, ranging from informative YouTube tutorials to step-by-step guides on specialized tech websites. I encourage you to dive into this wealth of resources to enhance your understanding of various AI subjects through these engaging and informative materials.

In a world where technology constantly shapes how we access information, consider this: What will your inaugural dialogue with the internet look like? Standing at the crossroads of search engines and reasoning engines, we are on the brink of a paradigm shift that reimagines information seeking. As we venture forward, this journey holds the promise of shaping a landscape where our questions lead to profound conversations, expanding our horizons and transforming the way we interact with knowledge.

AI technology is taking off at a remarkable rate with respect to how we seek information. Sophisticated “chatbots” are turning search queries from simple texts to sophisticated answers and images. Enjoy the experience receiving information from your reasoning engine.

Pierce Hanna

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote For Today: “You only have to do a very few things right in your life so long as you don’t do too many things wrong.”

~~ Warren Buffet

What Happened On This Day, August 31, – Today is the day after Warren Buffett’s birthday. Mr. Buffett is 93 years young as of yesterday.

MARKET ANALYSIS

INDICATORS OF INTEREST:

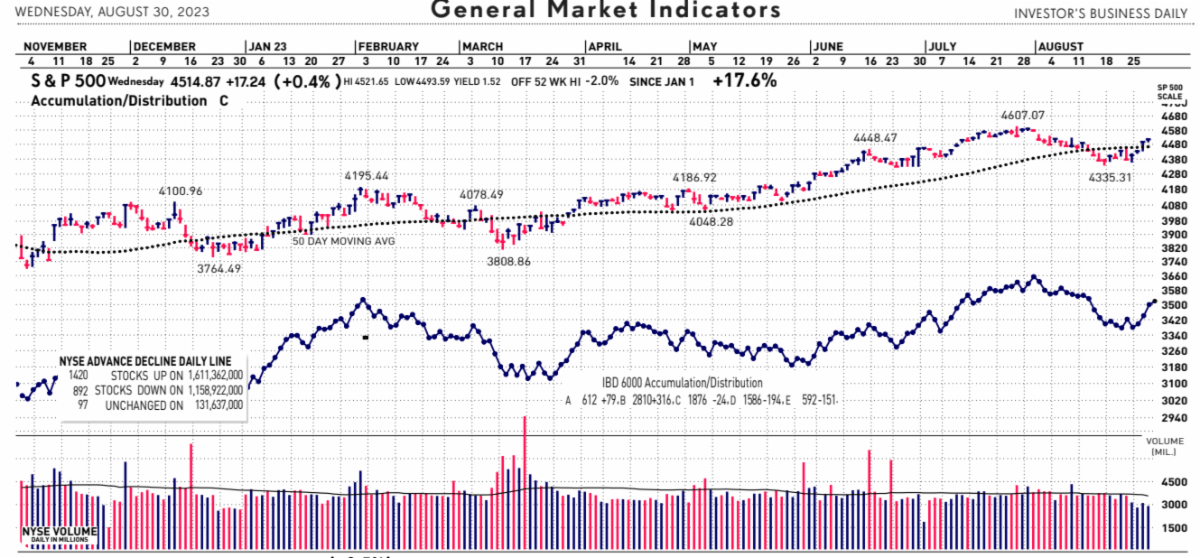

- Market’s Current Signal: Confirmed Uptrend. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. I analogize this to a traffic signal’s changing colors from green to yellow and then to red. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal is Confirmed Uptrend.

The Stock Market Trend: Confirmed Uptrend. The U.S. stock market was trending in a Confirmed Uptrend from May 10 to August 2. A steep, broad and high volume bearish sell-off on that day caused a weaker stock market trend outlook to Uptrend Under Pressure. Continued persistent selling triggered a more bearish signal, knocking the market’s trend into Correction on August 17. A 3-week losing streak came to sudden stop as the resilient market showed strength again, resulting in another trend change to Confirmed Uptrend this Tuesday, August 29.

