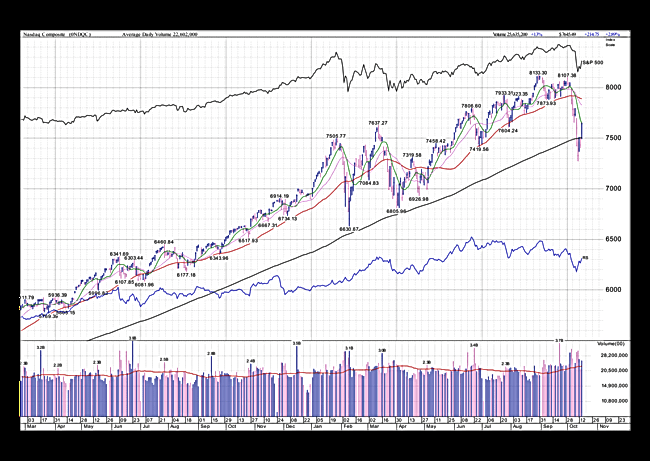

My market updates are intended to be few and far apart; reserved for noteworthy, extreme moves in the market. But, extreme market moves, certainly noteworthy, have occurred with a higher-than-normal frequency this month so far. This is my third in 8 trading days. No surprise, given the month we are in. So goes October! Today’s brief note is to highlight the bullish behavior in the market, a welcomed change in the market which has been in the grips of the bear’s paws since the first of the month. For the major U.S. stock indexes, it was the best day since March 26. The Dow soared over 500 points. The strongest showing was the NASDAQ, jumping nearly 3%. The impressive, bullish bounce back today went a long ways to regaining all that was lost this month, recapturing about 40% of those recent declines today. I have, for over 33 years since my rookie season as professional investment advisor, focused mainly on market technical conditions for hints of the market’s health and near term direction than anything else. Look at the chart of the NASDAQ index below for an example:

Thank you for your continued trust and confidence. I remain vigilant as I manage and oversee your investment account.

Please call anytime you have a question or I may be of help. I am always happy to be of service.

Sincerely,