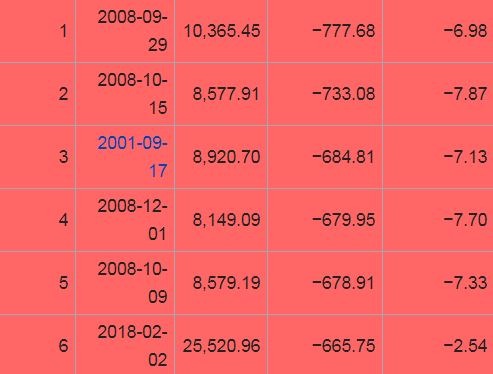

One of the biggest Dow down days in history

It’s always a matter of WHEN, not IF, when considering the stock market will decline big. Today was one of those days! As you can see in the chart below, today was the 6th worst day in history of the DJIA. As a side bar, notice how awful the last 3 months of 2008 were! Four of worst 5 days ever occurred in the last 3 months of ’08. Now that is a BEAR market. Now, back to today. It was a fast and furious fall, and nearly an ominous point drop…

Many are glad the Dow ONLY fell 665.75. We narrowly missed the “The Number of the Beast.” A coincidence??

Was today really so bad? No, not really. While I would never minimize big single-day stock market drops like today’s, I do want to mix in proper perspective as the media will certainly report today’s massive POINT drop with lot’s of noise and hyperbole. Though today’s big down day was historical and there was a lot of RED, it was relatively tame and expected.

First the relative perspective. Yes, again today was a big point loss and one of worst ever. But, the Dow was off -2.54%. So, in PERCENTAGE terms, relatively little. The chart above also gives you that. The real bad historical market days were down 7%. That’s in one day! Further, the other 2 days in history when the DJIA was down more than 600 points in a day, they were both huge losses of over 5.5%.

Now for the expected part. Again, we can never know when a sharp stock sell-off will happen, just that it is inevitable. Especially from the record highs the U.S. stock market indices have risen to. And how quickly! Aberrational. But not euphoric. So, we were overdue. I have written for months (since last July) that there was too much complacency in the stock market. The price action of the VIX is evidence of that. No doubt, now volatility is back. And your portfolio is positioned for it. As volatility spiked today, the VXX in your account shot UP over 13%.

With the Dow down 2.54%, it is again relatively important to compare that to the four primary

ERPE Equity Portfolios that make up the majority of your investment account allocation. Here’s today’s results:

Strategic Income -2.07

Diversified Value -1.99%

Thematic Growth -1.66%

Global Opportunities -2.87

Thank you for your continued trust and confidence. Still, after 33 years as an investment advisor and portfolio manager, I am reminded of the great honor the stewardship of your investment account is to me.

Please call anytime you have a question or I may be of help. I am always happy to be of service.