Here are key market levels as of Monday, August 28:

Recapping Last Week

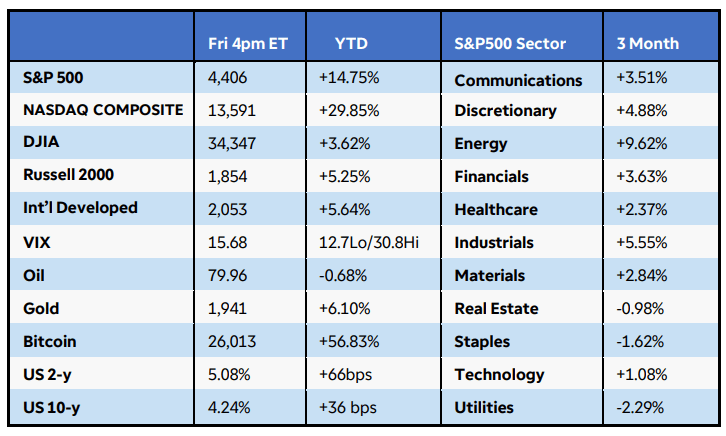

U.S. equities completed an up-and-down week with mixed performance as investors parsed Federal Reserve Chair Powell’s latest remarks on monetary policy at the Jackson Hole Symposium. The Nasdaq Composite Index gained 2.25%, while the S&P500 added 0.8%. The Russell 2000 slid 0.3% as regional banks underperformed due to ratings downgrades by S&P Global. Seven of 11 S&P500 sectors gained ground, led by technology after Nvidia jumped 6%+ for the week despite giving back most of its post-earnings release gains. U.S. Treasury yields rose at the short end after Powell’s Friday speech, where he acknowledged that strong economic growth could warrant further rate hikes to prevent a resurgence in inflation. However, he also said that rates are now high enough to be considered restrictive, and that the committee will proceed carefully to assess the impact of tightening thus far. The probability for no rate hike at the September FOMC meeting remained above 80%, according to fed funds futures. In other news, U.S. business activity neared stagnation in August, with S&P Global composite PMI falling to 50.4 from 52.0 prior and manufacturing contracting for a fourth straight month. Durable goods orders, excluding volatile transportation figures, increased only slightly in July, suggesting cautious capital investment. Housing data was mixed, with new home sales rising 4.4% in July, while existing home sales fell 2.2% and the median sales price ticked up to $406.700. Mortgage applications sank to a 28-year low as rates averaged 7.2%.

Internationally, China’s central bank disappointed investors after making smaller-than-expected interest rate adjustments. In Japan, BOJ core inflation surged to 3.3% year-over-year in July, above estimates and the prior month’s reading of 3.0%. Europe braced for recession as business activity contracted once again in August. Germany’s services PMI registered in the negative for the first time in eight months and GDP saw zero growth from April to June. Lastly, Britain’s economy appears headed for a downturn as PMIs reflected broader weakness and manufacturing activity plunged to May 2020 lows.

Current View

The U.S. stock market closes August today as it has most often history: down. However, it closed strong. But, not without increased volatility. In fact, After falling about 5% across the board, the major indices approached the finish line of August by rising the last 4 days in a row. This morning the market is on track for a 5th straight win. As today progresses and the market closes out the month, my thoughts will shift to my Market Monthly podcast. With a review of the month past and preview of the one ahead, I will remind my audience of the seasonal challenge for the market that September brings. Historically, September has been the worst month for the stock market since 1945 – average a negative 0.73%. Since 1896 the Dow has lost on average 1.08%.

- Industry Group Strength: BULLISH. As of yesterday, 141 out the 197 groups I monitor are up year-to-date. 56 are down.

- New Highs vs. New Lows: BULLISH. In yesterday’s session, there were 154 new 52-week highs and 57 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.21%. The 10-year Treasury now 4.10%.

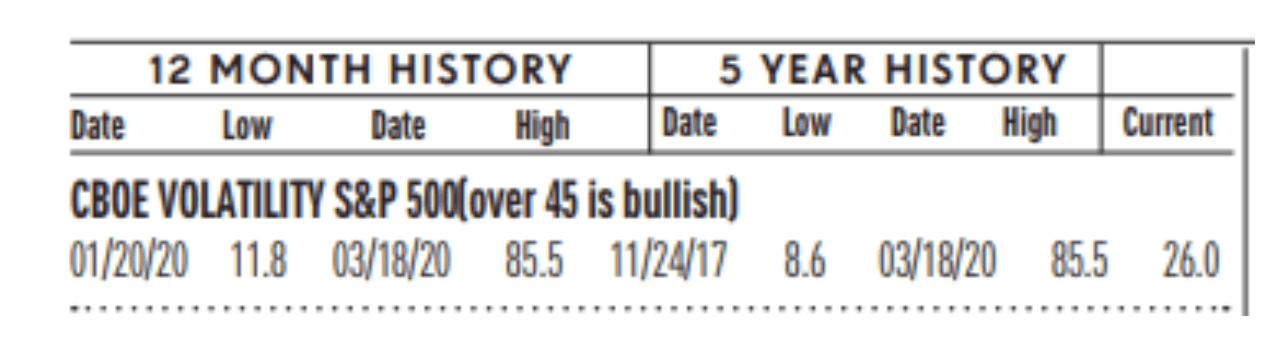

- Volatility Index: BEARISH. Volatility has been volatile. The “VIX” is now 13, up from 14 two weeks ago. It is still at its lowest level since February 20, of 2020. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

