Bi-Monthly ERPE Excerpts

Bi-MONTHLY MARKET ANALYSIS & ECONOMIC UPDATES

October 6, 2022

On a lighter ERPE Excerpts, here are some fast, fun facts. In most of this year’s Excerpts and market updates, I have covered the less-than fun situations and circumstances impacting the global economies and financial markets, and the lives of many. So, today’s Excerpts will hopefully offer you some surprising stats and some facts that may make you go, “Hmmm”.

- Costlier Cars… According to Experian, U.S. consumers are responding to surging prices for new cars and trucks by going deeper into debt, pushing the average new vehicle loan to a record-high of nearly $40,290 during the second quarter. The average monthly payment for a new vehicle loan rose to $667 in the second quarter, up nearly 15% from a year earlier. Yesterday heard an analyst say the average new car price has exceeded $50,000 and the average monthly car payment is $1,000. Used car buyers also are borrowing more. The average used vehicle loan jumped 18.7% to $28,534, with an average monthly payment of $515, up 17%. Source: CNN.

- How do you say Tomatoe?… The Golden State produces more than 90% of the country’s processed tomatoes and almost half of global processed tomatoes, according to the California Tomato Growers Association. Source: BBC.

- Making More Units… Some 420,000 new apartments are expected to be completed in cities across the U.S. this year, marking a historic 50-year high in multifamily construction, according to data from the listing service RentCafe. Source: Axios.

- Expensive Energy… Electricity prices are soaring, and many Americans are struggling to make their payments. One in six homes in the U.S., or roughly 20 million households, have fallen behind on utility bills, according to the National Energy Assistance Directors Association. In total, U.S. households are on the hook for $16 billion in late energy payments, which is double the amount pre-Covid. Source: Bloomberg.

- There’s No Place Like Home… American companies are on pace to re-shore, or return to the U.S., nearly 350,000 jobs this year, according to a report by the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010. Source: The Wall Street Journal.

- Snack Time… The U.S. snack market grew from about $116.6 billion in 2017 to an estimated $150.6 billion in 2022 and is forecasted to grow to $169.6 billion in 2027, according to Euromonitor International, which includes fruit snacks, ice cream, biscuits, snack bars, candy and savory snacks in the category. Source: CNN.

- Dollars for Drugs… The median annual price of 13 novel drugs approved for chronic conditions by the U.S. Food and Drug Administration so far this year is $257,000. Source: Reuters.

- 2 Wallets Are Better Than 1… The median net worth of married couples 25 to 34 years old was nearly 9x as much as the median net worth of single households in 2019, according to the most recent data from the Federal Reserve Bank of St. Louis. In 2010, married households’ median net worth was 4x as much. Source: The Wall Street Journal.

- Betting Early and Often… The latest revenue report from the Nevada Gaming Control Board has revealed that the state’s licensed gambling operators combined to generate $1.28 billion in revenue during the month of June. The latest figures represent a jump of 22.7% from pre-pandemic 2019 levels and an increase of 8.1% year-on-year. June was also the 16th consecutive month that gaming revenue topped $1 billion in Nevada. 2022 set a new state record for the highest revenue total in a fiscal year at $14.6 billion. Source: Gambling Industry News.

- Charging It… According to data from VantageScore, card usage is jumping the most for younger consumers and those who already have low credit scores. The balances of Americans 25 and younger jumped 30% in Q2, and people with credit scores below 660 saw a spike of about 25%. Source: VantageScore.

- And Carrying It… Credit card balances in the United States increased $46 billion in the second quarter, a 5.5% increase from the first quarter, and there was also an uptick in new credit card accounts. The 13% balance increase from the second quarter of 2021 to the second quarter of 2022 was the biggest such jump in more than 20 years. Source: The Washington Post

- Cheaper To Rent… In 38 of the 50 largest U.S. metros, the monthly cost of renting a home is lower than buying a starter home. This is a stark difference from January when just 24 markets favored renting. Year-over-year rent growth peaked in January at 17.3% and has decreased each consecutive month. Rent in June is just 6.3% higher than in January. Source: Realtor.com

- Higher Prices… April air travel costs ticked up 33.3% year over year, the biggest jump since December 1980. Food prices rose 0.9% last month and 9.4% year over year, the biggest jump since April 1981. Grocery store prices were up 10.8% for the year ended in April, the biggest increase since November 1980. Source: CNN

- More Insureds… The national uninsured rate dropped to a record low of 8% in the first quarter of 2022, according to a new analysis from the Department of Health and Human Services. Approximately 5.2 million people—including 4.1 million adults and 1 million children—have gained coverage since 2020. Source: Axios.

