Russian Invasion: Surging Oil and Stock Selloff

March 7, 2022

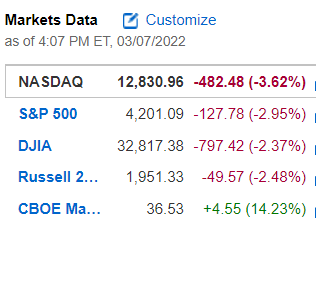

True to my promise many years ago, I offer my perspective on the U.S. stock market anytime two or more major indices fall 3% or more in a day. Today was as close as it gets. As the graph below of the market indexes shows, the S&P 500 was essentially down 3% and the Nasdaq fell even further. My last Market Update was February 18, though the market’s indexes did not fall as hard that day. Rather, it was my hope then to share my perspective on the bear market that I had determined we were in.

The Ukraine-Russia war sent oil prices higher again today, and the U.S. stock market down. Besides oil, volatility also spiked today. U.S. oil prices briefly surged above $130 a barrel to hit their highest level since 2008. The VIX (the volatility index) hit its highest level since last April. The VIX is referenced in the graph above by the “CBOE”. The technology sector was hit the hardest. Expect these companies to dramatically increase their share-buyback programs. Further, with valuations now at pre-pandemic levels for many, mergers and acquisitions could occur soon.

There are now compounding concerns that soaring commodity prices could spark a painful recession. What will the Fed day next week? They have firmly said they will raise rates, but now run the risk of exacerbating an increasingly precarious economy due greatly to inflation fueled by energy prices. In my opinion, the Fed has an extremely tough job now. Above all, the threat of “stagflation” is real and an economic condition they, nor do we, want. Expect a quarter point increase next week, but less frequent moves this year and next. Even last Friday’s super strong jobs report won’t out-influence the Fed fearing additional war-induced commodity supply disruptions.

As I wrote in my February 10 ERPE Excerpts, now is the time to keep proper perspective as an investor. A solid investment plan with a strong defense is critical now.

Today’s market meltdown was seen in nearly all the primary sectors aside from energy and other commodities. Do not think that there is “no where to hide” in this bear market. Prudent asset allocation results in the diversification required to minimize losses in an overall negative equity market. Staying with an investment plan and avoiding panic is required to be a successful stock market investor over time.

Though I have zero direct exposure to Russia or Ukraine in client investment accounts, it is impossible for an investor to avoid the affect of war there. The impact is being felt worldwide in the global financial markets and all economies.

I reiterate, proper perspective promotes positive portfolio performance.

Call anytime you have questions.

Hope this was helpful.

John

Contact us at 888-985-7526 or visit www.blackhawkwealthadvisors.com.