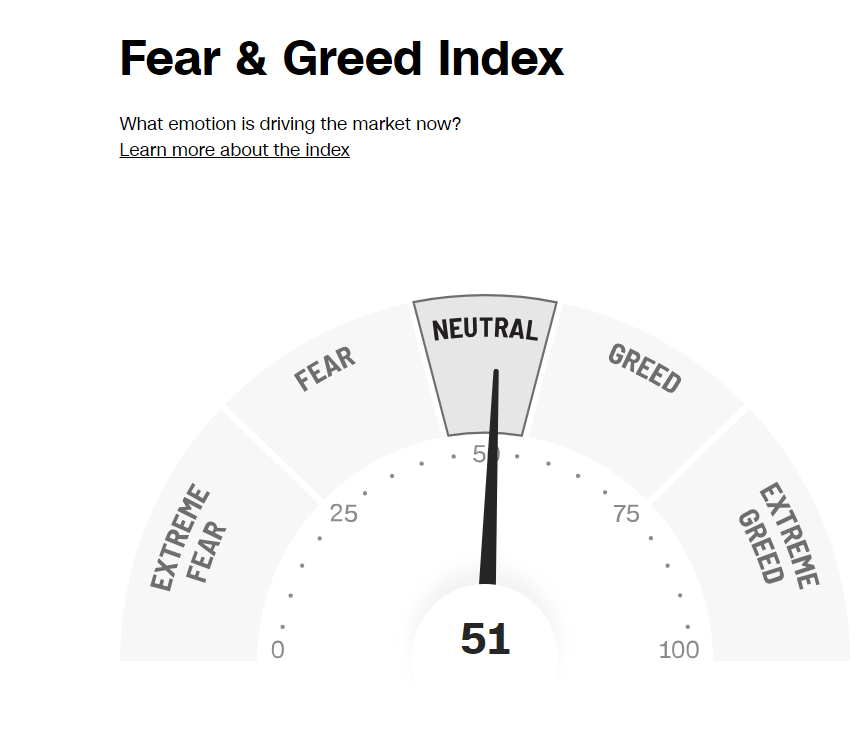

- Fear / Greed Index: BEARISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 51, the Fear & Greed Index is up from 74 two weeks ago. The greed read has fallen fast from 84 in 4-weeks.

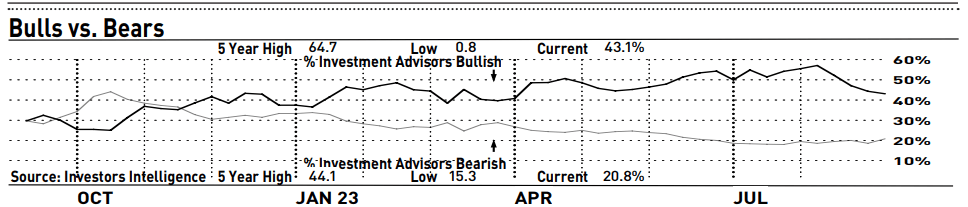

- Bull / Bear Barometer: NEUTRAL. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence (see below), bullish sentiment is 43.1% and the bears came in at 20.8%. Bullish sentiment is down from 57.3% two weeks ago, while the bearish read is up from 18.6% in the last two weeks. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