- Where’s World’s Waste Going?… The most recent United Nations data indicates the world generated a staggering 53.6 million metric tons of e-waste in 2019, and only 17.4% of that was recycled. Source: CNN

- America’s Team is Most Valuable… The Dallas Cowboys, worth $7.64 billion, are the most valuable franchise in the NFL and across all professional sports, per Sportico. Source: Sportico.

Which Fun Fact surprised you?

TAKING PERSPECTIVE…

Proper Perspective: In our hectic and often hard to comprehend world, it is very easy to lose perspective. You may agree it is sometimes difficult to see the big picture. The media often doesn’t help with this, but unfortunately instead encourages us to see things in a most negative light. Here is hopefully a pause to gain positive perspective.

Famous Quote On This Day October 6: “I’ve reached the pinnacle of my career. I just feel that I don’t have anything else to prove.”

~ ~ Michael Jordan, 1993

What Happened On this Day, 1857 – American Chess Association is organized.

MARKET ANALYSIS

INDICATORS OF INTEREST:

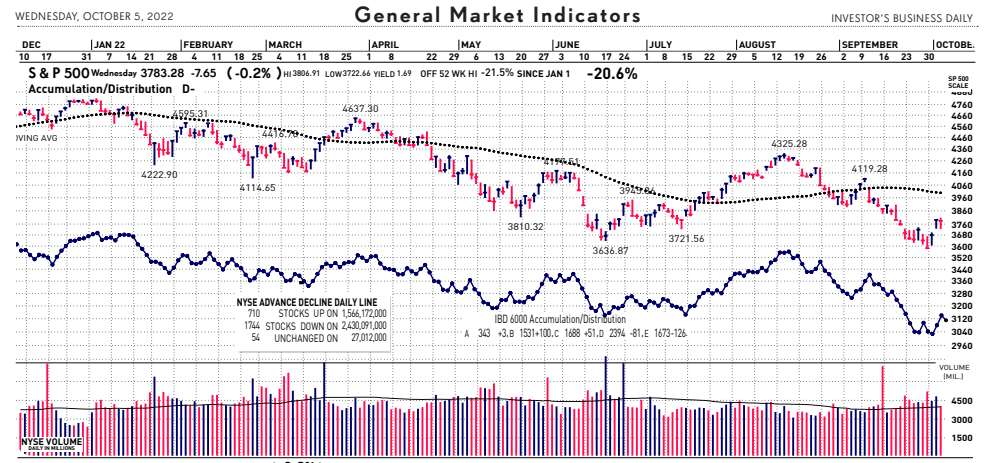

- Market’s Current Signal: Market in Correction. Analysis of the stock market over 130 years of history shows we can view it in terms of three stages – market in uptrend, uptrend under pressure and market correction. Since the 1880’s, this perspective has led to investment out-performance relative to market indexes. This is due to trend analysis which determines risk reducing, return enhancing market entry and exit points. The U.S. stock market’s current signal weakened again on September 16 to Market in Correction from August 26 when the trend weakened to Uptrend Under Pressure.

-

The Stock Market Trend: Market in Correction. Friday, September 16, the market’s trend weakened to Market in Correction. From there, the market weakened further to end the month and quarter at near new lows for the year. As I detailed in my for clients only “Stock/Market Alert” September 30, the U.S. stock market closed harshly lower as volume spiked and investor sentiment plummeted. Then, as the calendar turned to Q4, the market turned higher this week.

We are certainly not out of a bear market yet. The market has not even signaled a new confirmed rally. But the first hints of that have been given by the market with the kick-off of the 4th quarter over the last 3 trading days. Today is day 4 of an attempted rally, and if the market can close higher on solid volume a confirmed rally would be underway.

The market could now be showing once again its nature of being a “discounting mechanism”. The market current expectation for a fourth straight hike of 75 basis points in the fed funds rate at the November 2 Fed meeting now stands at a 65% probability. This “higher for longer” Fed policy may be near all priced in by the market and it may be now setting its sites on likely future conditions. The next stress test for the U.S. stock market will be tomorrow’s monthly jobs report (looking back at the September jobs market).

