March Market Madness

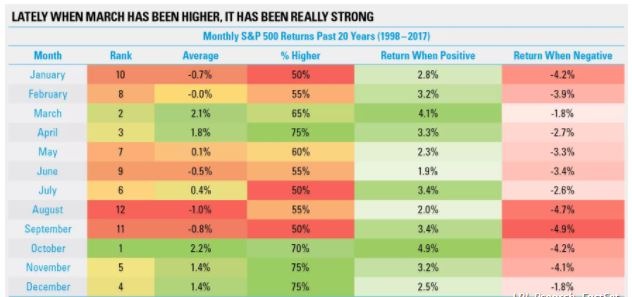

The S&P 500 ended February with a nearly 4% monthly loss. It was exceeded on the downside by the Dow Jones Industrial Average, which dropped more than 4%. The good news as the short month ended was that March was next. Historically, March kicks off two of the strongest months for equities. Over the past two decades, March has been the second strongest month for the S&P, scoring an impressive 2.10% on average. Going back further, all the way to 1950, the index still averages 1.2% growth in March, making it the fourth best month. And April has historically been even stronger. Today, though, as March is only a week from being gone, a repeat positive performance by the market in the month of March is increasingly unlikely. Take a look at the graphs below for perspective of the strength of the market in March’s past.

To say the least, this month has not lived up to the Market in March hype. Otherwise, March has been true to form: Spring has sprung (away from the North East, that is), March Madness is on. There have been fantastic finishes, bringing busted brackets. Instead of the hoped historical March market move up, the market has been manic in March. It as given us a tough tape and triggered a compound correction. Magic or tragic? March is on track to defy its record of market magic. The looming question is, will it go lower, longer?

What a Weak Week…

The last 5 days represent the worst week for the major U.S. stock market since January of 2016. The DJIA slid nearly 6% this week. All 30 of the Dow components were down. Sellers were everywhere as all 11 of the S&P 500 fell. Trade war fears between the U.S. and China sparked a sharp spike in volatility. The VXX holding in your account is doing its job…going up in a down market. The plan works and pays to stick to it.

Now, there’s still the hope for an April market repeat…

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.