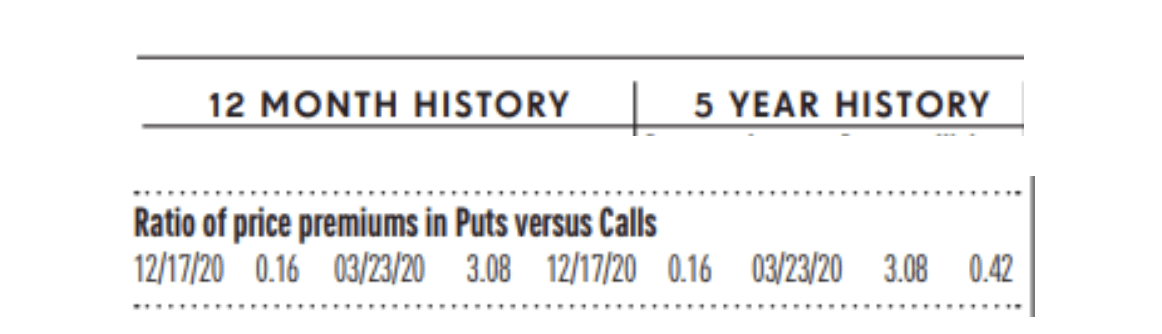

- Put / Call Ratio: BEARISH. The ratio of put-to-call options is 0.37, up from 0.32 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Initial Jobless Claims Down: Initial jobless claims fell by 4,000 to 228,000 in the week last week, the Labor Department said today. It’s the lowest level of claims since the week ended July 29. Economists polled by The Wall Street Journal had estimated new claims would rise 5,000 to 230,000. Last week claims fell a revised 8,0000 to 232,000. That compared with the initial estimate of a decrease of 10,000 to 230,000. The big jobs data will be released tomorrow with the August non-farm jobs report. Economists expect the U.S. labor market added 170,000 net new jobs in August and that the unemployment rate slips to 3.5%.

Philly Fed Against Another Hike: The president of the Federal Reserve Bank of Philadelphia said he thinks the U.S. central bank has raised interest rates high enough to bring inflation down over the next few years to pre-pandemic levels of around 2%. Harker has previously indicated he would prefer to leave a key interest rate unchanged at the Fed’s next meeting in late September. He is a voting member this year of the 12-member committee that sets rates. “I am in the camp of, let the restrictive stance work for a while. That should bring inflation down,” Harker said.

Case-Shiller Rises: U.S. home prices rose in June, as demand to purchase homes outpaced the supply of for-sale listings. Home prices went up in June as the housing market continues to be hampered by its inventory woes. Homeowners who have no reason to sell hang on to their homes, and buyers converge on a limited number of home listings. A persistent lack of home listings has pushed up home prices, as buyers converge on a limited number of homes on the market. Bidding wars are back in some markets, while others are seeing an uptick in all-cash buying, as those purchasers avoid relatively high borrowing costs.

WEAK INDICATORS

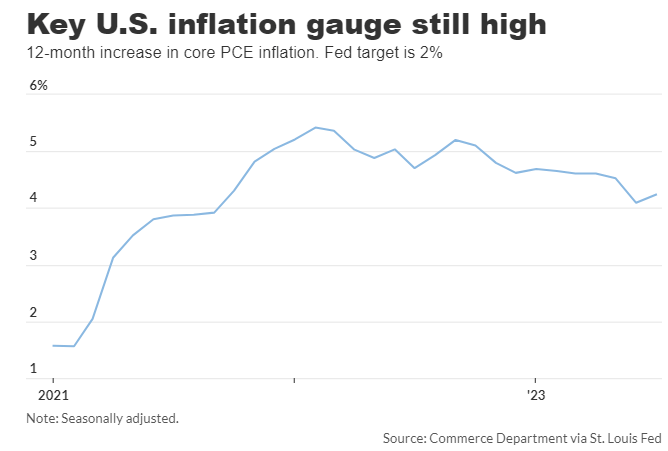

PCE Up: U.S. inflation rate creeps higher, the PCE shows, leaving Fed with perhaps more work to do. The cost of goods and services rose a mild 0.2% in July, but overall inflation crept higher and remained stuck above 3%. Economists polled by The Wall Street Journal had forecast a 0.2% advance in the personal consumption expenditures (PCE) index. The increase in prices over the past year, meanwhile, moved up to 3.3% from 3%, the government said today.

Consumer Sentiment Dips: A survey of consumer sentiment hung close a two-year high in August, but Americans expressed more worries about the future of the economy. The final reading of the sentiment survey in August slipped to 69.5 from a preliminary 71.2, the University of Michigan said last Friday. Interest rates are high and likely to remain so through next year as the Federal Reserve aims return the inflation genie to the bottle. Higher borrowing costs are all but certain to depress the economy and perhaps increase unemployment

Consumer Confidence Down: The index of U.S. consumer confidence dipped to 106.1 in August from a revised 114 in the prior month, the Conference Board said Tuesday. Economists polled by The Wall Street Journal had forecast a modest pullback to 116 from the initial reading of 117, which was the highest level in two years. Part of the survey that tracks how consumers feel about current economic conditions fell to 114.8 this month from 153 in July. A gauge that assesses what Americans expect over the next six months dropped to 80.2 from 88. The August reading is just above to 80 level that historically signals a recession within the next year.