Beyond the Fed and its interest rate policy, the market will soon be flooded with the downpour of company earnings reports. Third-quarter results will give stock investors more clues to how much high inflation, and a definite slowdown in the U.S. economy, is affecting profits, perhaps the No. 1 factor in stock prices. At the end of June, the Street had been expecting an 8.5% increase in earnings among S&P 500 companies. That estimate has now fallen to a measly 2.5%.

As I wrote to clients in recent note, October is known as the “Bear Killer” month. However, it has also delivered some spooky days like Black Monday of 1987 and Black Tuesday of 1929 – two to the worst single stock sell-off days in history. Hopefully the market will conjure up the Bear Killer again this year.

- Industry Group Strength: BEARISH. As of yesterday, 26 out the 197 groups I monitor are up year-to-date. 171 groups are down for the year.

- New Highs vs. New Lows: BEARISH. In yesterday’s session, there were 91 new 52-week highs and 115 new 52-week lows.

- Dow Dividend Yield: BEARISH. The current yield for the Dow Jones Industrial Average is 2.48%. The 10-year Treasury now 3.81%, is up fromand near 1.6% at the start of the year.

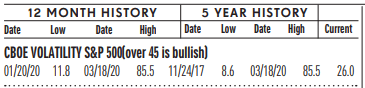

- Volatility Index: NEUTRAL. Volatility has been volatile. The “VIX” is now 29, up from 28 two weeks ago. The index is also known as the “Fear Index.” It is considered a contrarian indicator and therefore viewed as bullish as it rises indicating investors are becoming more fearful. The VIX:

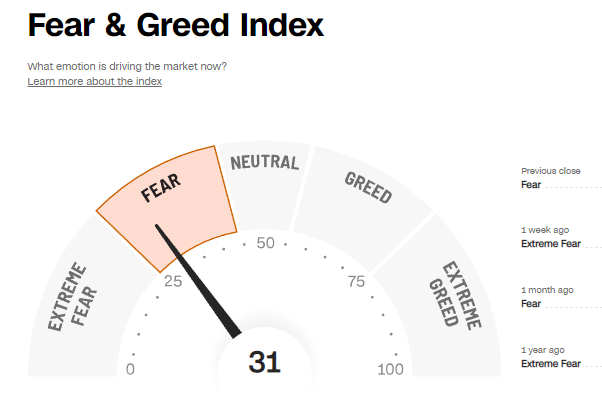

- Fear / Greed Index: BULLISH. Investors are driven by two emotions: fear and greed. Too much fear can create a condition of oversold/ undervalued stock prices. Too much greed can result in overbought/overvalued stock prices. The AAII Investor Sentiment Index is now neutral. BE FEARFUL WHEN OTHERS ARE GREEDY. At 31, the Fear & Greed Index is up from 29 two weeks ago.

- Bull / Bear Barometer: BULLISH. This secondary market indicator should also be viewed with a contrarian perspective. As of yesterday, according to the latest survey of stock market newsletter writers by Investor’s Intelligence, the bulls have dropped again to 25.4% each. The bears have jumped to 41.8%. The bearish read was 31.4% 2 weeks ago. Consider this a contrarian indicator because the crowd is often wrong at market tops and bottoms. In other words, extreme bullishness has been seen near several market tops in the past, while extreme bearishness has been seen at market bottoms.

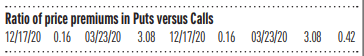

- Put / Call Ratio: BULLISH. The ratio of put-to-call options is 1.42, down from 1.49 two weeks ago. The put-call ratio tracks the mood of what options investors are doing, not just saying. They typically buy puts if they think a stock will decline and calls if they think it will rise. If they’re buying lots of puts, they see the market declining. And if they’re loading up on calls, they’re generally bullish. Historically, market bottoms occurred when the reading spikes to 1.2 or more. Market tops are often made when the reading is 0.6 or less. Note how reliable this is with respect to the February record low coinciding with the market high. Keep in mind this is also a contrarian indicator.

