100 PPM

The back-to-back stock market sessions between Friday and today have brought back to me less-than fond memories of market “corrections” past. One thing is for certain, no two market draw downs are alike. Today, the DJIA fell 100 points per minute (PPM). Starting late morning (Pacific Time) the Dow fell 1100 points in 11 minutes! October 19, 1987, a.k.a. Black Monday, was (we all hope) as bad as it gets. Crashing from the opening bell, the DJIA began a precipitous drop to finally close down 508 points, or 22.6%. Yes, down that much in one day! Only a bit less surprising was the drop on top of the Friday (the 16th) fall when the DJIA had lost 4.6%. Over 27% in 2 days!

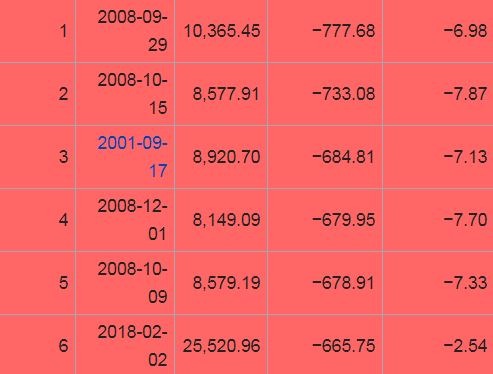

By a long shot, today’s point loss in the DJIA of 1,175 was the biggest single decline in history. I didn’t expect to send a market update note to you today (after Friday’s), but I think it is necessary and hope it helps with keeping proper perspective. It is only fitting, and again worth noting, that the table below be included with this writing as it was Friday.

With today’s stunning point drop in the DJIA, consider more importantly its decline of 4.6%. Coupled with Friday’s drop, the Dow has lost over 7% in 2 days. No where near the 2-day crash on the 16th & 19th of October ’87.

The clearest statement made to me with today’s market action was the end of the market complacency that has befuddled me for months. As volatility spiked again today, the VIX soared nearly 100%!! Unprecedented.

Even worse than Friday, today’s historical down day was a sea of RED. With the Dow down 4.6%, it is again relatively important to compare that to the four primary

ERPE Equity Portfolios that make up the majority of your investment account allocation. Here’s today’s results:

Strategic Income -3.73%

Diversified Value -3.71%

Thematic Growth -3.57%

Global Opportunities -3.58%

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.

John Gardner