S&P Flash Indexes Shrink: The S&P Global flash U.S. services-sector index fell to a six-month low of 51 in August from 52.3 in the prior month. Most Americans are employed on the service side of the economy, in areas such as health care, retail and hospitality. The S&P U.S. manufacturing-sector index, meanwhile, slipped to 47 from 49 and remained in negative territory. The S&P Global surveys are among the first indicators each month to provide an assessment of the health of the economy. Any number above 50 signals expansion, while numbers below 50 point to contraction. The large service side of the economy has been delivering virtually all of the growth, but the S&P survey suggests momentum has faltered. New orders, a sign of future demand, fell for the first time in six months in a bad omen.

US Consumer Confidence Signals Recession: The index of U.S. consumer confidence dipped to 106.1 in August from a revised 114 in the prior month. Part of the survey that tracks how consumers feel about current economic conditions fell to 114.8 this month from 153 in July. A gauge that assesses what Americans expect over the next six months dropped to 80.2 from 88. The August reading is just above to 80 level that historically signals a recession within the next year. The Conference Board said it still expects a recession before the end of the year.

US Trade Deficit Widens : The U.S. trade deficit in goods widened 2.6% to $91.2 billion in July, according to the Commerce Department’s advanced estimate released Wednesday. Trade data has been volatile this year while the underlying trend has been soft. Economists think that weak growth overseas might dampen U.S. economic growth in coming quarters.

ADP Labor Market Data Shows Cooling: Private payrolls rose by 177,000 in August, down from a revised 371,000 in the prior month, according to the payroll services firm ADP on Wednesday. The softness of the report adds a sense that the economy is slowing a bit — something Federal Reserve officials would welcome. Looking beyond the seasonal volatility, the trend in ADP data shows a labor market that is still growing moderately with only hints of cooling.

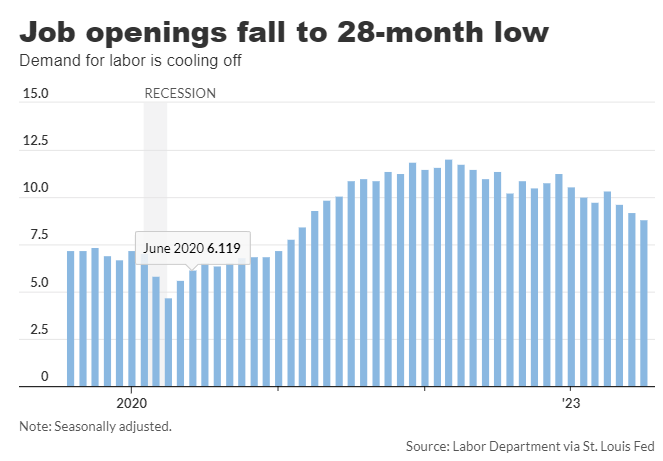

Job Openings Fall: Job openings in the U.S. fell in July to a 28-month low of 8.8 million, as companies scale back hiring in response to worries about an economic slowdown. Job postings have dropped from a record 12 million last year partly because of a surge in hiring, but also because businesses have become more cautious amid worries about a recession. Job openings fell the most in white-collar jobs and professional businesses. They also declined for health care and government positions. Fed official expect hiring to continue to slow and unemployment to rise as higher rates squeeze the economy. The Fed is concerned that rapid wage growth might stoke inflationary pressures in 2024, but wage growth is likely to slow in coming months with workers seeing fewer opportunities to raise wages by switching jobs.

Call me if you have any questions. I am always happy to help!

John J. Gardner, CFP®, CPM®.

Blackhawk Wealth Advisors, Inc.

3860 Blackhawk Rd. Ste. 160 Danville, CA. 94506

Phone: 888-985-PLAN · Email: jg@blackhawkwealthadvisors.com

BLACKHAWKWEALTHADVISORS.COM

For my Market Monthly podcast, click on the link below. I provide a review of global stock market highlights over the past month and preview of the month ahead. Forward insights and perspectives are based on current financial market and economic trends with an emphasis on relevant developments in various areas from Fed policy to company earnings announcements.

Link to my Market Monthly Podcast