ECONOMIC UPDATES

Global Economic Indicators & Analysis:

POSITIVE INDICATORS

Consumer Confidence Up: Americans feel a lot better because of falling gasoline prices: A survey of U.S. consumer confidence jumped to a five-month high of 108 in September. The strong labor market and rising wages also gave Americans more confidence, the nonprofit Conference Board said last Tuesday. The unemployment rate is close to a 54-year low and wages are rising at the fastest pace in decades. Economists polled by The Wall Street Journal had forecast the index to rise to 104.5 from a revised 103.6 in the prior month. A measure of how consumers feel about the economy right now rose to 149.6 in September from 145.3 in the prior month.

New Home Sales Up: U.S. new home sales surged 28.8% to a seasonally-adjusted annual rate of 685,000 in August, from a revised 532,000 in the prior month, the Commerce Department reported last Tuesday. That’s the second-biggest jump on record for new home sales. The pace of sales is a sharp reversal of a drop of 8.6% in July. Yet the sales of new homes are still below a peak of 1.04 million in August 2020. Analysts polled by the Wall Street Journal had forecast new home sales to come in at 500,000 in August. Year-over-year, new home sales are still down by 0.1%. New home sales fell a revised 8.6% to 532,000 in July, compared with the initial estimate of a 12.6% drop to 511,000.

ISM Service Index Shows Growth: An ISM barometer of U.S. business conditions at companies such as hotels and restaurants dipped to 56.7% in September, yesterday’s report showed. Yet the survey also showed steady growth and rising employment in a sign the economy is still expanding. Numbers over 50% are viewed as positive for the economy, and anything over 55% is considered exceptional. Economists polled by The Wall Street Journal had expected the index to drop to 56%. The survey is produced by the institute for Supply Management.

Jobs Market Indicator Down – Bad News Good News?: Job openings in the U.S. fell sharply in August to a 13-month low of 10.1 million, a sign the red-hot labor market might be cooling off a bit as interest rates rise and the economy slows. Job listings slid from 11.2 million in July to mark the second largest monthly drop ever, the Labor Department said Tuesday. Layoffs also rose to the highest level in 18 months, though they are historically low. The decline in job openings was the fourth in five months. And openings sank below 11 million for the first time since November 2021. The number of job openings is viewed as a way to assess the strength of the labor market and the broader economy. Yet while it isn’t sizzling as much as it was earlier in the year, the labor market is still quite strong. This is more evidence that the U.S. economy is starting to sputter as the Federal Reserve jacks up interest rates.

Global Economic Indicators & Analysis:

WEAK INDICATORS

Jobless Claims Up: This weak news could be considered news (if we want the Fed to back-off its interest rate hike plan. Today’s jobless claims report showed the number of people who applied for unemployment benefits last week jumped by 29,000 to a five-week high of 219,000, possibly a sign of rising layoffs as the U.S. economy slows and businesses scale back employment. Economists polled by the Wall Street Journal had forecast new claims to total 203,000 in the last week. The figures are seasonally adjusted. The number of people applying for jobless benefits is one of the best barometers of whether the economy is getting better or worse.

Consumer Sentiment Mixed – Below Expectations: Consumer sentiment rose in September to a final reading of 58.6 amid falling gas prices, though Americans remain broadly pessimistic about the economic outlook. Last Friday showed the University of Michigan index advanced from 58.2 in August but fell from an initial 59.5 print earlier this month. Economists were expecting a reading of 59.5, according to a Wall Street Journal poll. Consumer expectations for inflation over the next year hit a one-year low of 4.7% compared to 4.8% last month, while expectations for inflation over the next five years declined to 2.7% from 2.8% in August, its lowest level since July 2021. Falling gas prices over the past several months have helped buoy Americans attitudes toward the economy, but persistent inflation in other areas like food has helped keep sentiment mired at levels typically seen during economic recessions.

Durable Goods Orders Down: Durable Goods orders at U.S. factories for long-lasting goods fell 0.2% in August, a data released last Tuesday showed. This was because of lower demand for large airplanes, but investment rose in a sign the industrial side of the economy is still chugging ahead. Economists polled by the Wall Street Journal had forecast a 0.5% decline. Durable goods are products such as cars, appliances and computers that are meant to last at least three years. More important, a key measure of business spending jumped 1.3% last month and showed surprising strength. So-called core orders — which don’t include military spending or the up-and-down auto and aerospace industries — are viewed as a reliable sign of whether the outlook for businesses and the broader economy is good or bad.

GDP Dips: The U.S. economy shrank in the first six months of the year, revised government figures confirm, and painted a picture of economy buffeted by strong headwinds and tailwinds. Gross domestic product, the official scorecard of the economy, fell at a 0.6% annual clip in the second quarter, the Bureau of Economic Analysis said last Thursday. That’s unchanged from the prior estimate. The previously reported 1.6% decline in first-quarter GDP, meanwhile, was also unchanged. Consumer spending accounts for as much as 70% of U.S. economic activity and outlays were somewhat stronger than previously reported in the first half of the year.

Spending rose at an inflation-adjusted 2% annual pace in the second quarter and 1.3% in the first quarter. What caused GDP to shrink was a record trade deficit, the end of most pandemic stimulus and a sharp decline in business spending, especially on new inventories. The biggest surprise in the report was a reduction in so-called gross domestic income — basically wages and profits. That should lead to less spending.

PCE Up – Inflation Persists: A key gauge of U.S. inflation rose a mild 0.3% in August last Friday, as another sharp decline in gasoline prices helped to ease the financial stress on households and businesses. But prices are still going up at the fastest pace in 40 years. The small increase in the so-called personal-consumption price index last month follows a decline in July. Retreating gas prices were the chief reason. In a more worrisome sign, another measure of inflation that omits volatile food and energy costs jumped 0.6% last month. That was above Wall Street’s 0.5% forecast for the so-called core PCE. The Federal Reserve views the PCE index as the best barometer of inflation trends. The rate of inflation over the past year slowed a bit to 6.2% from 6.4% in the prior month. The core rate of inflation in the past 12 months, however, climbed to 4.9% from 4.7%. It had touched a 40-year high of 5.3% in February.

ISM Manufacturing Index Down: A key barometer of American factories fell to a 28-month low of 50.9% in September as high inflation and rapidly rising U.S. interest rates rattled the economy. Monday’s Institute for Supply Management’s manufacturing survey showed it declined from 52.8% in August. The ISM report is viewed as a window into the health of the U.S. economy. Economists polled by The Wall Street Journal had forecast the index to drop to 52%.While numbers above 50% signify economic growth, the index has fallen sharply since earlier in the year. New orders have declined, particularly exports, and manufacturers aren’t hiring as many workers. Rising interest rates are acting as an increasing headwind on the economy and manufacturers are feeling it.

Construction Spending Down: Outlays for construction projects fell 0.7% in August to $1.78 trillion, the Commerce Department reported Tuesday. Wall Street was expecting a drop of 0.2%. Spending in July fell a revised 0.6% to $1.79 trillion, up from the prior estimate of a 0.4% drop. Over the past year, construction spending is still up 8.5%. Total private construction fell 0.6% in August. Private residential construction fell 0.9%, while private nonresidential spending fell 0.1%. Total public construction fell 0.8%%. Residential public construction fell 2.7% while nonresidential public construction fell 0.8% last month.

Home Prices Downtick: Last Tuesday’s S&P CoreLogic Case-Shiller 20-city house price index rise slowed to 16.1% year-over-year in July, a lower rise than the 18.7% jump in the previous month. In the month of July, the 20-city index fell a seasonally adjusted 0.4% down from a rise of 0.4% in June. That’s the first time since March 2012 that the 20-city index fell. The rate of price rises has sharply slowed since reaching a peak of 21.2% in April. A broader measure of home prices, the national index, fell a seasonally adjusted 0.2% in July from June. July’s monthly fall was the first time the national index fell on a monthly basis since February 2012. A big part of the deceleration that continues from earlier this year is due to higher mortgage rates. The average on the 30-year fixed-rate mortgage was at 6.29% last Thursday, according to Freddie Mac.

Pending Home Sales Down: U.S. pending-home sales fell 2% in August, for the third straight monthly drop, according to the monthly index released last Wednesday by the National Association of Realtors (NAR). Analysts polled by the Wall Street Journal had forecast the pending home sales index to drop by 1.4%. Contract signings fell by double-digits in all regions across the country. Pending home sales reflect transactions where the contract has been signed for an existing-home sale, but the sale has not yet closed. Economists view it as an indicator for the direction of existing-home sales in subsequent months.

|

|